Medicare costs at a glance

- $1,484 deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 coinsurance per day of each benefit period

- Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

- Beyond lifetime reserve days: all costs

Full Answer

Does Medicare charge a deductible?

Dec 14, 2021 · What Is a Deductible? A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in. For example, if your Medicare plan has a $200 annual deductible, you must pay for the first $200 worth of covered services or items yourself.

Do I have to pay the annual Medicare deductible?

Feb 11, 2020 · Your deductible is the amount of money you have to pay for your prescriptions and healthcare before Original Medicare, other insurance, or your prescription drug plan starts paying for your healthcare expenses. The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and...

How much is a Medicare yearly deductible?

A deductible can be based upon a calendar year, upon a plan year or — as is unique to Medicare Part A — upon a benefit period. For 2022, the benefit period deductible for Medicare Part A (see details below) is $1,556. For Medicare Part B, the annual deductible is $233. Part C (Medicare Advantage) and Part D (drug coverage) deductibles vary by plan.

How high will the Medicare Part B deductible get?

Nov 06, 2020 · The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act …

What is the deductible for Medicare Part B 2021?

$203 in 2021Medicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

What is the normal deductible for Medicare?

Medicare Deductibles. The 2022 deductible for Medicare Part A is $1,556 for each benefit period: $0 for days 1-60, $389 coinsurance per day for days 61-90 and $778 per each "lifetime reserve day" after 91 days. The Medicare Part B deductible is $233.

What is the 2022 deductible for Medicare?

$1,556 perIn 2022, the Medicare Part A deductible is $1,556 per benefit period, and the Medicare Part B deductible is $233 per year.Dec 14, 2021

What is the Medicare annual deductible for 2020?

Medicare Advantage deductible in 2021 According to eHealth research, the average Medicare Advantage plan annual deductible went down from $145 in 2018, to $133 in 2019, to $129 in 2020.Dec 20, 2021

Is there a deductible for Medicare Part D?

The Medicare Part D deductible is the amount that you will pay each year before your Medicare plan pays its portion. Some drug plans charge a $0 yearly deductible, but this amount can vary depending on the provider, your location, and more. The highest deductible amount that any Part D plan can charge in 2021 is $445.

Is Medicare Part D tax deductible?

Since 2012, the IRS has allowed self-employed individuals to deduct all Medicare premiums (including premiums for Medicare Part B – and Part A, for people who have to pay a premium for it – Medigap, Medicare Advantage plans, and Part D) from their federal taxes, and this includes Medicare premiums for their spouse.

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Is there a deductible for Medicare Part B?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the Part D deductible for 2021?

$445 a yearSummary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year. You probably know that being covered by insurance doesn't mean you can always get services and benefits for free.

What is the difference between Medicare Part B premium and deductible?

The standard Part B premium amount is $148.50 (or higher depending on your income) in 2021. You pay $203.00 per year for your Part B deductible in 2021. After your deductible is met, you typically pay 20% of the In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

What is the Medicare Deductible for 2022?

A deductible refers to the amount of money you must pay out of pocket for covered healthcare services before your health insurance plan starts to p...

Does Original Medicare Have Deductibles?

Original Medicare is composed of Medicare Part A and Medicare Part B. Both parts of Original Medicare have deductibles you will have to pay out of...

Do You Have to Pay a Deductible with Medicare?

You’ve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

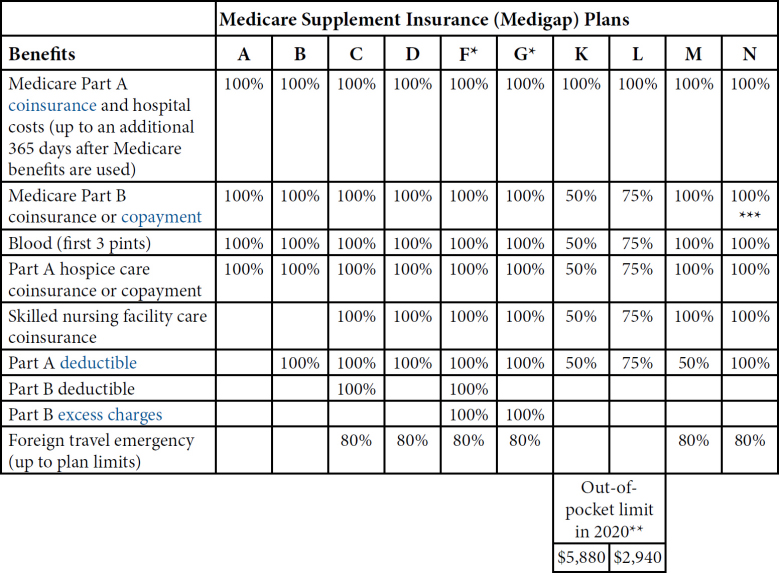

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What is the Medicare deductible for 2021?

Medicare Part A. Medicare Part A has the most complex deductible. For 2021, the Medicare Part A deductible is $1,484. However, this is not a yearly deductible. Rather, it is a deductible for each benefit period. The benefit period begins the first day you enter a hospital or skilled nursing care facility for an inpatient stay.

How much is Medicare Part B deductible in 2021?

Medicare Part B. The deductible for Medicare Part B is $203 per year in 2021. After you spend this amount out of pocket on covered services, you will usually pay 20% of the Medicare-approved amount for most services.

Does Medicare Advantage have a deductible?

Medicare Advantage plans that offer prescription drug coverage may sometimes feature two different deductibles, with one being for medical costs and the other for prescription costs.

What is Medicare Part C?

Medicare Part C (Medicare Advantage) The deductibles for Medicare Advantage plans are more like those of conventional private health insurance. Part C plan deductible amounts will vary from one plan to the next. This is different from Medicare Part A and Part B (Original Medicare) where deductibles come at a fixed amount for everyone enrolled.

What is Medicare Supplement Insurance?

A Medicare Supplement Insurance plan, or “Medigap,” can provide coverage for Medicare Part A and Part B deductibles, among other out-of-pocket expenses. There are several Medigap plans that offer full coverage for the Medicare Part A deductible and some plans that offer partial coverage.

Who is Christian Worstell?

Or call 1-800-995-4219 to speak with a licensed insurance agent. Christian Worstell is a health care and policy writer for MedicareSupplement.com. He has written hundreds of articles helping people better understand their Medicare coverage options.