Does Medicare charge a deductible?

In 2021, the Medicare deductible for each benefit period is $1,484, which is $76 higher than in 2020. Coinsurance Long-term care requires coinsurance. Medicare Part A enrollees have to pay a $371 coinsurance fee each day for days 61 through 90, increasing from $352 in 2020.

How high will the Medicare Part B deductible get?

Jan 04, 2022 · What is the medicare part b deductible for 2021 year. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, which is $5 more than the annual deductible of $198 in 2020. appropriation of 2021 and other changes to the law (8337).

When are Medicare premiums deducted from Social Security?

Sep 01, 2021 · Specifically, Medicare beneficiaries may only deduct Medicare expenses from their taxes if their total deductible medical and dental expenses exceed 7.5% of their adjusted gross income (AGI). If you meet this qualification, you will need to complete Schedule A of Form 1040. The amount you deduct is subtracted from your gross income.

What is the current Medicare premium amount?

What is the 2021 deductible for Medicare?

$203Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is my deductible for Medicare?

The Medicare Part B deductible is $233. Once met, you pay 20 percent of the Medicare-approved amount for most doctor services, outpatient therapy and durable medical equipment.

What is the deductible for Medicare Part D in 2022?

$480What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

PinPoints

Medicare made some modifications to the 2021 deductible. The rising cost of healthcare necessitates an increase in Medicare premiums and deductibles.

What changes are made to Medicare Part A in 2021?

Medicare Part A covers hospitalization, nursing home care, and a portion of home healthcare.

The adjustments to Medicare Part B for 2021 are as follows

Part B of Medicare covers physician costs, outpatient treatments, some home health care services, medical equipment, and medications.

Medicare Part D will have the following changes in 2021

Medicare prescription medication coverage is another name for Medicare Part D.

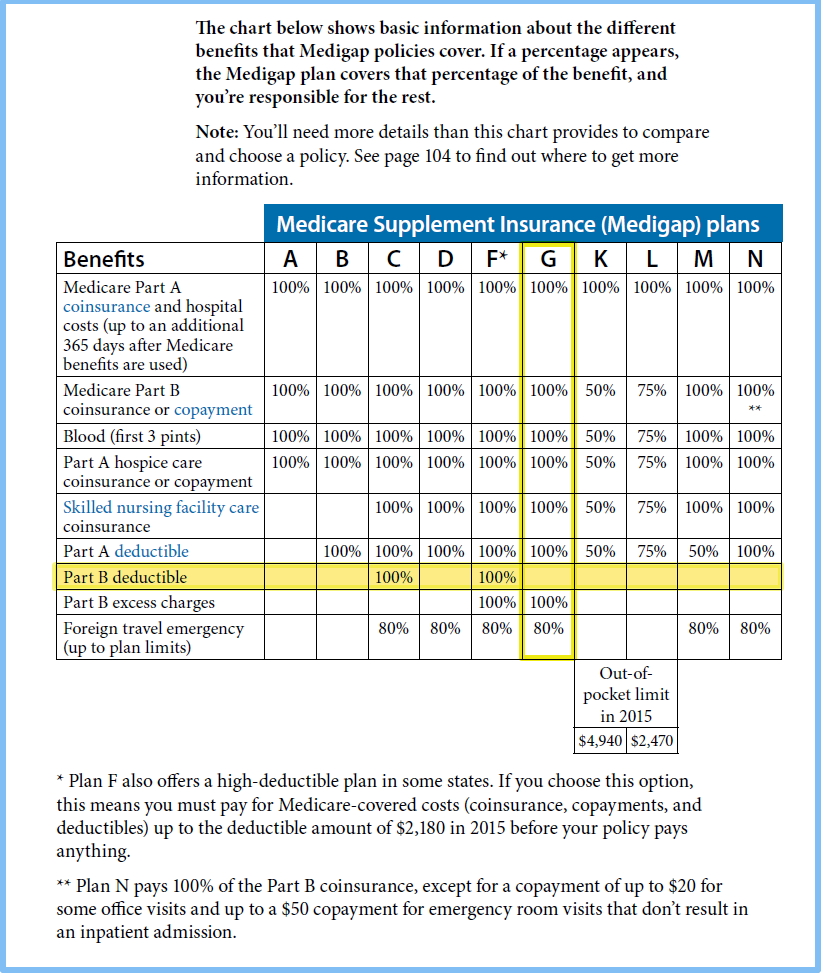

What changes are coming to Medigap in 2021?

Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

To fight the coronavirus (COVID-19)

On March 20, 2020, Medicare was modified to fulfil the needs of enrollees.

Conclusion

Apart from increased Medicare premiums and deductibles, there are more ways to save money on healthcare.

What is deductible medical expenses?

Any costs associated with the treatment or diagnosis of a medical condition or an injury can be deducted. This includes preventive care and the cost of any medical equipment or supplies. The IRS provides a list of deductible medical expenses. The list includes some items you might not expect.

What are the different types of deductions?

What Are the Four Major Categories of Tax Deductions? 1 Business Deductions 2 Standard Deductions 3 Above the Line Deductions 4 Below the Line Deductions

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Is Medicare free?

Medicare isn't free and we understand your desire to save money wherever you can. If you've been considering a Medigap plan but have been hesitant because of the price, we can help you compare plans and rates. Please call us at the number above or fill out our online rate form to get started.

What is the AGI for taxes?

The AGI is your gross income minus adjustments, such as student loan interest, retirement account contributions, and alimony payments. Another example is work-related moving expenses.

Is Medicare premium tax deductible?

The answer is yes; some Medicare premiums are tax-deductible. Most insurance premiums qualify for Form 1040’s Schedule A deductions but only over a certain threshold, including some Medicare premiums. This amount will be subtracted from your gross income. Your taxable income (after the deductions are made) will ultimately be used to determine ...