One plan may have a no copay for primary care doctors and a $35 copay for specialists, while another has a $20 copay for primary care doctors and a $50 copay for specialists. Here is an example of what that might look like: It is important to look at the coverage details on Advantage plans very closely. They vary widely from one plan to the next.

What is a medicare copay?

· Medicare copay. Many Medicare Advantage plans require that you pay a copay when you see a doctor. This is a fixed cost — and an alternative to Original Medicare’s 20 percent coinsurance. Premiums. As noted above, the average monthly premium for Medicare Advantage plans with drug coverage is $60.96 per month in 2022.

Does Medicare have a copay for doctor visits?

· A copayment, or copay, is a fixed amount of money that you pay out-of-pocket for a specific service. Copays generally apply to doctor visits, specialist visits, and prescription drug refills. Most...

What is the Medicare copay for the first 20 days?

· Even though it's called coinsurance, it operates like a copay. For hospital and mental health facility stays, the first 60 days require no Medicare coinsurance. Days 61 to 90 require a coinsurance of $389 per day. Days 91 and beyond come with a $778 per day coinsurance for a total of 60 “lifetime reserve" days.

Can I get financial assistance to pay my Medicare copays?

· One plan may have a no copay for primary care doctors and a $35 copay for specialists, while another has a $20 copay for primary care doctors and a $50 copay for …

How much is a copay to see a specialist?

between $30 and $50Typical co-pays for a visit to a primary care physician range from $15 to $25. Co-pays for a specialist will generally be between $30 and $50. Most plans also require that the insured pay a deductible before the insurance provider will take over payments to a physician.

Do Medicare patients pay a copay?

If you have Original Medicare, you typically don't have to pay copayments. But you will have to pay coinsurance after you meet your deductible. A fixed amount of money you pay for each medical service or item, like $25 for each doctor's visit or prescription.

Is there a copay or deductible with Medicare?

Original Medicare does not use copayments in the same way as other health plans. Instead, enrollees pay a deductible (per year for Medicare Part B, and per benefit period for Medicare Part A), and then coinsurance. For Medicare Part B, the coinsurance is 20 percent of the cost of care.

What is the copay on Medicare Part B?

Although Part B has no copayment, a person may pay the following costs in 2021: Premium: Everyone pays a premium for Part B. The standard premium is $148.50 per month, but this amount could be higher depending on a person's income. Deductible: The 2021 deductible is $203 per year.

What is the Medicare deductible for 2021?

$203 inThe standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What is the Medicare deductible for 2020?

$198 inThe annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.

Does Medicare Part B cover 100 percent?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What is the deductible for Medicare Part D in 2022?

$480The initial deductible will increase by $35 to $480 in 2022. After you meet the deductible, you pay 25% of covered costs up to the initial coverage limit. Some plans may offer a $0 deductible for lower cost (Tier 1 and Tier 2) drugs.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What does Medicare type a cover?

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

Does the Medicare deductible apply to office visits?

Medicare deductible: Part B Medicare Part B benefits include (but aren't limited to) doctor's office visits, preventive screenings, and durable medical equipment. For some of these services, a deductible will apply ($233 in 2022).

Does Medicare have a coinsurance?

Coinsurance is when you and your health care plan share the cost of a service you receive based on a percentage. For most services covered by Part B, for example, you pay 20% and Medicare pays 80%.

What is a copay in Medicare?

A copayment, or copay, is a fixed amount of money that you pay out-of-pocket for a specific service. Copays generally apply to doctor visits, specialist visits, and prescription drug refills. Most copayment amounts are in ...

How much does Medicare copay cost?

Copays generally apply to doctor visits, specialist visits, and prescription drug refills. Most copayment amounts are in the $10 to $45+ range , but the cost depends entirely on your plan. Certain parts of Medicare, such as Part C and Part D, charge copays for covered services and medications.

What percentage of Medicare coinsurance is paid?

coinsurance for services, which is 20 percent of the Medicare-approved amount for your services. Like Part A, these are the only costs associated with Medicare Part B, meaning that you will not owe a copay for Part B services.

How much is Medicare Part A monthly premium?

monthly premium, which varies from $0 up to $471. per benefits period deductible, which is $1,484. coinsurance for inpatient visits, which starts at $0 and increases with the length of the stay. These are the only costs associated with Medicare Part A, meaning that you will not owe a copay for Part A services.

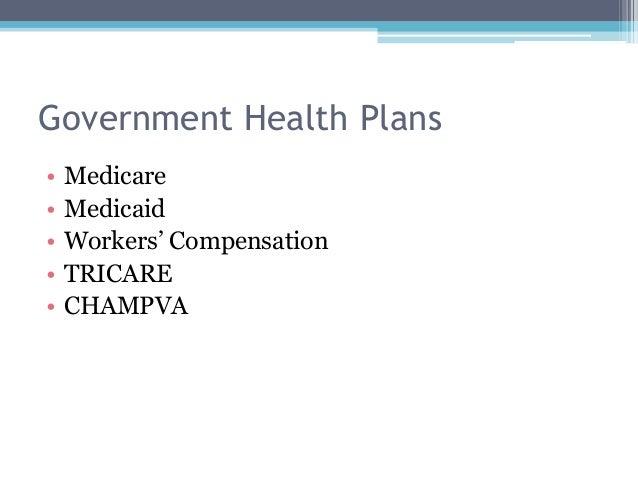

What is Medicare for 65?

Cost. Eligibility. Enrollment. Takeaway. Medicare is a government-funded health insurance option for Americans age 65 and older and individuals with certain qualifying disabilities or health conditions. Medicare beneficiaries are responsible for out-of-pocket costs such as copayments, or copays for certain services and prescription drugs.

What is covered by Medicare Part C?

Under Medicare Part C, you are covered for all Medicare parts A and B services. Most Medicare Advantage plans also cover you for prescription drugs, dental, vision, hearing services, and more.

How long does it take to get Medicare if you have a disability?

Most individuals will need to enroll into Medicare on their own, but people with qualifying disabilities will be automatically enrolled after 24 months of disability payments.

What is a copay in Medicare?

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays (also called copayments) most often come in the form of a flat-fee and typically kick in after a deductible is met. A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin ...

How much is Medicare coinsurance for days 91?

For hospital and mental health facility stays, the first 60 days require no Medicare coinsurance. Days 91 and beyond come with a $742 per day coinsurance for a total of 60 “lifetime reserve" days.

What percentage of Medicare deductible is paid?

After your Part B deductible is met, you typically pay 20 percent of the Medicare-approved amount for most doctor services. This 20 percent is known as your Medicare Part B coinsurance (mentioned in the section above).

How much is Medicare Part B deductible for 2021?

The Medicare Part B deductible in 2021 is $203 per year. You must meet this deductible before Medicare pays for any Part B services. Unlike the Part A deductible, Part B only requires you to pay one deductible per year, no matter how often you see the doctor. After your Part B deductible is met, you typically pay 20 percent ...

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is Medicare approved amount?

The Medicare-approved amount is the maximum amount that a doctor or other health care provider can be paid by Medicare. Some screenings and other preventive services covered by Part B do not require any Medicare copays or coinsurance.

How long does Medicare Part A last?

A benefit period begins the day you are admitted to a hospital or skilled nursing facility for an inpatient stay, and it ends once you have been out of the facility for 60 consecutive days.

What is a copay?

A copay is a set dollar amount that you must pay when you see a provider.

How much of your bill is a copay?

Providers may require you to pay a copay at the time of the service. The copay will never be more than 20% of the bill.

What is Medicare Part B?

Medicare Part B is outpatient medical coverage. We talked more about Part B in a different post. Click here to read.

What is Janet's smart senior plan?

Janet has the Smart Senior Part D plan. She takes a Tier 1 drug, a Tier 2 drug, and a Tier 3 drug.

What surgeries can be performed after colonoscopy?

Certain surgeries (polyp or tissue removal after a colonoscopy, implantation of a cardiac defibrillator)

Where is hospice done?

Hospice is done in someone’s home or in a nursing facility. It’s only purposed to better someone’s last days of living.

Does Lucille have Medicare?

Lucille has supplemental Plan N in addition to Medicare Part A and Part B.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.

Health Maintenance Organization (HMO) Plans

In most cases you have to get a referral to see a specialist in HMO Plans. Certain services, like yearly screening mammograms, don't require a referral.

Preferred Provider Organization (PPO) Plans

In most cases, you don't have to get a referral to see a specialist in PPO Plans. If you use plan specialists, your costs for covered services will usually be lower than if you use non-plan specialists.

Special Needs Plans (SNPs)

In most cases, you have to get a referral to see a specialist in SNPs. Certain services don't require a referral, like these:

What is Medicare copay 2021?

Copays, coinsurance, and deductibles are all part of Medicare cost-sharing, or out-of-pocket costs .

What is a copay in Part D?

These will differ according to your individual Part D plan. Copays in Part D are when you pay a flat fee (for example, $10) for all drugs in a certain tier. Generic drugs usually have a lower copay amount than brand-name drugs. Coinsurance in Part D means that you pay a percentage of the drug’s cost (for example, 25 percent).

How much is coinsurance for Medicare 2021?

For example, after you have paid the Medicare Part B (medical insurance) deductible for the year ($203 in 2021), you will be required to pay 20 percent of each service covered by Part B, and Medicare pays the remaining 80 percent. For Medicare Part A (hospital insurance), coinsurance is a set dollar amount that you pay for covered days spent in ...

What is the coinsurance amount for Part D 2021?

Coinsurance in Part D means that you pay a percentage of the drug’s cost (for example, 25 percent). Catastrophic coverage in Part D for 2021 is $6,550. Once you pay this amount out of pocket, you will pay only the copay on your prescription drugs, or 5 percent coinsurance, whichever is greater. Make sure, if you have a plan (Medicare Advantage, ...

How much is Medicare Part B 2021?

For 2021, the Medicare Part B deductible is $203. This amount will be paid only once per year. The 2021 Part A deductible is $1,484 per benefit period. A benefit period in Part A begins on the first day you are admitted to the hospital and ends after you have spent 60 consecutive days out of the hospital.

How much is Part A coinsurance for 2021?

Here are the Part A coinsurance amounts for 2021: Days 1 – 60: $0. Days 61 – 90: $371. Days 90 – lifetime reserve days: $742 per day until you have used up your lifetime reserve days (you get 60 lifetime reserve days over the course of your life); after that, you pay the full cost.

How much can you get out of your Medicare plan?

Medicare Advantage – No Medicare Advantage plan can have a maximum out-of-pocket limit higher than $7,550, but not all plans will charge the full $7,550 amount.

How much is the copay for DME?

There is a 20% copay for Medicare-approved durable medical equipment (DME).

How much is Medicare after day 91?

After day 91 there is a $704 daily coinsurance payment for each lifetime reserve day used. After the maximum 60 lifetime reserve days are exhausted, there is no more coverage under Part A for inpatient hospital stays. There is a 20% copay for Medicare-approved durable medical equipment (DME). Medicare does not cover any room ...

How much is the deductible for Medicare Part B 2020?

There is a $198 annual deductible for Medicare Part B in 2020. After the deductible, you’ll pay a 20% copay for most doctor services while hospitalized, as well as for DME and outpatient therapy. There is a 20% copay of the Medicare-approved amount for doctor visits to diagnose a mental health condition after the deductible.

What is Medicare Part D?

Medicare Part D – prescription drug coverage. Medicare Part D covers prescriptions drugs. Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by plan, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

What happens if you don't enroll in Medicare Part B?

If you don't enroll in Medicare Part B as soon as you are eligible, you could be assessed a late enrollment penalty when you do enroll. The penalty could be as high as a 10% increase in your premium for each 12-month period that you were eligible but not enrolled. Your Part B premium could be higher depending on your income.

What is the premium for Medicare Part B?

Medicare Part B – medical coverage. Most 2020 Medicare members must pay a monthly premium of $144.60. If you don't enroll in Medicare Part B as soon as you are eligible, you could be assessed a late enrollment penalty when you do enroll.

Why don't people pay Medicare premiums?

Most people don't pay a monthly premium for Medicare Part A because they paid Medicare taxes while they were working. However, there are costs you will have to deal with.

Does Medicare Advantage cover physicals?

All of our Medicare Advantage plans cover an annual routine physical examination with no cost share. The exam includes a comprehensive physical exam and evaluates the status of chronic diseases.

Does Medicare cover syphilis?

Medicare covers STI screening for chlamydia, gonorrhea, syphilis or Hepatitis B when tests are ordered by a primary care provider for members who are pregnant or have an increased risk for an STI. These tests are covered once every year or at certain times during pregnancy.

What is a copayment for a doctor?

Copayment. A fixed amount ( $20, for example) you pay for a covered health care service after you've paid your deductible. Let's say your health insurance plan's allowable cost for a doctor's office visit is $100. Your copayment for a doctor visit is $20. If you've paid your deductible: You pay $20, usually at the time of the visit. ...

How much is a doctor's copayment?

Your copayment for a doctor visit is $20. If you've paid your deductible: You pay $20 , usually at the time of the visit. If you haven't met your deductible: You pay $100, the full allowable amount for the visit.

What is a copay?

Copayments (sometimes called "copays") can vary for different services within the same plan, like drugs, lab tests, and visits to specialists. Generally plans with lower monthly premiums have higher copayments. Plans with higher monthly premiums usually have lower copayments.