What is the coverage gap in Medicare?

Aug 01, 2016 · The $51 that you spend will count toward your out-of-pocket spending limit or TrOOP. The 2017 Donut Hole discount for brand-name drugs will increase to 60% and you will receive credit for 90% of the retail drug cost toward meeting your 2017 total out-of-pocket maximum (TrOOP) or Donut Hole exit point (the 40% you spend plus the 50% drug …

What is the 25% coverage gap for prescription drugs?

Apr 15, 2022 · In the coverage gap, beneficiaries pay 51 percent of drug costs for generics and 40 percent for brand-name drugs. The True Out-of-Pocket (TrOOP) limit for Part D in 2017 is $4,950. Upon reaching this limit, beneficiaries enter catastrophic coverage and have limited cost-sharing for any remaining drug expenses for the year.

How much will Medicare pay for generic drugs during the gap?

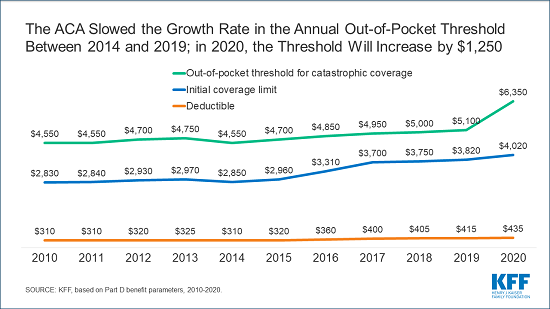

will increase from $3,310 in 2016 to $3,700 in 2017. Out-of-Pocket Threshold: will increase from $4,850 in 2016 to $4,950 in 2017. Coverage Gap (donut hole): begins once you reach your Medicare Part D plan’s initial coverage limit ($3,700 in 2017) and ends when you spend a total of $4,950 in 2017. In 2017, Part D enrollees will receive a 60% ...

How can I avoid the Medicare Part D coverage gap?

For 2017, the coverage gap at $3,700, representing the total amount that you and your plan pays for drugs during the year. Once you hit the coverage gap, …

What is the Part D donut hole for 2021?

What is the Medicare gap period?

Does the Medicare donut hole reset each year?

What is the coverage gap limit?

What is the Medicare donut hole for 2022?

Does Medigap cover the donut hole?

Can I avoid the donut hole?

Does the donut hole end at the end of the year?

How does Medicare Part D calculate donut holes?

- Plan deductible.

- Coinsurance/copayments for your medications.

- Any discount you get on brand-name drugs. For example, if your plan gives you a manufacturer's discount of $30 for a medication, that $30 counts toward the Medicare Part D donut hole (coverage gap).

Has the donut hole been eliminated?

What is coverage gap discount?

Is there an out-of-pocket maximum for Medicare Part D?

What is Medicare Part D?

Medicare Part D covers outpatient prescription drugs and is solely offered by private insurance companies who contract with Medicare. Each insurer can design plans with varying benefits and costs provided that each plan is determined to be at least as good as the standard benefit design as regulated by Medicare. The average basic premium for Part D plans in 2017 is estimated to be $34 per month, an increase of 4.6 percent from 2016; however, like Part B, individuals are subject to income-related premium adjustments. [iv] The maximum deductible allowed in 2017 for Part D is $400, an 11 percent increase from 2016. [v] Upon reaching the deductible, beneficiaries enter the initial coverage period in which they pay 25 percent of their costs. Once overall costs exceed $3,700, the beneficiary enters the coverage gap, known as the “donut hole”. In the coverage gap, beneficiaries pay 51 percent of drug costs for generics and 40 percent for brand-name drugs. The True Out-of-Pocket (TrOOP) limit for Part D in 2017 is $4,950. Upon reaching this limit, beneficiaries enter catastrophic coverage and have limited cost-sharing for any remaining drug expenses for the year.

Does Medicare require a monthly premium?

Medicare beneficiaries are required to pay monthly premiums and annual deductibles like most individuals enrolled in other health insurance plans. Medicare coverage is separated into four “parts”, each covering different health care products and services. Medicare Part A covers inpatient hospital services, as well as skilled nursing facility stays and some home health care services. Most beneficiaries qualify to receive Part A coverage without paying a monthly premium if they have paid Medicare taxes on their earned income for 10 or more years. There is a deductible, though, of $1,316 in 2017 for inpatient hospital services (compared with $1,288 in 2016), as well as co-payments required for long-term hospital and skilled nursing facility stays. [i]

How much is the initial deduction for 2017?

Initial Deductible: will be increased by $40 to $400 in 2017. Initial Coverage Limit: will increase from $3,310 in 2016 to $3,700 in 2017. Out-of-Pocket Threshold: will increase from $4,850 in 2016 to $4,950 in 2017.

When will Medicare Part D enrollment start in 2022?

If you would like for us to send you an email as additional 2022 Medicare Part D plan information comes online and when enrollment begins (October 15th), please complete the form below. We will NOT share your information with any third-parties.

What is the out of pocket threshold?

Out-of-Pocket Threshold - This is the Total Out-of-Pocket Costs including the Donut Hole.

What is the increase in the cost of a generic drug in 2017?

will increase to greater of 5% or $3.30 for generic or preferred drug that is a multi-source drug and the greater of 5% or $8.25 for all other drugs in 2017. will increase to $3.30 for generic or preferred drug that is a multi-source drug and $8.25 for all other drugs in 2017.

Does Medicare Part D count toward TROOP?

The 50% discount paid by the brand-name drug manufacturer will apply to getting out of the donut hole, however the additional 10% paid by your Medicare Part D plan will not count toward your TrOOP.

What is the coverage gap for Medicare Part D?

Because this feature of Part D provides no benefits for a certain expense amount in between the initial coverage and the catastrophic coverage maximum out-of-pocket provisions, this gap is also known as the donut hole. For 2017, the coverage gap at $3,700, representing the total amount that you and your plan pays for drugs during the year.

How many credits do you need to get Medicare?

Medicare plays a key role in financial security for seniors, but not everyone is eligible. In order to get Medicare coverage, including free Part A hospital insurance without monthly premiums, you need to have 40 credits under the Social Security program. With each credit requiring $1,300 of earned income in 2017, most people who work are able to earn enough to get the maximum of four credits per year. Therefore, it takes most people 10 years to become eligible for Medicare.

Does Medicare Part B charge monthly?

Medicare Part B medical coverage charges participants a monthly premium. However, what that premium is depends on how long you've had Medicare and whether you have your premiums withheld directly from your Social Security benefits.

What is the Medicare premium for 2017?

For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80. Because of the “hold harmless” provision covering the other 70 percent of beneficiaries, premiums for the remaining 30 percent must cover most ...

What is the average Social Security premium for 2017?

Among this group, the average 2017 premium will be about $109.00, compared to $104.90 for the past four years.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is Medicare Part A deductible?

The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,316 per benefit period in 2017, an increase of $28 from $1,288 in 2016. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the “hold harmless” provision include beneficiaries who do not receive Social Security benefits, those who enroll in Part B for the first time in 2017, those who are directly billed for their Part B premium, those who are dually eligible for Medicaid and have their premium paid by state Medicaid agencies, and those who pay an income-related premium. These groups represent approximately 30 percent of total Part B beneficiaries.

Is Medicare Part B deductible finalized?

Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B monthly premiums. These income-related monthly premium rates affect roughly five percent of people with Medicare.

How much did Medicare save in 2017?

The FY 2017 Budget includes a package of Medicare legislative proposals that will save a net $419.4 billion over 10 years by supporting delivery system reform to promote high‑quality, efficient care, improving beneficiary access to care, addressing the rising cost of pharmaceuticals, more closely aligning payments with costs of care, and making structural changes that will reduce federal subsidies to high‑income beneficiaries and create incentives for beneficiaries to seek high‑value services. These proposals, combined with tax proposals included in the FY 2017 President’s Budget, would help extend the life of the Medicare Hospital Insurance Trust Fund by over 15 years.

What is the Medicare premium for 2016?

The Bipartisan Budget Act of 2015 included a provision that changed the calculation of the Medicare Part B premium for 2016. Due to the 0 percent cost-of-living adjustment in Social Security benefits, about 70 percent of Medicare beneficiaries are held harmless from increases in their Part B premiums for 2016 and continue to pay the same $104.90 monthly premium as in 2015. The remaining 30 percent of beneficiaries who are not held harmless would have faced a monthly premium this year of more than $150 (a nearly 50 percent increase from 2015). Under the Act, these beneficiaries will instead pay a standard monthly premium of $121.80, which represents the actuary’s premium estimate of the amount that would have applied to all beneficiaries without the hold harmless provision plus an add-on amount of $3. In order to make up the difference in lost revenue from the decrease in premiums, the Act requires a loan of general revenue from Treasury to the Part B Trust Fund. To repay this loan, the standard Part B monthly premium in a given year is increased by the $3 add-on amount until this loan is fully repaid, though the hold harmless provision still applies to this $3 premium increase. This provision will apply again in 2017 if there is a zero percent cost-of-living adjustment from Social Security.

What is the evidence development process for Medicare Part D?

It will be modeled in part after the coverage with evidence development process in Parts A and B of Medicare and based on the collection of data to support the use of high cost pharmaceuticals in the Medicare population. For certain identified drugs, manufacturers will be required to undertake further clinical trials and data collection to support use in the Medicare population, and for any relevant subpopulations identified by CMS. Part D plans will be able to use this evidence to improve their clinical treatment guidelines and negotiations with manufacturers. The proposal helps to ensure that the coverage and use of new high-cost drugs are based on evidence of effectiveness for specific populations. [No budget impact]

How much is the withhold for end stage renal disease?

This proposal changes the withhold for the End Stage Renal Disease Networks from 50 cents to $1.50 per treatment , to be updated annually by the consumer price index. The withhold is deducted from each End Stage Renal Disease Prospective Payment System per‑treatment payment, and has not been increased since 1986 when it first took effect. The End Stage Renal Disease Networks are currently underfunded to meet statutory and regulatory obligations. In order for the End Stage Renal Disease Networks to effectively and efficiently administer the future demands of the End Stage Renal Disease program, increased operational resources are required. [No budget impact]

Can Medicare magistrates be used for appeals?

This proposal allows the Office of Medicare Hearings and Appeals to use Medicare magistrates for appealed claims below the federal district court amount in controversy threshold ($1,500 in calendar year 2016 and updated annually), reserving Administrative Law Judges for more complex and higher amount in controversy appeals. [No budget impact]

Does Medicare revise the Part D plan payment methodology?

This proposal allows Medicare to revise the Part D plan payment methodology to reimburse plans based on their quality star ratings. Plans with quality ratings of four stars or higher would have a larger portion of their bid subsidized by Medicare, while plans with lower ratings would receive a smaller subsidy. This proposal is modeled after the Medicare Advantage Quality Bonus Program, but would be implemented in a budget neutral fashion. It would not impact risk corridor payments, reinsurance, low-income subsidies, or other components of Part D payments. [No budget impact]

When will hospitals receive bonus payments?

Under this proposal, hospitals that furnish a sufficient proportion of their services through eligible alternative payment entities will receive a bonus payment starting in 2022. Bonuses would be paid through the Inpatient Prospective Payment System permanently and through the Outpatient Prospective Payment System until 2024. Each year, hospitals that qualify for this bonus will receive an upward adjustment to their base payments. Reimbursement through the inpatient and outpatient prospective payment systems to all providers will be reduced by a percentage sufficient to ensure budget neutrality. [No budget impact]

What is the coverage gap in Medicare?

Typically, each new coverage phase begins once your spending has reached a certain amount. The coverage gap is one of the coverage phases under Medicare Part D.

When will the Medicare coverage gap end?

This gap will officially close in 2020 , but you can still reach this out-of-pocket threshold where your medication costs may change. Find affordable Medicare plans in your area.

What is the deductible phase of Medicare?

Deductible phase: For most stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans, you’ll pay 100% for medication costs until you reach the yearly deductible amount (if your plan has one). After you reach the deductible, the Medicare plan begins to cover its share of prescription drug costs. The deductible amount may vary by plan, and some plans may not have a deductible. If your Medicare plan doesn’t have a deductible, then you’ll start your coverage in the initial coverage phase (see below).

How to avoid coverage gap?

Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap. Here are some tips for how you can lower the amount you spend on medications: Many expensive prescription drugs have a generic or lower-cost alternative. Switching to lower-cost drugs may help you avoid entering the coverage gap.

What is the Medicare Part D coverage gap?

The Medicare Part D Coverage Gap (“Donut Hole ”) Made Simple. Summary: When it comes to Medicare prescription drug coverage, you might have questions surrounding the Medicare Part D coverage gap, also known as the “donut hole.”. The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage ...

Why won't Medicare pay the $4,020 coverage gap?

Now that you know about the coverage gap (“donut hole”), here is some good news: Many Medicare beneficiaries won’t have to pay the increased prices during the coverage gap because their prescription drug costs won’t reach the initial coverage limit of $4,020 in 2020.

What happens if you spend $6,350 on prescriptions in 2020?

Remember, if your prescription drug spending reaches $6,350 in 2020, you’ll have catastrophic coverage for the rest of the year. The following costs count towards your out-of-pocket spending and getting you out of the coverage gap: Your prescription drug plan’s yearly deductible.

What is Medicare Part D coverage gap?

Period of consumer payment for prescription medication costs. The Medicare Part D coverage gap (informally known as the Medicare doughnut hole) is a period of consumer payment for prescription medication costs which lies between the initial coverage limit and the catastrophic-coverage threshold, when the consumer is a member ...

When will the coverage gap be eliminated?

Provisions of the Patient Protection and Affordable Care Act of 2010 gradually phase out the coverage gap, eliminating it by 2020.

How much does Medicare pay for a donut hole?

Medicare Part D beneficiaries who reach the Donut Hole will also pay a maximum of 25% co-pay on generic drugs purchased while in the Coverage Gap (receiving a 75% discount). For example: If you reach the 2020 Donut Hole, and your generic medication has a retail cost of $100, you will pay $25. The $25 that you spend will count toward your TrOOP ...

How much is Medicare Part D 2020?

The 2020 Medicare Part D standard benefit includes a deductible of $435 (amount beneficiaries pay out of pocket before insurance benefits kick in) and 25% co-insurance, up to $6,350.

What percentage of Medicare Part D enrollees in 2007 were not eligible for low income subsidies?

The most common forms of gap coverage cover generic drugs only. Among Medicare Part D enrollees in 2007 who were not eligible for the low-income subsidies, 26 percent had spending high enough to reach the coverage gap. Fifteen percent of those reaching the coverage gap (four percent overall) had spending high enough to reach ...

What is the gap between insurance and consumer?

The gap is reached after shared insurer payment - consumer payment for all covered prescription drugs reaches a government-set amount, and is left only after the consumer has paid full, unshared costs of an additional amount for the same prescriptions.

When will the Medicare doughnut hole close?

From 2017 to 2020, brand-name drug manufacturers and the federal government will be responsible for providing subsidies to patients in the doughnut hole.

What happens if you spend $6,550 in 2021?

Once you've spent $6,550 out-of-pocket in 2021, you're out of the coverage gap. Once you get out of the coverage gap (Medicare prescription drug coverage), you automatically get "catastrophic coverage." It assures you only pay a small Coinsurance percentage or Copayment for covered drugs for the rest of the year.

What is catastrophic coverage in 2021?

Catastrophic coverage. Once you've spent $6,550 out-of-pocket in 2021, you're out of the coverage gap. Once you get out of the coverage gap (Medicare prescription drug coverage), you automatically get "catastrophic coverage.". It assures you only pay a small. An amount you may be required to pay as your share of the cost for services ...