What is the Medicare Part B deductible for 2020?

Oct 13, 2014 · The 2015 Medicare Part A deductible -- for inpatient hospital, skilled nursing facility and home healthcare services -- will increase by $44 in calendar year 2015 to $1,260, while the monthly Part A premium will decline by $19. Medicare Part B monthly premiums and deductibles will remain unchanged.

What is the income limit for Medicare taxes?

Oct 10, 2014 · Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147. The Medicare Part A...

How does the Medicare deductible work?

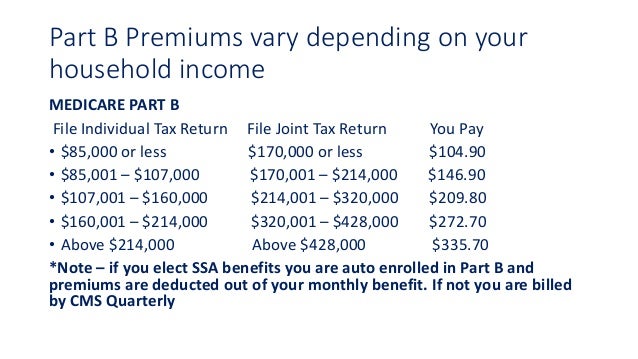

The 2015 Medicare Part B annual deductible remains $147 (unchanged from 2014 and 2013). 2015 Part B Premium Slightly higher Income Related Medicare Adjustment Amounts (IRMAA) in 2015. If Your Yearly Income is. File Individual Tax Return. File Joint Tax Return.

What is the Social Security and Medicare tax rate?

The amount you can deduct for qualified long-term care in- surance contracts (as defined in Pub. 502) depends on the age, at the end of 2015, of the person for whom the premi- ums were paid. See the following chart for details. IF the person was, at the end of 2015, age . . . THEN the most you can deduct is . . . 40 or under $ 380.

How much is Medicare Part B in 2015?

Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147. The Medicare Part A deductible, which covers the first 60 days of Medicare-covered inpatient hospital care, will rise to $1,260 in 2015, a $44 increase from 2014.

How much is Medicare Advantage going up?

The average premium for a Medicare Advantage plan is going up by about 9.5%, to $33.90 per month (you’re still on the hook for Part B premiums). However, premiums will remain the same for about 61% of people if they elect to stay with the same Medicare Advantage plan.

How long can you open enrollment for Medicare Supplement?

Medicare supplement policies don’t have an annual open-enrollment period; you can buy them anytime. But you usually can be rejected or charged more because of your health if you get the policy more than six months after signing up for Medicare Part B.

How much is Medicare Part B deductible in 2015?

If you have to pay a higher amount for your Part B premium and you disagree, you can appeal the IRMAA. The 2015 Medicare Part B annual deductible remains $147 (unchanged from 2014 and 2013).

What is Medicare Part D 2015?

2015 Part D (Medicare Prescription Drug Plan) Monthly Premium & Deductible. Medicare Prescription Drug Plan (Part D) premiums*, deductibles, and benefits vary by plan and state. Remember that you can receive Part D prescription drug coverage from a stand-alone Medicare Part D plan (PDP) or a Medicare Advantage plan that includes drug coverage ...

How much is Medicare Advantage premium for 2015?

The 2015 Medicare Advantage plan premiums range from $0 to $348.

How much is the 2015 Part D premium?

The 2015 Part D plan premiums range from $0 to $172. The 2015 standard Part D plan deductible is $320, however the actual plan deductible can be anywhere from $0 to $320 .

Do you pay Social Security if your adjusted gross income is above a certain amount?

However, if your modified adjusted gross income as reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS) is above a certain amount (see chart below), you may pay more.

What line do you deduct a TIPreceived assistance under?

530 for the amount you can deduct on line 6.

What line do you deduct a home loan on?

530 for the amount you can deduct on line 10 or 11.

What is the maximum Social Security tax for 2015?

The Social Security Tax Rate remains at 6.2 percent. The resulting maximum Social Security Tax for 2015 is $7,347.00. There is no limit on the amount of earnings subject to Medicare (Hospital Insurance) Tax.

What is the FICA rate for 2015?

The FICA Tax Rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2015 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

Is Medicare taxed on self employment?

All wages, self-employment income, and other compensation that are subject to regular Medicare Tax and are paid in excess of the applicable threshold are subject to the additional Medicare Tax.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

Is The Medicare Part A Deductible Increasing For 2021

Part A has a deductible that applies to each benefit period . The deductible generally increases each year. In 2019 it was $1,364, but it increased to $1,408 in 2020. And it has increased to $1,484 for 2021.

Does Everyone Have To Pay The Part B Deductible

Some Medicare enrollees arent directly responsible for the Part B deductible:

How High Is The High Deductible

The insurance company sets the deductible. One company that I know of offers two different plan deductibles. This company offers one plan with a $5000 and another with an $8000 deductible. And each plan comes with a different annual deposit into the Medical Savings Account.

Are There Inflation Adjustments For Medicare Beneficiaries In High

Medicare beneficiaries with high incomes pay more for Part B and Part D. But what exactly does high income mean? The high-income brackets were introduced in 2007 for Part B and in 2011 for Part D, and for several years they started at $85,000 .

How Do Medicare Copays And Deductibles Work

by Christian Worstell | Published April 22, 2021 | Reviewed by John Krahnert

Do You Worry About Your Medicare Deductibles Premiums And Other Costs

Many Medicare beneficiaries are concerned about Medicare costs, like premiums, deductibles, and copayments/coinsurance, according to an eHealth study in 2020.

Is Original Medicare Enough

The short answer is that Original Medicare alone can leave you open to large medical bills. Unlike traditional health insurance, Medicare does not limit your maximum out-of-pocket medical costs.

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.