Medicare Supplement “Plan D” and Medicare “Part D” Differences

- Provides prescription drug coverage to Medicare beneficiaries

- A standalone Part D plan works with Original Medicare, but prescription drug coverage can be included in a Medicare Advantage (Part C) instead.

- Can have either Part A or Part B to enroll

Full Answer

How much does Medicare Plan D cost?

Dec 06, 2021 · Medicare Plan D is a Medicare Supplement plan, also known as a Medigap plan. Plan D is one of the 10 standardized Medicare Supplement plans available in most states: A, B, C, D, F, G, K, L, M, and N. The names “Medicare Plan D”, “Medicare Supplement Plan D”, and “Medigap Plan D all mean the same thing. But these plans are not the same thing as Medicare Part D, …

How do I choose a Medicare Part D plan?

Mar 06, 2022 · Definition of Medicare Part D. Part D is an optional Medicare benefit that helps pay for your prescription drug expenses. If you want this coverage, you will have to pay an additional premium. Private insurance companies contract with the federal government to offer Part D programs through the Medicare system.

How to select Medicare Part D plan?

Apr 16, 2021 · Part D, which is your prescription drug coverage. Because there is very little prescription drug coverage in Original Medicare, Congress created Part D as part of the Medicare Modernization Act in 2003. Medicare Part D is designed to help make medications more affordable for people enrolled in Medicare.

What are types of Medicare Part D plans?

What Medicare Part D drug plans cover. All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

What is Medicare Part D and how does it work?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications.

What is the difference between Medicare B and Medicare D?

Medicare Part B only covers certain medications for some health conditions, while Part D offers a wider range of prescription coverage. Part B drugs are often administered by a health care provider (i.e. vaccines, injections, infusions, nebulizers, etc.), or through medical equipment at home.Oct 1, 2021

Is Medicare Part D for everyone?

Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1.

What is the main benefit of Medicare Part D?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...Jun 4, 2019

What is not covered by Medicare Part D?

Drugs never covered by Medicare Drugs for anorexia, weight loss, or weight gain (i.e., Xenical®, Meridia, phentermine HCl, etc.) Drugs that promote fertility (i.e., Clomid, Gonal-f, Ovidrel®, Follistim®, etc.) Drugs for cosmetic purposes or hair growth (i.e., Propecia®, Renova®, Vaniqa®, etc.)

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Does Medicare Part D have an out of pocket maximum?

Medicare Part D, the outpatient prescription drug benefit for Medicare beneficiaries, provides catastrophic coverage for high out-of-pocket drug costs, but there is no limit on the total amount that beneficiaries have to pay out of pocket each year.Jul 23, 2021

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What is the max out of pocket for Medicare Part D?

A Medicare Part D deductible is the amount you must pay every year before your plan begins to pay. Medicare requires that Medicare Part D deductibles cannot exceed $445 in 2021, but Medicare Part D plans may have deductibles lower than this. Some Medicare Part D plans don't have deductibles.

What Is Medicare Part D Prescription Drug Coverage?

As a Medicare beneficiary, you don’t automatically get Medicare Part D prescription drug coverage. This Medicare Part D coverage is optional, but c...

What Types of Medicare Part D Prescription Drug Plans Are available?

You can get Medicare Part D prescription drug coverage in two different ways, depending on whether you’re enrolled in Original Medicare or Medicare...

Am I Eligible For A Medicare Part D Prescription Drug Plan?

You’re eligible for Medicare Part D prescription drug coverage if: 1. You have Part A and/or Part B. 2. You live in the service area of a Medicare...

When Can I Sign Up For Medicare Part D Coverage?

As mentioned, you don’t have to enroll in Medicare Part D coverage. That decision will not affect the Original Medicare coverage you have, but if y...

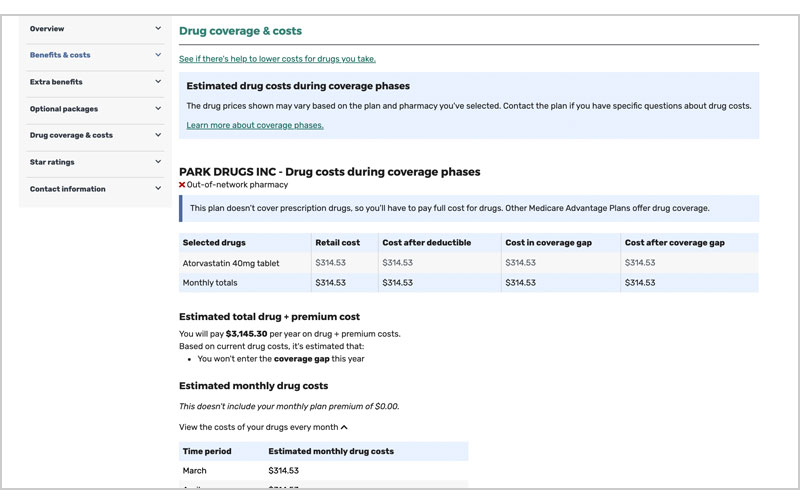

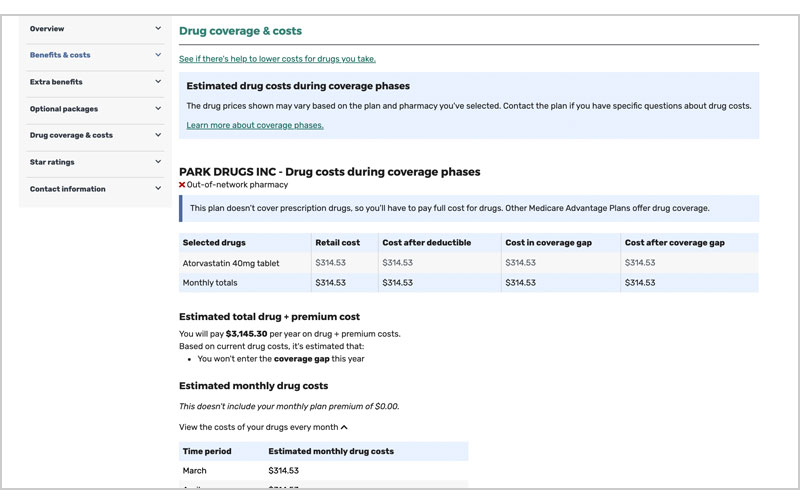

What’S The Medicare Part D Coverage Gap (“Donut Hole”), and How Can I Avoid It?

The coverage gap (or “donut hole”) refers to the point when you and your Medicare Part D Prescription Drug Plan or Medicare Advantage Prescription...

What Does Medicare Part D Cost?

Your actual costs for Medicare Part D prescription drug coverage vary depending on the following: 1. The prescriptions you take, and how often 2. T...

Can I Get Help With My Medicare Prescription Drug Plan Costs If My Income Is Low?

As mentioned, Medicare offers a program called the Low-Income Subsidy, or Extra Help, for eligible people with limited incomes. If you are enrolled...

What is Medicare Plan D?

Medicare Plan D is a Medicare Supplement plan, also known as a Medigap plan. Plan D is one of the 10 standardized Medicare Supplement plans available in most states: A, B, C, D, F, G, K, L, M, and N. The names “Medicare Plan D”, “Medicare Supplement Plan D”, and “Medigap Plan D all mean the same thing. But these plans are not the same thing as ...

What is Medicare Supplement Plan D?

Medicare Supplement Plan D. Medicare Part D. Helps play some of the costs original Medicare doesn’t cover, which are mostly copays, coinsurance, and deductibles. Only works with Original Medicare. Must have both Parts A and B to enroll. Provides prescription drug coverage to Medicare beneficiaries.

How long does Medigap Plan D last?

The best time to get Medigap Plan D (or any Medicare Supplement plan) is during your Medigap Open Enrollment Period (OEP) because you won’t have to go through medical underwriting. 4. Your Medigap OEP last for six months and begins ...

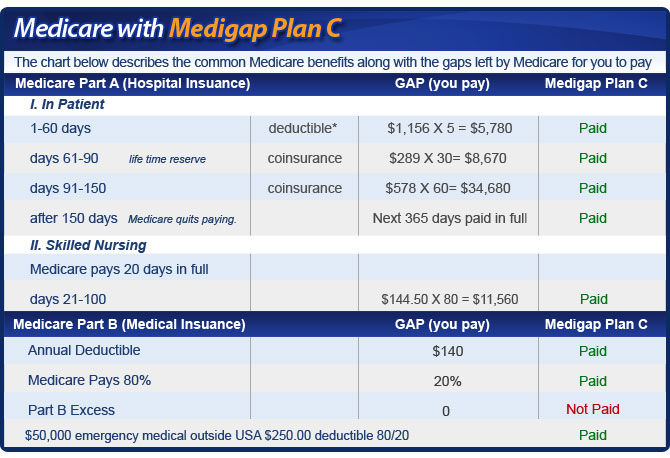

How much is coinsurance for Part B?

For example, Part B charges a 20% coinsurance for covered services after you’ve met your Part B deductible ($203 in 2021). 1 If you have total medical charges are $20,000, for instance, your coinsurance would be $4,000. The higher your total charges, the higher your coinsurance, and there’s no limit to how much you can be charged ...

How much is the cost of a Plan D in 2021?

The average monthly premiums can vary, depending on your state of residence. In 2021, it ranged between $192-265 for Plan D and $202-280 for Plan C for a nonsmoking male living in Orlando, Florida. 6.

What is Plan D?

Plan D covers 80 percent of the cost for qualified emergency care you receive in a foreign country after you pay a $250 deductible. You’re covered for the first 60 days of foreign travel with a lifetime limit of $50,000. 3. No networks. You can visit any provider nationwide who accepts Medicare. Guaranteed renewable.

Can you keep Plan C?

If you do, you will be “grandfathered in,” which means you can keep Plan C for as long as you continue to pay the premiums. Plan C was one of the guaranteed issue plans insurance companies offered. But starting 2020, Medicare Plan D replaced Plan C as one of the guaranteed issue plans for new enrollees.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

What drugs are covered by Part D?

Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

Why was Medicare Part D created?

Because there is very little prescription drug coverage in Original Medicare, Congress created Part D as part of the Medicare Modernization Act in 2003. Medicare Part D is designed to help make medications more affordable for people enrolled in Medicare.

Why is it important to enroll in a Part D plan?

It’s important to enroll in a plan when you are first eligible if you want to avoid a late enrollment penalty with your monthly premium. If you go without creditable prescription drug coverage and you don’t enroll in Part D when you are first able, you’ll pay a penalty of 1% of the national base premium for each month you go without coverage.

What is coinsurance in Medicare?

Copayments (flat fee you pay for each prescription) Coinsurance (percentage of the actual cost of the medication ) Many Medicare Advantage plans include prescription drug coverage. If you enroll in a plan with Part D included, you typically won’t pay a separate premium for the coverage. You generally pay one monthly premium for Medicare Advantage.

What is a formulary in Medicare?

Each Medicare prescription drug plan uses a formulary, which is a list of medications covered by the plan and your costs for each. Most plans use a tiered copayment system. Prescription drugs in the lowest tiers, usually generic medications, have lower copayments.

What are the different types of Medicare?

There are four parts to the Medicare program: 1 Part A, which is your hospital insurance 2 Part B, which covers outpatient services and durable medical equipment (Part A and Part B are called Original Medicare) 3 Part C, or Medicare Advantage, which offers an alternate way to get your benefits under Original Medicare 4 Part D, which is your prescription drug coverage

How much is coinsurance for 2021?

If you and your plan spend more than $4,130 on prescription medications in 2021, special coverage rules kick in.

How many Medicare Part D plans are there in 2021?

According to the Kaiser Family Foundation, the average Medicare beneficiary has 30 stand-alone Medicare Part D prescription drug plans to choose from in 2021. It’s important to comparison shop to find the one that’s right for you.

What does Medicare Part D cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

What is a drug plan's list of covered drugs called?

A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary. Many plans place drugs into different levels, called “tiers,” on their formularies. Drugs in each tier have a different cost. For example, a drug in a lower tier will generally cost you less than a drug in a higher tier.

What is formulary exception?

A formulary exception is a drug plan's decision to cover a drug that's not on its drug list or to waive a coverage rule. A tiering exception is a drug plan's decision to charge a lower amount for a drug that's on its non-preferred drug tier.

What happens if you don't use a drug on Medicare?

If you use a drug that isn’t on your plan’s drug list, you’ll have to pay full price instead of a copayment or coinsurance, unless you qualify for a formulary exception. All Medicare drug plans have negotiated to get lower prices for the drugs on their drug lists, so using those drugs will generally save you money.

How many prescription drugs are covered by Medicare?

Plans include both brand-name prescription drugs and generic drug coverage. The formulary includes at least 2 drugs in the most commonly prescribed categories and classes. This helps make sure that people with different medical conditions can get the prescription drugs they need. All Medicare drug plans generally must cover at least 2 drugs per ...

How many drugs does Medicare cover?

All Medicare drug plans generally must cover at least 2 drugs per drug category, but plans can choose which drugs covered by Part D they will offer. The formulary might not include your specific drug. However, in most cases, a similar drug should be available.

What is a tier in prescription drug coverage?

Tiers. To lower costs, many plans offering prescription drug coverage place drugs into different “. tiers. Groups of drugs that have a different cost for each group. Generally, a drug in a lower tier will cost you less than a drug in a higher tier. ” on their formularies. Each plan can divide its tiers in different ways.

How it works

After Medicare pays its approved amount for services, Medigap plans help cover what would otherwise be your out-of-pocket costs: copayments, coinsurance and some deductibles. These plans are available only to individuals enrolled in Medicare Part A and Part B — not to Medicare Advantage members.

How much does Medigap Plan D cost?

Medigap Plan D is regulated by the government but sold by private insurers. Prices vary according to factors including age, location and tobacco use. In a representative California ZIP code (92589) in 2022, monthly premiums for a 65-year-old nonsmoker range from $124 to $230.

Compare alternative plans

About the author: Alex Rosenberg is a NerdWallet writer focusing on Medicare and information technology. He has written about health, tech, and public policy for over 10 years. Read more

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

What is coinsurance and copayment?

Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin. A copayment is usually a fixed dollar amount (such as $5) while coinsurance is most often a percentage of the cost (such as 20 percent). Plans might have different copayment or coinsurance amounts for each tier of drugs.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

What is a Part D plan?

The best Medicare Part D plans not only help you manage the cost of prescription drugs, they also play a role in ensuring medicines stay affordable and they can protect against future price hikes. Roughly 70% of Americans signed up for Medicare supplement with a Part D plan, ...

How long does Medicare Part D last?

There are three different enrollment periods for Medicare Part D, as follows: Initial enrollment period: This covers a total of seven months - three months before you turn 65, your birthday month itself, and then the three months directly after your 65th birthday. So seven months in total.

What is the Medicare Part D deductible for 2020?

In 2020, the allowable Medicare Part D deductible is $435. Depending on the provider you choose, plans may either charge the full deductible, a partial, or waive the deductible (zero deductible). You pay the network discounted price for prescription drugs until your plan equals the deductible.

What is the best Medicare Part D provider?

The best Medicare Part D providers include AARP, Humana Medicare Rx, WellCare, and Cigna-HealthSpring. If you’re eligible for Part D coverage, the three main considerations you’re likely to make are your current health, budget, and any medicine you take.

What are the deductibles for Medicare?

Deductibles apply to services covered under Part A and B. Medicare Part C (Medicare Advantage Plans) and Medicare Part D are optional and have their own premiums. If you live in a low income household, you may qualify for a subsidy to reduce the overall cost of Medicare.

Is AARP a good Medicare plan?

AARP Medicare Rx, with services provided by United Healthcare, is an excellent all-round provider of Medicare Part D plans and is the only range of plans backed by AARP. This is the best Medicare Part D plan option for seniors as it mixes low co-pays with competitive premiums and has a network of preferred providers.

Does Medicare Part D have monthly premiums?

Similar to other commercial health insurance plans, Medicare Part D Prescription Drug Plans vary with the monthly premiums, depending on the company and the coverage and the prescriptions you need covered. Expert Advice.