What is the monthly premium for Medicare Part B?

Nov 12, 2021 · Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021.

How high will the Medicare Part B deductible get?

Nov 12, 2021 · The annual deductible for Medicare Part B beneficiaries grows with the Part B financing and is increasing from $203 in 2021 to $233 in 2022. The Administration is taking action to address the rapidly increasing drug costs that are posing a threat to the future of the Medicare program and that place a burden on people with Medicare.

How much does Medicare Part B cost?

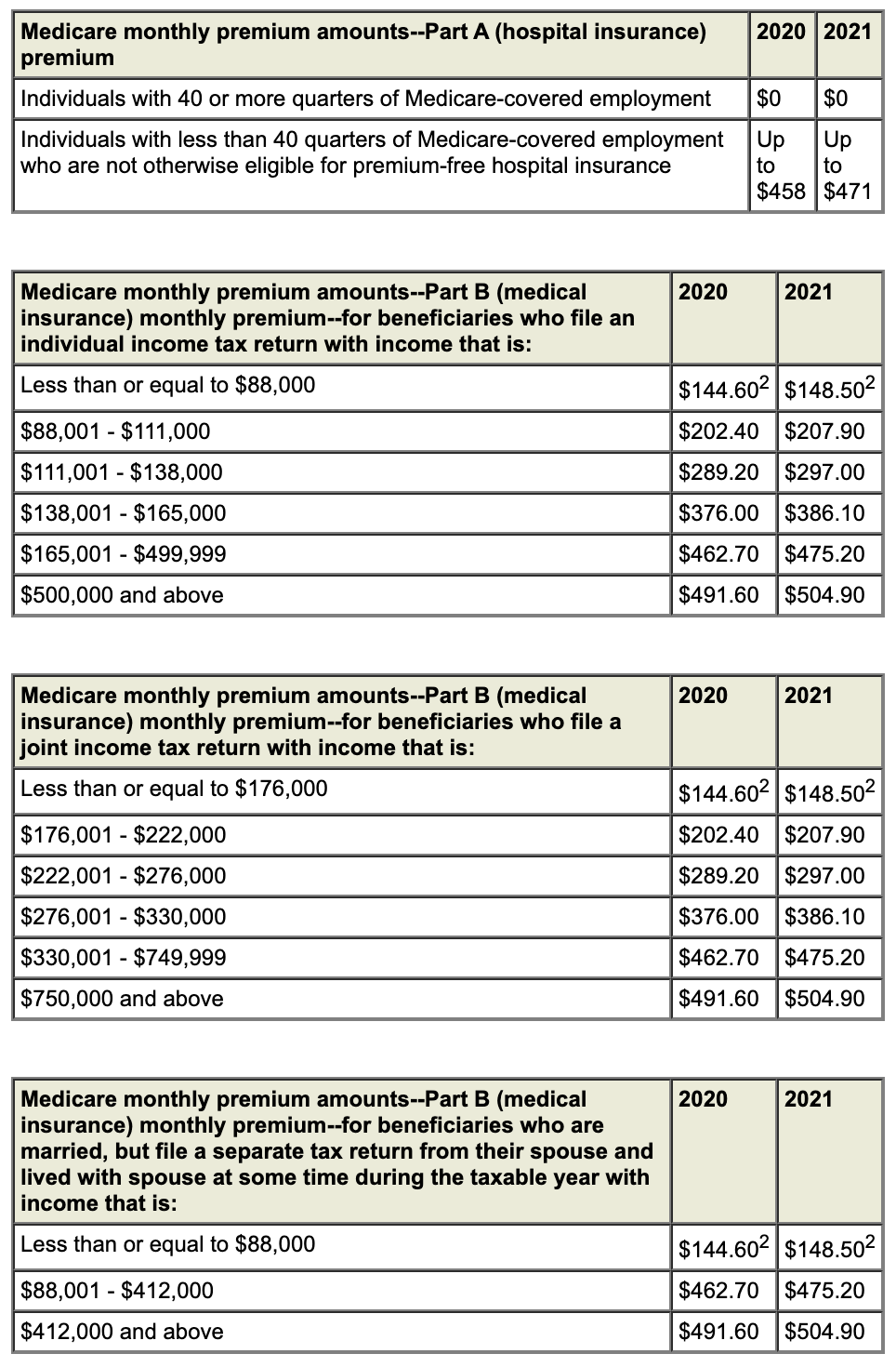

Nov 12, 2021 · The standard Part B premium amount in 2022 will be $170.10. Most people will pay the standard Part B premium amount. If you modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How to collect a part B deductible?

Medicare Part B (Medical Insurance) Costs. Part B monthly premium. Most people pay the standard Part B monthly premium amount ($170.10 in 2022). Social Security will tell you the exact amount you’ll pay for Part B in 2022. You pay the standard premium amount if: You enroll in Part B for the first time in 2022.

Will Medicare Part B premium go up in 2022?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $170.10 in 2022, an increase of $21.60 from $148.50 in 2021.

What is the Medicare limit for 2022?

2022 Wage Cap Jumps to $147,000 for Social Security Payroll TaxesPayroll Taxes: Cap on Maximum EarningsType of Payroll Tax2022 Maximum Earnings2021 Maximum EarningsSocial Security$147,000$142,800MedicareNo limitNo limitSource: Social Security Administration.Oct 13, 2021

What will the Part B deductible be for 2022?

$233What is the Medicare deductible for 2022? The Part A deductible for 2022 is $1,556 for each benefit period. The Part B deductible is $233. You will usually then pay 20 percent of the cost for anything covered by Part B after you have met your deductible.

Will Social Security get an increase in 2022?

For 2022, Social Security benefits and Supplemental Security Income (SSI) payments will increase by 5.9%. This means that more than 70 million Americans will see a change in their benefit payments.Dec 16, 2021

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How much is deducted from Social Security for Medicare?

Medicare Part B If your 2020 income was $91,000 to $408,999, your premium will be $544.30. With an income of $409,000 or more, you'll need to pay $578.30. If you receive Social Security benefits, your monthly premium will be deducted automatically from that amount.Feb 24, 2022

What is the deductible for Medicare Part D in 2022?

$480 inWhat is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

What is Medicare premium?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. A deductible is the amount you pay out of pocket before your insurance company covers its ...

How does Medicare Part B work?

How it Works Premiums & Deductibles Coverage & Enrollment FAQs. Medicare Part B provides the medical portion of your Medicare coverage . Part B has costs, including a premium, deductible and coinsurance. Together, they make up the overall cost of Medicare Part B. But the costs aren’t the same for everyone.

What is coinsurance on medical insurance?

Coinsurance is the percentage of your medical costs that you pay after you meet your deductible. The remaining amount is paid by your insurance company.

What is premium insurance?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. and annual deductible. A deductible is the amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs ...

Does Medicare Advantage include Part B?

Some insurance companies will include the Part B premium in what you pay each month for your Medicare Advantage policy . Others will pay the cost of the Part B premium and charge you a reduced rate. If you’re on Medicare Advantage and want to find out what you have, give your insurance company a call.

Does Medicare Supplement Insurance cover Part B?

Medicare Supplement Insurance (Medigap) has several policies that will help cover your Part B costs, including premiums, deductibles and out-of-pocket costs.

Is Medicare Part B based on income?

Unlike the Part B premium, this amount isn’t based on income. Everyone enrolled in Original Medicare pays the same Part B deductible. That means no matter how high your income is, you’ll pay the standard Medicare Part B deductible amount.

What You Need to Know

Each year the Centers for Medicare and Medicaid Services (CMS) announces the Medicare Part B premium. The 2022 Standard Medicare Part B premium amount is $170.10 (the 2021 premium was $148.50).

Reimbursement of Premiums

If you or your dependents are eligible for Medicare Part B reimbursement, CalPERS will automatically reimburse the eligible amount on your retiree warrant.

Requesting Additional Reimbursement

If you or your dependents are paying an increased Part B premium (IRMAA) and would like to request additional reimbursement, submit a copy of your entire SSA notice showing the IRMAA determination, MAGI, and increased Part B premium to CalPERS. Processing time for IRMAA documents is up to 60 calendar days.

Secure Upload

To ensure secure and timely processing, upload your or your dependent’s SSA notice online by logging in to your myCalPERS account.

How Are Monthly Rates Determined For Those Filing Jointly?

At Cornerstone Senior Advisors, we help you get the best coverage available to you. Don’t let increasing rates discourage you – with our assistance, you’ll come away with a policy you can be truly satisfied with. Call us today at 316-260-3331 to learn more about Medicare Part B.

Learn More About Part B Today!

At Cornerstone Senior Advisors, we help you get the best coverage available to you. Don’t let increasing rates discourage you – with our assistance, you’ll come away with a policy you can be truly satisfied with. Call us today at 316-260-3331 to learn more about Medicare Part B.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022.