What is the premium for Medicare Part A?

Mar 09, 2022 · For the 2021 tax year, the standard deduction is getting bumped up to: $12,550 for single filers and married couples filing separately (up $150 from 2020). $18,800 for heads of households (up $150 from 2020). $25,100 for married couples filing jointly (up $300 from 2020). Why is my Medicare premium so high?

Is there a deductible for Medicare Part A?

Dec 14, 2021 · In 2022, the Medicare Part A deductible is $1,556 per benefit period, and the Medicare Part B deductible is $233 per year. Medicare Advantage deductibles, Part D drug plan deductibles and Medicare Supplement deductibles can vary. Learn more about 2022 Medicare deductibles and other Medicare costs.

Does Medicare charge a deductible?

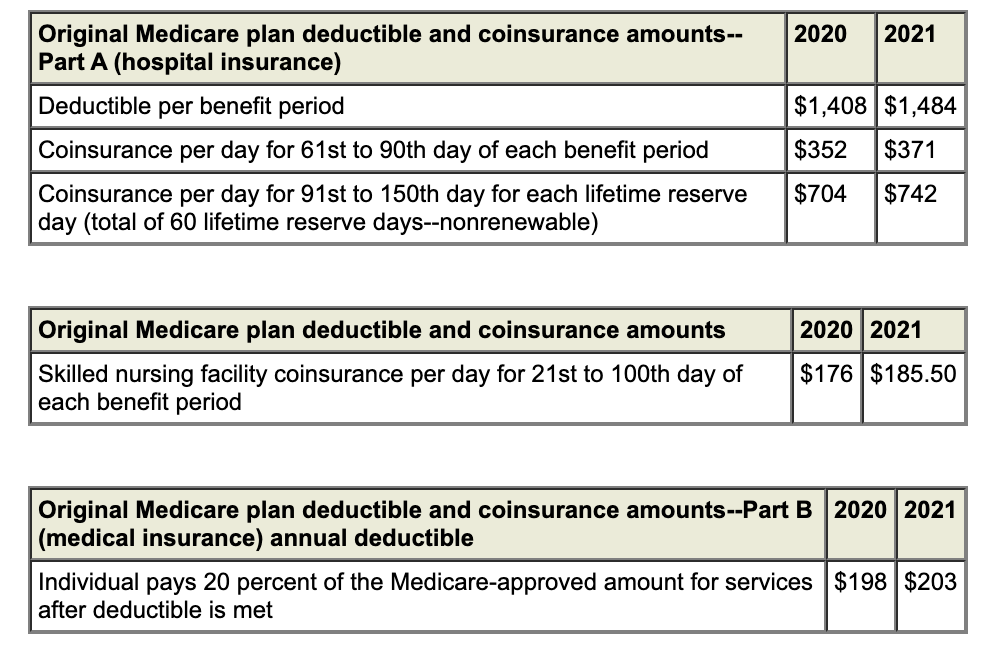

Apr 21, 2022 · Medicare Part A Premiums/Deductibles. The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. What is the Medicare Part B premium for 2021? The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly ...

Do I pay for Medicare Part?

Nov 12, 2021 · The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,556 in 2022, an increase of $72 from $1,484 in 2021. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

Does Medicare Part A have a deductible?

Does Medicare have a deductible? Yes, you have to pay a deductible if you have Medicare. You will have separate deductibles to meet for Part A, which covers hospital stays, and Part B, which covers outpatient care and treatments.

What is the standard deductible for Medicare Part A?

$1,556If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. You pay: $1,556 deductible for each benefit period. Days 1-60: $0 coinsurance for each benefit period.

What is the Medicare Part A coinsurance for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, which is an increase of $76 from $1,408 in 2020....2021 Medicare Premiums & Deductibles.Part A Deductible & Coinsurance AmountsType of Cost Sharing20202021Daily Coinsurance for 61st - 90th Day$352.00$371.003 more rows

How often do you pay Medicare Part A deductible?

Key Points to Remember About Medicare Part A Costs: With Original Medicare, you pay a Medicare Part A deductible for each benefit period. A benefit period begins when you enter the hospital and ends when you are out for 60 days in a row. One benefit period may include more than one hospitalization.

What is the Part D deductible for 2022?

$480What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

PinPoints

Medicare made some modifications to the 2021 deductible. The rising cost of healthcare necessitates an increase in Medicare premiums and deductibles.

What changes are made to Medicare Part A in 2021?

Medicare Part A covers hospitalization, nursing home care, and a portion of home healthcare.

The adjustments to Medicare Part B for 2021 are as follows

Part B of Medicare covers physician costs, outpatient treatments, some home health care services, medical equipment, and medications.

Medicare Part D will have the following changes in 2021

Medicare prescription medication coverage is another name for Medicare Part D.

What changes are coming to Medigap in 2021?

Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

To fight the coronavirus (COVID-19)

On March 20, 2020, Medicare was modified to fulfil the needs of enrollees.

Conclusion

Apart from increased Medicare premiums and deductibles, there are more ways to save money on healthcare.

What is Medicare Part A?

Medicare Part A is hospital insurance for Medicare beneficiaries. It is probably most well-known for covering services provided on an “inpatient” basis in the hospital. It also covers a few other skilled services I never want to use like hospice, home health, and skilled nursing care.

How long does Medicare last?

The benefit period only lasts for 60 inpatient days. So once the Medicare beneficiary ‘fills up’ their $1,484 bucket, Medicare covers them the rest of the way until they hit day 61. If the hospital stay goes on beyond 60 days, things get a little more complicated.

Does Medicare cover hospital stays?

Unfortunately, Medicare Part A does not cover the entire cost of the inpatient hospital stay. They pass the first $1,484 of the cost onto the Medicare beneficiary. So, an inpatient hospital stay will usually come hand-in-hand with the Medicare Part A deductible.

How much is the Medicare deductible for 2021?

Assuming someone is ordered inpatient by a qualified practitioner and is a Medicare beneficiary, we can expect to get hit with a $1,484 deductible in 2021. This assumes the hospital stay is 60-days or less. *There are several nuances to the Medicare program that can’t always be anticipated.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $148.50 per month. The maximum cost of Medicare Part B coverage is $504.90 per month in 2021, and that's for individuals reporting half a million dollars or more in income in 2019.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,370 in 2021.

What is the Medicare deductible for 2021?

Medicare Part A. Medicare Part A has the most complex deductible. For 2021, the Medicare Part A deductible is $1,484. However, this is not a yearly deductible. Rather, it is a deductible for each benefit period. The benefit period begins the first day you enter a hospital or skilled nursing care facility for an inpatient stay.

How much is Medicare Part B deductible in 2021?

Medicare Part B. The deductible for Medicare Part B is $203 per year in 2021. After you spend this amount out of pocket on covered services, you will usually pay 20% of the Medicare-approved amount for most services.

Who is Christian Worstell?

Or call 1-800-995-4219 to speak with a licensed insurance agent. Christian Worstell is a health care and policy writer for MedicareSupplement.com. He has written hundreds of articles helping people better understand their Medicare coverage options.

Does Medicare Advantage have a deductible?

Medicare Advantage plans that offer prescription drug coverage may sometimes feature two different deductibles, with one being for medical costs and the other for prescription costs.

What is Medicare Part C?

Medicare Part C (Medicare Advantage) The deductibles for Medicare Advantage plans are more like those of conventional private health insurance. Part C plan deductible amounts will vary from one plan to the next. This is different from Medicare Part A and Part B (Original Medicare) where deductibles come at a fixed amount for everyone enrolled.

What is Medicare Supplement Insurance?

A Medicare Supplement Insurance plan, or “Medigap,” can provide coverage for Medicare Part A and Part B deductibles, among other out-of-pocket expenses. There are several Medigap plans that offer full coverage for the Medicare Part A deductible and some plans that offer partial coverage.