How early should you sign up for Medicare?

If you’re under 65 years old, you might be eligible for Medicare:

- If you receive disability benefits from Social Security or certain disability benefits from the Railroad Retirement Board (RRB) for at least 24 months in a row

- If you have amyotrophic lateral sclerosis (ALS, also called Lou Gehrig’s disease)

- If you have end-stage renal disease (ESRD). ...

How far in advance to sign up for Medicare?

You can sign up as early as three months before the month in which you turn 65 and as late as three months after your 65th-birthday month. To avoid any delay in coverage, enroll before you turn 65, says Joe Baker, of the Medicare Rights Center.

When is the deadline for signing up for Medicare?

The General Enrollment Period lasts from January 1 to March 31 each year. You can only sign up for Part A and/or Part B during this period, and your coverage starts on July 1. You may have to pay a late enrollment period for Part A and/or Part B, as detailed below.

When is the best time to sign up for Medicare?

Situations that don’t qualify for a Special Enrollment Period:

- Your COBRA coverage or retiree coverage ends. If you miss your 8-month window when you stopped working, you’ll have to wait until the next General Enrollment Period to sign up.

- You have or lose your Marketplace coverage.

- You have End-Stage Renal Disease (ESRD). Learn more about Medicare coverage for ESRD.

Is December 7th the last day to sign up for Medicare?

When you first become eligible for Medicare, you can join a plan. Open Enrollment Period. From October 15 – December 7 each year, you can join, switch, or drop a plan. Your coverage will begin on January 1 (as long as the plan gets your request by December 7).

What is the time limit to sign up for Medicare?

Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

Do you have to sign up for Medicare or is it automatic when you turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What happens if you forget to sign up for Medicare at age 65?

The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled. For example, suppose that: You were eligible for Medicare in 2019, but you didn't sign up until 2021.

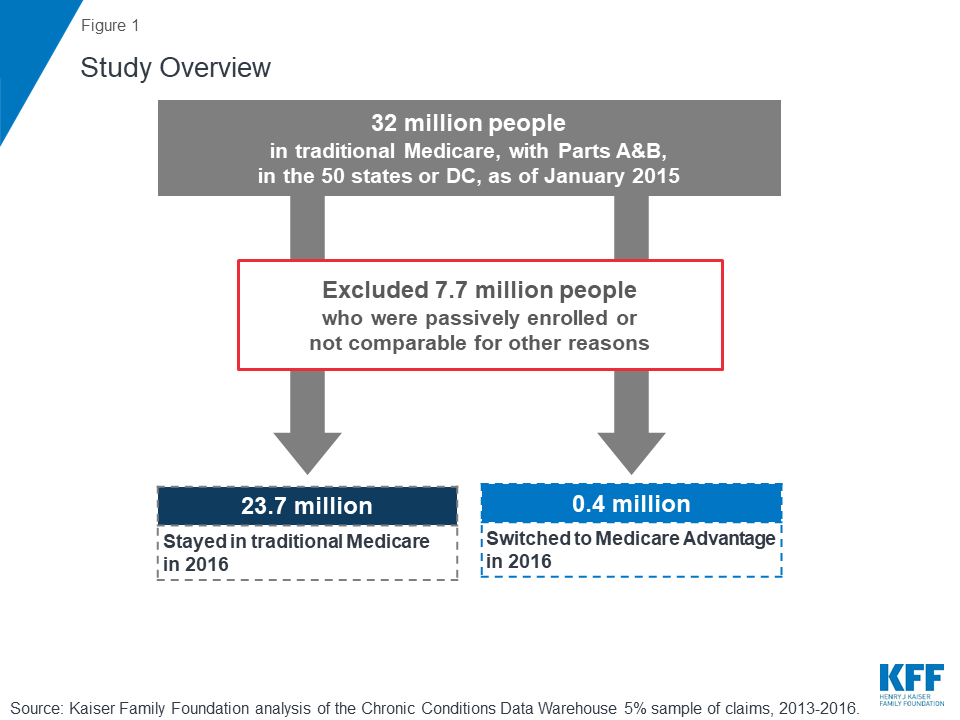

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Does Medicare coverage start the month you turn 65?

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare.

What documents do I need to apply for Medicare?

What documents do I need to enroll in Medicare?your Social Security number.your date and place of birth.your citizenship status.the name and Social Security number of your current spouse and any former spouses.the date and place of any marriages or divorces you've had.More items...

When should I sign up for Medicare Part B if I am still working?

You can wait until you stop working (or lose your health insurance, if that happens first) to sign up for Part B, and you won't pay a late enrollment penalty.

What do I need to do before I turn 65?

Turning 65 Soon? Here's a Quick Retirement ChecklistPrepare for Medicare. ... Consider Additional Health Insurance. ... Review Your Social Security Benefits Plan. ... Plan Ahead for Long-Term Care Costs. ... Review Your Retirement Accounts and Investments. ... Update Your Estate Planning Documents.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Is Medicare Part A free?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Can I sign up for Medicare at age 70?

The initial open enrollment period for Medicare Part A and Part B begins three months before you turn 65 and ends three months after your birthday. Even if you are continuing to work past your sixty-fifth birthday, it is important to sign up for Medicare, especially if you have worked for more than 10 years.

How to get Medicare if you are not collecting Social Security?

If you’re not already collecting Social Security benefits before your Initial Enrollment Period starts, you’ll need to sign up for Medicare online or contact Social Security. To get the most from your Medicare and avoid the Part B late enrollment penalty, complete your Medicare enrollment application during your Initial Enrollment Period.

When is the best time to join Medicare?

The best time to join a Medicare health or drug plan is when you first get Medicare. Signing up when you’re first eligible can help you avoid paying a lifetime Part D late enrollment penalty. If you miss your first chance, generally you have to wait until fall for Medicare’s annual Open Enrollment Period (October 15–December 7) to join a plan.

Answer a few questions to find out

These questions don’t apply if you have End-Stage Renal Disease (ESRD).

Do you have health insurance now?

Are you or your spouse still working for the employer that provides your health insurance coverage?

When can I join a health or drug plan?

Find out when you can sign up for or change your Medicare coverage. This includes your Medicare Advantage Plan (Part C) or Medicare drug coverage (Part D).

Types of Medicare health plans

Medicare Advantage, Medicare Savings Accounts, Cost Plans, demonstration/pilot programs, and Programs of All-inclusive Care for the Elderly (PACE).

Your first chance to sign up (Initial Enrollment Period)

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

Between January 1-March 31 each year (General Enrollment Period)

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don’t qualify for a Special Enrollment Period.

Special Situations (Special Enrollment Period)

There are certain situations when you can sign up for Part B (and Premium-Part A) during a Special Enrollment Period without paying a late enrollment penalty. A Special Enrollment Period is only available for a limited time.

Joining a plan

A type of Medicare-approved health plan from a private company that you can choose to cover most of your Part A and Part B benefits instead of Original Medicare. It usually also includes drug coverage (Part D).

How to change your Medicare plan?

Medicare Open Enrollment is almost over. If you’re thinking about changing your Medicare plan, you have until December 7 to take these actions: 1 Change how you get your Medicare coverage—Original Medicare or a Medicare Advantage Plan 2 Switch Medicare Advantage Plans (with or without drug coverage) 3 Join, switch, or drop a Medicare drug plan

Is it important to know your Medicare coverage options?

Even if you’re happy with your current health coverage, it’s important to know your Medicare coverage options and compare other health and drug plans during Open Enrollment. You may find Medicare coverage that better meets your needs for the upcoming year.

Is Medicare coverage the same for 2021?

Compare Medicare health & drug plans for 2021. Not all Medicare coverage options offer the same benefits, and costs can change each year. There may be other health and prescription drug plans available that better meet your needs for 2021.

When is the enrollment period for Medicare?

Drop your Medicare Advantage plan and return to Original Medicare. Drop your stand-alone Medicare prescription drug plan. Annual Enrollment Period: October 15 – December 7 each year.

How long does Medicare enrollment last?

You’re eligible for Medicare because you turn age 65. Initial Enrollment Period: the 7-month period that begins 3 months before your birthday month, includes your birthday month, and ends 3 months after your birthday month.

What is Medicare Part C?

Medicare Part C is Medicare Advantage. Medicare Part D is prescription drug coverage. You want to do any of these…. Medicare Advantage and Medicare prescription drug plan enrollment period. Sign up for a Medicare Advantage plan. Switch from one Medicare Advantage plan to another.

How long is the Medicare Supplement Open Enrollment Period?

Or, you already had Medicare Part A and you’ve just enrolled in Medicare Part B. Medicare Supplement Open Enrollment Period (OEP): this 6-month period starts the first month that you’re both age 65 or over, and enrolled in Medicare Part B.

How long is a SEP period?

The month after employment-based health insurance ends. Your SEP Period is usually 2 full months after the month of the triggering events. Your situation with a Medicare Advantage plan or a stand-alone Medicare prescription drug plan (PDP) Medicare Advantage/PDP Special Enrollment Period.

Can you change your Medicare coverage?

When you enroll in Medicare, you have a choice of how you receive your Medicare benefits. You can also make changes in your Medicare coverage. It’s important to understand the Medicare enrollment periods, when they happen, and how you can use them.

1. Current enrollees

Open enrollment is only for seniors who are already receiving health coverage through Medicare, not for those signing up for the first time.

2. Think about your Medicare coverage for 2022

Carefully review your current Medicare coverage, and note any upcoming changes to your costs or benefits.

3. Review your 2022 Medicare & You handbook

The Medicare & You handbook has information about Medicare coverage and Medicare plans in your area.

4. Preview 2022 health and prescription drug plans

Medicare helps you compare coverage options and shop for health plans.

5. When your coverage starts

For existing Medicare enrollees, from October 15 to December 7 of each year, you can join, switch, or drop a plan.

When is the Medicare Advantage open enrollment deadline?

Medicare Advantage Plan participants can switch to another Medicare Advantage Plan or drop their Medicare Advantage Plan and return to original Medicare, including purchasing a Medicare Part D plan, from Jan. 1 to March 31 each year.

What happens if you don't sign up for Medicare?

If you don't sign up for Medicare during this initial enrollment period, you could be charged a late enrollment penalty for as long as you have Medicare. The Medicare enrollment period is: You can initially enroll in Medicare during the seven-month period that begins three months before you turn age 65. If you continue to work past age 65, sign up ...

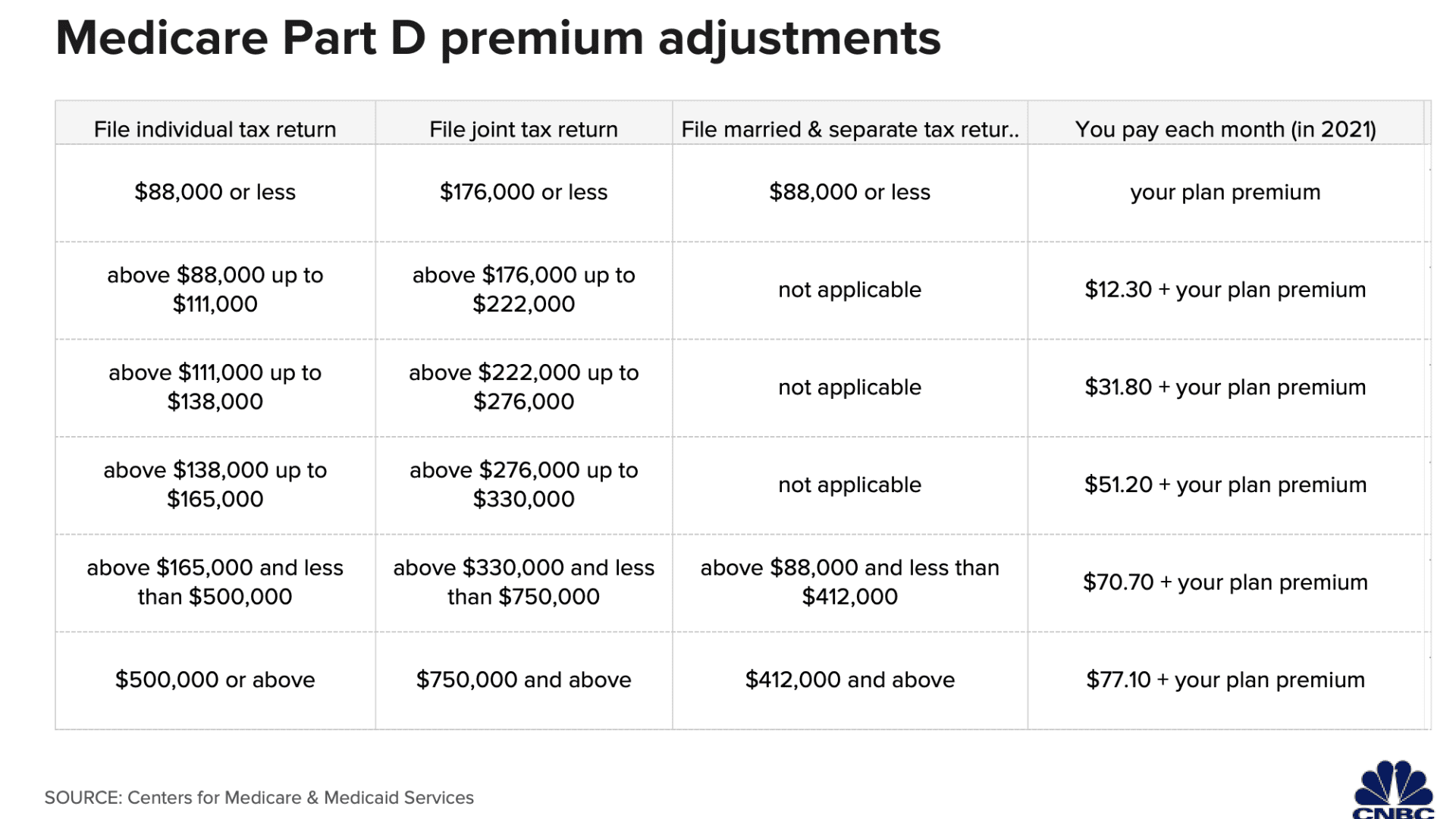

How long does Medicare Part D coverage last?

Medicare Part D prescription drug coverage has the same initial enrollment period of the seven months around your 65th birthday as Medicare parts A and B, but the penalty is different. The late enrollment penalty is applied if you go 63 or more days without credible prescription drug coverage after becoming eligible for Medicare. The penalty is calculated by multiplying 1% of the "national base beneficiary premium" ($32.74 in 2020) by the number of months you didn't have prescription drug coverage after Medicare eligibility and rounding to the nearest 10 cents. This amount is added to the Medicare Part D plan you select each year. And as the national base beneficiary premium increases, your penalty also grows.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans can be used to pay for some of Medicare's cost-sharing requirements and sometimes services traditional Medicare doesn't cover. The Medicare Supplement Insurance plans' enrollment period is different than the other parts of Medicare. It's a six-month period that begins when you are 65 or older and enrolled in Medicare Part B. During this open enrollment period, private health insurance companies are required by the government to sell you a Medicare Supplement Insurance plan regardless of health conditions.

How to enroll in Medicare Supplement?

The Medicare enrollment period is: 1 You can initially enroll in Medicare during the seven-month period that begins three months before you turn age 65. 2 If you continue to work past age 65, sign up for Medicare within eight months of leaving the job or group health plan to avoid penalties. 3 The six-month Medicare Supplement Insurance enrollment period begins when you are 65 or older and enrolled in Medicare Part B. 4 You can make changes to your Medicare coverage during the annual open enrollment period, from Oct. 15 to Dec. 7. 5 Medicare Advantage Plan participants can switch plans from Jan. 1 to March 31 each year.

How much is the late enrollment penalty for Medicare?

The late enrollment penalty is applied if you go 63 or more days without credible prescription drug coverage after becoming eligible for Medicare. The penalty is calculated by multiplying 1% of the "national base beneficiary premium" ($32.74 in 2020) by the number of months you didn't have prescription drug coverage after Medicare eligibility ...

How long does it take to get Medicare if you are 65?

If you continue to work past age 65, sign up for Medicare within eight months of leaving the job or group health plan to avoid penalties. The six-month Medicare Supplement Insurance enrollment period begins when you are 65 or older and enrolled in Medicare Part B. You can make changes to your Medicare coverage during the annual open enrollment ...