Best Rated Medicare Part D Plans

- SilverScript Medicare Prescription Drug Plans. There are three different plans available with SilverScript. ...

- Humana Medicare Part D Plans. ...

- Cigna-HealthSpring Medicare Prescription Drug Plans. ...

- Mutual of Omaha Medicare Part D Plans. ...

- UnitedHealthcare Medicare Part D Plans. ...

- Best in Ease of Use: Humana.

- Best in Broad Information: Blue Cross Blue Shield.

- Best for Simplicity: Aetna.

- Best in Number of Medications Covered: Cigna.

- Best in Education: AARP.

Who has the best Medicare Part D plan?

Mar 11, 2021 · Best Medicare Part D plans 2022: Find the right prescription drugs plan for you. 1. Cigna: Best Medicare Part D Plan overall. (Image credit: Cigna) 2. AARP Medicare Rx: Best Medicare Part D plan for seniors. 3. Humana Medicare Rx: Best Medicare Part D Plan for home delivery. 4. SilverScript: Best ...

What is the best Medicare Prescription D plan?

The best Medicare Part D prescription drug plans depend on what medications you take and where you live. There are hundreds of plans, but not all plans are available in all states or cities. Carefully comparing Medicare Part D plans that are available can save you hundreds of dollars a year. Written by Terry Turner Edited By Lamia Chowdhury

What is the cheapest Medicare Part D plan?

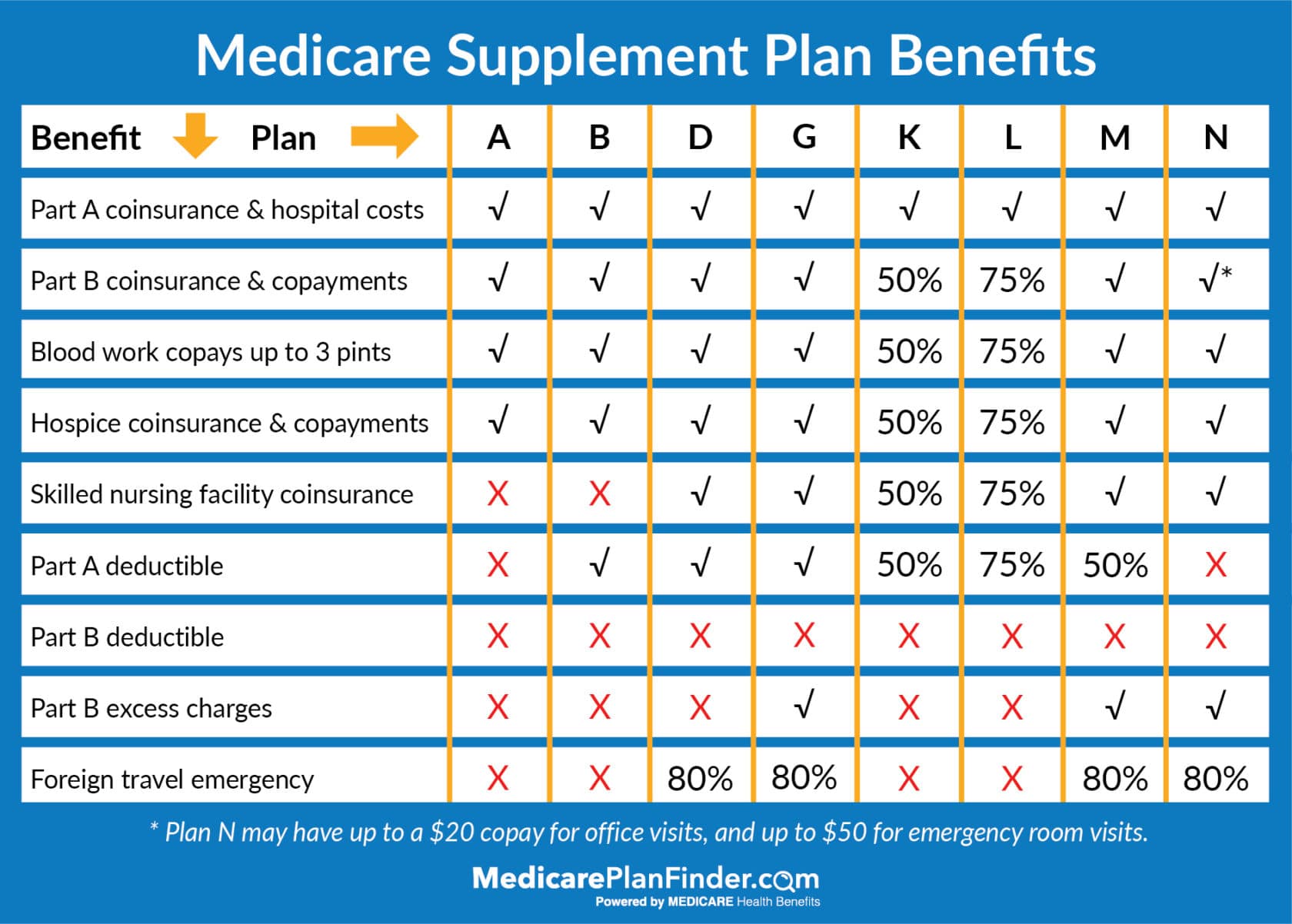

Dec 06, 2021 · Medicare Plan D is a Medicare Supplement plan, also known as a Medigap plan. Plan D is one of the 10 standardized Medicare Supplement plans available in most states: A, B, C, D, F, G, K, L, M, and N. The names “Medicare Plan D”, “Medicare Supplement Plan D”, and “Medigap Plan D all mean the same thing. But these plans are not the same thing as Medicare …

How to find best Medicare Part D plan?

Mar 24, 2022 · Best in Ease of Use: Humana. Best in Broad Information: Blue Cross Blue Shield. Best for Simplicity: Aetna. Best in Number of Medications Covered: Cigna. Best in Education: AARP. Best Medicare ...

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Who has the cheapest Medicare Part D plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.Sep 27, 2021

Is SilverScript Part D good plan?

Fortunately, the SilverScript SmartRx plan has very low copays on the most common prescriptions. It won't be the best fit for everyone, but it can be a good choice for those on only Tier I generics. The Choice or Plus plan can also be a good fit if you're taking more expensive medications.

What is the Best Medicare plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is the maximum out of pocket for Medicare Part D?

A Medicare Part D deductible is the amount you must pay every year before your plan begins to pay. Medicare requires that Medicare Part D deductibles cannot exceed $445 in 2021, but Medicare Part D plans may have deductibles lower than this. Some Medicare Part D plans don't have deductibles.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

Is there a premium for Medicare Part D?

How much does Part D cost? Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do I need Part D if I have Medicare Advantage?

Plans can now cover more of these benefits. You can join a separate Medicare drug plan (Part D) to get drug coverage. Drug coverage (Part D) is included in most plans. In most types of Medicare Advantage Plans, you don't need to join a separate Medicare drug plan.

Are all Part D plans the same?

Medicare Part D coverage varies based on medication tiers in your plan's formulary list. Each plan must offer a basic level of coverage that's set by Medicare. Medicare Part D plans may cover both generic and brand-name medications. The costs for Part D plan vary by the coverage you choose and the area where you live.

How often can you change Medicare Part D plans?

If you want to switch to a Part D plan or a Medicare Advantage plan that has earned Medicare's highest quality rating (five stars) — if one is available in your area — you can do so once at any time of the year, except for one week (Nov.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

How many states does United Medicare Advisors work in?

While this is fairly common in today's internet age, it's still something to note. Another fact is that United Medicare Advisors is active in 44 states, leaving out Alaska, California, Hawaii, Massachusetts, New York and Rhode Island. If you live in one of those states, you should keep reading further in our reviews.

Who are United Medicare Advisors?

United Medicare Advisors specializes in Medicare and related supplemental plans, giving you unbiased information and access to many different insurance companies. In business since 2009, they have enrolled hundreds of thousands of Medicare Supplement policies across the country. They work with over 20 carriers, including some of the major names in the industry (such as Aetna, Mutual of Omaha, and Humana).

How long has Aetna been around?

Aetna. Aetna has been around for a LONG time: over 160 years, as a matter of fact. And, as the insurer most often quoted during our process of finding Medicare Supplement Plans, Aetna is an obvious company to consider for your coverage needs.

Does United Medicare Advisors offer online quotes?

So, while United Medicare Advisors does not show you an online quote, they absolutely deliver the goods with the lowest priced Medicare Supplement Plans we found. This is because of their vast access to both the bigger names in the industry as well as smaller, reputable companies you might not have heard of before.

What is Medicare Plan D?

Medicare Plan D is a Medicare Supplement plan, also known as a Medigap plan. Plan D is one of the 10 standardized Medicare Supplement plans available in most states: A, B, C, D, F, G, K, L, M, and N. The names “Medicare Plan D”, “Medicare Supplement Plan D”, and “Medigap Plan D all mean the same thing. But these plans are not the same thing as ...

What is Plan D?

Plan D covers 80 percent of the cost for qualified emergency care you receive in a foreign country after you pay a $250 deductible. You’re covered for the first 60 days of foreign travel with a lifetime limit of $50,000. 3. No networks. You can visit any provider nationwide who accepts Medicare. Guaranteed renewable.

Does Medicare cover copays?

Helps play some of the costs original Medicare doesn’t cover, which are mostly copays, coinsurance, and deductibles. Only works with Original Medicare. Must have both Parts A and B to enroll. Provides prescription drug coverage to Medicare beneficiaries.

What is the difference between Medicare Advantage and Part D?

Medicare Advantage and Part D costs can vary on a number of important factors: provider, location, and most importantly, what medications need to be covered, but the main difference between the two will be in the cost of medication.

How many drugs does Cigna have?

Every company works from a "formulary," which is a list of prescriptions they cover. Cigna’s formulary includes more than 3,000 drugs, meaning there’s a much better chance that your medication is either covered or that you’ll be able to find an alternative option.

When was AARP founded?

AARP was founded in 1958, and was a trailblazer for the insurance of older people, especially since Medicare itself didn’t even exist until 1965. As such, AARP’s focus is 100% on patient understanding and comfort, and all of the information is written with you in mind.

Is Cigna a Part D plan?

Cigna won this category based on the sheer number of drugs on its formulary. Prescription medication is, after all, the whole point of a Part D Plan, so it’s important to have as many options for your medication as possible.

Does Medicare pay for Part D?

Unlike Parts A and B, Part D drug coverage comes from private insurance companies, with Medicare paying a portion of the costs. You need to sign up as soon as you're eligible—if you don't, you may have to pay a late enrollment penalty later when you do enroll.

Does Medicare Part D cover Tylenol?

If a formulary doesn’t cover your prescription, it may cover a similar or generic medication (think Tylenol vs acetaminophen, or Prozac and fluoxetine). Your doctor may also be able to negotiate an exception.

Why wade through overwhelming information if you don't have to?

Why wade through overwhelming information if you don’t have to? Engaging with a broker or a health insurance consultant is free. Brokers sometimes have access to more plans or better pricing and can use their connections with insurance companies to help find the best plan and coverage for you.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Does Cigna offer a discount on Medicare?

Cigna Medicare supplement has some added benefits when compared to other companies, such as a household premium discount. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

Is Plan F a good plan?

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

When will Medicare Part D be updated?

Home / FAQs / Medicare Part D / Top 5 Part D Plans. Updated on June 3, 2021. Medicare prescription drug plan changes in 2021 are noteworthy. Also, by knowing what to expect, you can stay ahead of the game. Drugs can be costly, and new brand-name drugs can be the most expensive. With age, you’re more likely to require medications.

What is the best Medicare plan for 2021?

SilverScript. Humana. Cigna. Mutual of Omaha. UnitedHealthcare. The highest rating a plan can have is 5-star. Just because a policy is 5-star in your area doesn’t mean it’s the top-rated plan in the country. There is no nationwide plan that has a 5-star rating.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare. You can also find her over on our Medicare Channel on YouTube as well as contributing to our Medicare Community on Facebook.

What is the SilverScript plan?

SilverScript Medicare Prescription Drug Plans. There are three different plans available with SilverScript. The Choice, the Plus plan, and the SmartRx plan. All policies are a great option, depending on the medications you take, one could be more beneficial to you than the other.

Does Cigna have a pharmacy network?

As far as in-network, Cigna has contracts with over 63,000 pharmacies nationwide. Preferred pharmacies include Kroger, Rite Aid, Walmart, Sam’s Club, Walgreens, and MANY more. For the most savings, consider enrolling in their mail-order pharmacy program.

Does Medicare cover Part D?

Medicare’s standalone Part D plan can cover you. Part D plans have a monthly premium that insurance companies determine. There may be several plans as well as companies to choose from in your state. Policies vary by county, so moving may warrant a plan change.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What does Medicare Part B cover?

Both plans also cover Medicare Part B coinsurances and copays, the first three pints of blood, Part A hospice care coinsurances or copays, skilled nursing facility care coinsurances, and the Part A deductible, but not at 100% like other plans. Plan K covers these benefits at 50% and Plan L covers them at 75%.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

Does Medicare pay for prescription drugs?

Medicare Part D helps you pay for prescription drugs. Depending on your plan, you may have to shop at preferred pharmacies to get the best price. You may also have to pay an out-of-pocket deductible before the insurance begins paying. Part D drug plans carry a premium which you must pay in addition to the Plan B premium.

What is Plan F?

Plan F. Plan F is the most extensive Medicare Supplement Insurance plan available. It covers everything the other plans cover, in addition to 100% of Medicare Part B excess charges. Plan F also covers 80% of medical emergency expenses when you travel outside of the country.