What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

What determines your Medicare Part B premium?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

How much does Medicare Part B costs?

and Part B which covers doctor’s visits and other medical services, and costs $170.10 per month for most enrollees in 2021. Everyone is eligible for Medicare at age 65, even if your full Social ...

How are Medicare Part B premiums paid?

for these:

- Most doctor services (including most doctor services while you're a hospital inpatient)

- Outpatient therapy

- Durable Medical Equipment (Dme) Certain medical equipment, like a walker, wheelchair, or hospital bed, that's ordered by your doctor for use in the home.

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What were Medicare Part B premiums in 2019?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

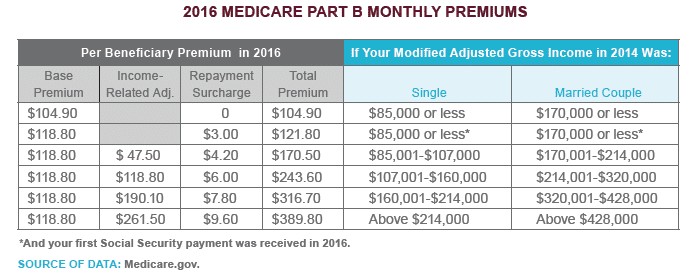

What were Medicare Part B premiums in 2016?

If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

How much did Medicare premiums increase in 2019?

By law, Part B premiums for current Medicare beneficiaries may not increase by more than the amount of the cost-of-living adjustment (COLA) for Social Security or Railroad Retirement Board benefits. The COLA in 2019 is 2.8 percent.

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is the Irmaa for 2018?

New 2018 Medicare SurchargesIRMAA TierIndividual MAGI (2017)Individual MAGI (2018)Tier 1Up to $107,000Up to $107,000Tier 2Up to $160,000Up to $133,500Tier 3Up to $214,000Up to $160,000Tier 4> $214,000> $160,0001 more row

What was the Medicare Part B premium for 2015?

Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147.

Is Medicare Part B premium adjusted annually?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

How much will Medicare B go up in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What were the Medicare Part B premiums in 2020?

Part B Monthly Premium The standard Part B premium amount in 2020 is $144.60 or higher depending on your income. However, most people who get Social Security benefits pay less than this amount ($130 on average). Social Security will tell you the exact amount you'll pay for Part B in 2020.

What were Medicare premiums for 2020?

For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts. The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019.

What was Irmaa for 2019?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2019More than $160,000 but less than $500,000 More than $500,000$433.40 $460.50Married filing jointlyMore than $170,000 but less than or equal to $214,000$189.60More than $214,000 but less than or equal to $267,000$270.909 more rows•Dec 6, 2021

What is the standard monthly premium for Medicare Part B?

$170.10Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the Magi for Medicare for 2019?

The base Medicare premium for 2019 is $135.50 per month. Surcharges are imposed on beneficiaries with higher income: single taxpayers with modified adjusted gross income (MAGI) in excess of $85,000 and married couples with MAGI greater than $170,000.

What are the Medicare premiums for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is Part D deductible for 2017?

In 2017, you can expect the following costs: The Part D deductible is $1,316 per benefit period. Once you meet the deductible, you’ll pay nothing out of pocket for the first 60 days of your stay. For days 61 to 90, you’ll pay $329 per day. For days 91 and beyond, you’ll pay $658 per day.

How much does it cost to get a quarter credit in 2017?

If you earn fewer than 30 quarter credits, the cost is $413 a month in 2017. Few people might pay the premium for Part A, but everyone with this coverage still must meet certain deductibles, and cost-sharing is still required. In 2017, you can expect the following costs:

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

What is Medicare Part B premium?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. Some beneficiaries who were held harmless ...

How much is Medicare premium in 2018?

The average basic premium for a Medicare prescription drug plan in 2018 is projected to decline to an estimated $33.50 per month.

What is the Medicare deductible for 2018?

CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

How much is Medicare Part A deductible?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017. ...

Will Part B premiums increase in 2018?

Some beneficiaries who were held harmless against Part B premium increases in prior years will have a Part B premium increase in 2018, but the premium increase will be offset by the increase in their Social Security benefits next year. “Medicare’s top priority is to ensure that beneficiaries have choices for affordable, ...

Is there more coverage for Medicare?

CMS recently released the benefit, premium, and Star Ratings information for Medicare health and drug plans which shows that there will be more health coverage choices, improved access to high-quality health choices, and decreased premiums in 2018.

What is part B of medical?

Medical diagnostic tests as part of one's ordinary treatment are also typical charges. Part B covers a wider range of items, ranging from ambulance services, clinical research, and durable medical equipment to mental-health services and second opinions for surgical operations. Image source: Getty Images.

How much does Medicare cover?

You're responsible for paying that amount out of your own pocket before Medicare starts providing coverage, and after that, Medicare typically covers 80% of most services that Part B covers, leaving you with the remaining 20%. There are exceptions to this rule for certain preventive services for which Part B pays the entire amount.

Why is Medicare paying a lower amount?

About a quarter of Medicare beneficiaries will qualify to pay a lower amount due to unusually low cost-of-living increases in their Social Security payments over the past several years.

What is a Medicare visit?

Referred to as a "Welcome to Medicare" visit, you'll get a doctor to review your medical history and assess key health characteristics such as height, weight, blood pressure, and a calculation of your body mass index.

Does Medicare cover wellness visits?

After that, Medicare also provides yearly wellness visits to keep your vital information up to date.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How Does Medicare Part B Work?

Before getting into the weeds of Medicare Part B premiums, let’s do a quick review of Medicare Part B and its role in federal retirement health insurance.

Medicare Part B Premiums

Medicare Part B premiums are calculated based on a person’s modified adjusted gross income (MAGI). For purposes of Part B premiums, your MAGI is the adjusted gross income you report on line 11 of your federal tax return, plus any tax-exempt interest income, such as municipal bonds (line 2a) earnings.

Who Pays More for Medicare Part B?

Each year the government crunches the numbers to determine total costs for providing Medicare Part B coverage. For most enrollees, the government agrees to cover 75% of the cost and charges enrollees the Medicare Part B premium to cover the other 25%.

How to Apply for Medicare Part B

If you are already receiving Social Security benefits when you turn 65, you will automatically be signed up for Medicare Part A and Medicare Part B by the Social Security program. Your Part B premium will be deducted from your retirement benefit each month.

The Bottom Line

Once you turn 65, the government agrees to cover the majority of your health insurance costs. But Medicare is not free. The Medicare Part B premium alone—irrespective of other Medicare out-of-pocket costs—is an important line-item expense you will want to plan for in retirement.