What is the current tax rate for Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers.

How to calculate additional Medicare tax properly?

- Normal medicare tax rate for individual is 1.45 % of gross wages or salary

- Normal medicare tax rate for self employed person is 2.9 % of Gross income.

- If wage or self employment income is more than the threshold amount , only then you are liable for additional medicare tax .

What is the additional Medicare tax?

What Is the Additional Medicare Tax?

- The Additional Medicare Tax has been in effect since 2013.

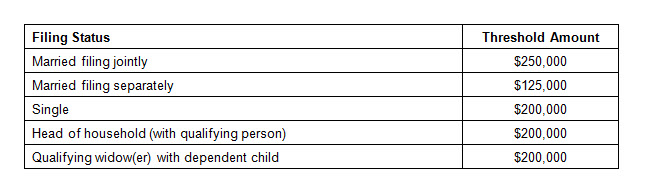

- Taxpayers who make over $200,000 as individuals or $250,000 for married couples are subject to an additional 0.9 percent tax on Medicare.

- The Additional Medicare Tax goes toward funding features of the Affordable Care Act.

Why is there a cap on the FICA tax?

Key Takeaways

- Social Security and Medicare payroll withholding are collected as the Federal Insurance Contributions Act (FICA) tax.

- Income tax caps limit do not apply to Medicare taxes, but Social Security taxes have a wage-based limit.

- The cap limits how much high earners need to pay in Social Security taxes each year.

What is the Medicare tax rate for 2018?

1.45%Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable-maximum amount. The Medicare portion is 1.45% on all earnings.

What is the tax rate for the Medicare tax?

1.45%Medicare tax: 1.45%. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions.

How do you calculate your Medicare tax?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

When did the Medicare tax rate change?

Since 2013, you'll pay a 3.8% Medicare tax rate on your net investment income when the total amount exceeds the income thresholds. The tax, known as the Net Investment Income tax, will go into the government's General Fund and not into Medicare. Most people only pay the 2.9% flat tax rate.

How does the 3.8 Medicare tax work?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

How much is SS and Medicare tax?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

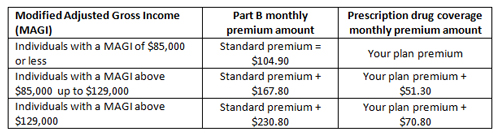

Are Medicare premiums based on adjusted gross income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How do you calculate FICA and Medicare tax 2022?

For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021).

Does everyone have to pay Medicare tax?

Generally, if you are employed in the United States, you must pay the Medicare tax regardless of your or your employer's citizenship or residency status. These taxes are deducted from each paycheck, and your employer is required to deduct Medicare taxes even if you do not expect to qualify for Medicare benefits.

Did the Medicare tax go up?

(Maximum Social Security tax withheld from wages is $9,114 in 2022). For Medicare, the rate remains unchanged at 1.45% for both employers and employees.

At what income level does Medicare tax increase?

The regulation has been in place since 2013. Everyone who earns income pays some of that income back into Medicare. The standard Medicare tax is 1.45 percent, or 2.9 percent if you're self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

What is the Medicare rate for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020.

What is Abacus payroll?

Abacus Payroll, Inc. is a leading provider of payroll solutions for businesses of all sizes. Whether yours is a family-owned small business or a national corporation, we provide payroll, tax and other financial services on time and at an affordable price. Unlike other payroll providers, Abacus Payroll will assign your very own payroll specialist who will understand your payroll needs inside and out. So no more speaking to a different person each time, no more sitting on hold for hours and most importantly no more missed deadlines! Contact us today to see how we can help your business. You can count on us.

What information do employers need to report to the state of New Jersey?

All employers in the states of New Jersey and Pennsylvania are required to report basic information about employees who are newly hired, rehired and returning to work after separation of employment or leave of absence, temporary employees, and contracted entities. Employers must report this information via the internet at www.nj-newhire.com and at www.cwds.pa.gov. Failure to report a new employee could result in a fine up to $25 per violation. New employers should receive instruction booklets upon registration with the state. Basic employee information which must be provided:

How much can I earn before my Social Security benefits are reduced?

A social security beneficiary under full retirement age can earn $16,920 before benefits are reduced. For every $2 a person under full retirement age earns over $16,920, $1 is withheld from benefits. In the year an employee reaches full retirement age, $1 in benefits will be withheld for each $3 they earn above $44,880 until the month the employee reaches full retirement age. Once an employee reaches full retirement age or older, their benefits are not reduced regardless of how much they earn.

What is the maximum pretax contribution for 2017?

The maximum employee pretax contribution remains unchanged at $18,000 in 2017. The “catch-up” contribution limit remains at $6,000 in 2017 for individuals who are age 50 or older.

When is the W-2 due for 2016?

The due date for filing 2016 Form W-2 with the Social Security Administration is now January 31st. This also applies to certain Form 1099-MISC reporting for non-employee compensation such as payments to independent contractors.

Does Social Security require W-2s?

Social Security has eliminated the use of magnetic tapes, cartridges and diskettes as a means of filing W-2 reports to SSA. Reports containing 250 or more W-2’s must be filed electronically via the Social Security Business Services Online (BSO).

What is the payroll tax rate for Medicare?

However, this amount is only assessed on the first $127,200 of wage income. Beyond this amount, the payroll tax rate is just 2.9% -- the employer and employee portions of the Medicare tax.

How much do you have to pay in taxes on a W-2?

For example, if you earn $50,000 from a W-2 employer and have payroll taxes withheld, and also earn $100,000 in self-employment income, you'll only need to pay Social Security tax on the first $77,200 of that amount, since when combined with the $50,000 of employment earnings, it reaches the $127,200 maximum.

What is payroll tax?

As a broad definition, a payroll tax is a tax withheld by an employer and paid on behalf of its employees, based on the wages or salary of the employee. They differ from income taxes in that everyone pays a flat payroll tax rate, as opposed to income taxes, which are progressive, or increasing rates, based on earnings.

What is FICA tax?

Also known as FICA taxes in the United States, the employer withholds a percentage of wages, which is calculated differently for the Social Security and Medicare portions of the tax.

What is the payroll tax rate for Social Security?

The Social Security part of the payroll tax is assessed at a rate of 6.2% each for the employer and employee, for a combined rate of 12.4%. Social Security tax is only assessed on earned income up to a certain maximum each year. For 2017, the Social Security taxable maximum is $127,200, and no tax is assessed on income above this amount.

What is the Medicare tax rate for $22,800?

For your other $22,800 of income, only the 1.45% Medicare tax rate would apply, which translates to another $330.60. Combined, this results in a payroll tax of $11,805.60 each for you and your employer.

How much is Medicare taxed?

In comparison with the Social Security tax, Medicare is taxed at a much lower rate of 1.45%. Unlike Social Security, however, there is no wage cap -- every dollar of earned income is subject to Medicare taxes.

What is FICA payroll tax?

FICA is the U.S. federal payroll tax, designed to help fund the Social Security and Medicare programs. As of 2017, about 171 million people work and contribute FICA taxes. Image source: Getty Images. The basic idea behind FICA is that the current generation of workers is funding these programs for today's retirees, ...

How much is FICA tax?

How much are the current FICA tax rates? 1 The Social Security tax rate is 6.2% of earned income up to a certain cap. For 2017, the maximum amount of income that can be subject to Social Security tax is $127,200. No Social Security tax is assessed on income in excess of this amount. 2 The Medicare tax rate is much lower, at 1.45% of earned income. However, there is no wage cap -- every dollar of earned income is subject to Medicare taxes, even if the income is in the millions. High-income individuals pay an additional Medicare tax as part of the Affordable Care Act as well.

What is FICA tax?

FICA, which stands for Federal Insurance Contribution Act, is a tax that is paid by employees as well as their employers, and is often referred to as the payroll tax. The purpose of the FICA tax is to fund the Social Security and Medicare programs, which provide benefits to American retirees.

Is FICA income taxed on passive income?

This includes salaries, wages, tips, bonuses, freelance income, and income from a business that you own and actively participate in. FICA taxes are not assessed on passive income , such as dividends, interest, and royalties.

Is Medicare taxed on income?

The Medicare tax rate is much lower, at 1.45% of earned income. However, there is no wage cap -- every dollar of earned income is subject to Medicare taxes, even if the income is in the millions. High-income individuals pay an additional Medicare tax as part of the Affordable Care Act as well. For both of these taxes, employers match their ...

Where is Matt from Motley Fool?

Matt is a Certified Financial Planner based in South Carolina who has been writing for The Motley Fool since 2012. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price.

Will Social Security run out of reserves?

Eventually -- in 2034 for Social Security and 2028 for Medicare -- both will be completely out of reserves and will need to make across-the-board benefit cuts.

What is the AMT rate for 2017?

In 2017, the 28 percent AMT rate applies to excess AMTI of $187,800 for all taxpayers ($93,900 for unmarried individuals). Under current law, AMT exemptions phase out at 25 cents per dollar earned once taxpayer AMTI hits a certain threshold.

What is PEP tax?

PEP and Pease are two provisions in the tax code that increase taxable income for high-income earners. PEP is the phaseout of the personal exemption and Pease (named after former U.S. House Representative Donald Pease ) phases out the value of most itemized deductions once a taxpayer’s adjusted gross income reaches a certain amount.

What is the AMT exemption for 2017?

The AMT is levied at two rates: 26 percent and 28 percent. The AMT exemption amount for 2017 is $54,300 for singles and $84,500 for married couples filing jointly (Table 7).

Why was the Alternative Minimum Tax created?

The Alternative Minimum Tax (AMT) was created in the 1960s to prevent high-income taxpayers from avoiding the individual income tax. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT.

How much is the 2017 tax credit?

The credit is $3,400 for one child, $5,616 for two children, and $6,318 for three or more children. All of the aforementioned are relatively small increases from 2016.

Why does the IRS adjust tax rates?

Every year, the IRS adjusts more than 40 tax provisions for inflation. This is done to prevent what is called “bracket creep.”. This is the phenomenon by which people are pushed into higher income tax brackets or have reduced value from credits or deductions due to inflation, instead of any increase in real income.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio