How much is the monthly premium for Medicare Part A?

Oct 29, 2013 · The monthly premium for Medicare Part B remains $104.90 for most people in 2014 – the same as in 2013. Seniors whose 2012 adjusted gross income (plus tax-exempt interest income) was more than...

How much are Medicare premiums in 2021?

Oct 02, 2020 · July 30, 2013 announcement of 2014 Part D National Average Monthly Bid Amount, Medicare Part D Base Beneficiary Premium, Part D Regional Low-Income Premium Subsidy Amounts, Medicare Advantage Regional Benchmarks, and Income Related Monthly Adjustment Amounts. Regional Rates and benchmarks Part D Low Income Premium Subsidy Amounts.

What are the high-income Medicare premium adjustments for 2022?

No, it is not true. In fact, the 2014 Part B premium will be $104.90 a month — the same amount as in 2013. A mass email claiming that the premium will rise to $247 a month by 2014 has been circulating since before the 2010 elections — and it still is. But it's just another attempt to scare older Americans and has never had any basis in fact.

How much does Medicare Part a cost in 2020?

Dec 13, 2021 · Medicare Part B premiums for tax year 2019 started at $135.50 and increased to up to $460.50, depending on your income. The rate of $135.50 was for single or married individuals who filed separately with MAGIs of $85,000 or less, and for married taxpayers who filed jointly with MAGIs of $170,000 or less. 4

What were Medicare premiums in 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

What were the Medicare Part A monthly premiums in 2013?

Only about 1 percent of people with Medicare pay a premium for Part A services—you need to have paid Medicare payroll taxes for 40 quarters of employment or be married to someone who did. For those few affected, the 2013 Part A premium is decreasing to $441, down from $451 in 2012.Nov 16, 2012

What was Medicare Part B premium in 2016?

Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

How much did Medicare cost in 2014?

CMS said the standard Medicare Part B monthly premium will be $104.90 in 2014, the same as it was in 2013. The premium has either been less than projected or remained the same, for the past three years. The Medicare Part B deductible will also remain unchanged at $147.Oct 28, 2013

What was Medicare premium in 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018....What You'll Pay for Medicare in 2018.Income (adjusted gross income plus tax-exempt interest income):$133,501 to $160,000$267,001 to $320,000$348.305 more rows

What was the Medicare Part B premium for 2018?

The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. However, a statutory “hold harmless” provision applies each year to about 70 percent of enrollees.Nov 17, 2017

How much did Medicare go up in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What is Medicare Part B 2020 premium?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What is the Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

News not so bad related to 2014 Medicare Premiums and deductibles

Anyone who has been enrolled in Medicare for a while knows that this is the time of year when CMS announces any changes in Medicare Premiums and deductibles.

2014 Medicare premiums

The following table shows Part B premiums based on income. The vast majority of people pay $104.90 per month. The 2014 Part B premiums are remaining at the same level as 2013 premiums.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

Who is Thomas Brock?

Thomas Brock is a well-rounded financial professional, with over 20 years of experience in investments, corporate finance, and accounting. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar.

Who is Dana Anspach?

Linkedin. Follow Twitter. Dana Anspach is a Certified Financial Planner and an expert on investing and retirement planning. She is the founder and CEO of Sensible Money, a fee-only financial planning and investment firm.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

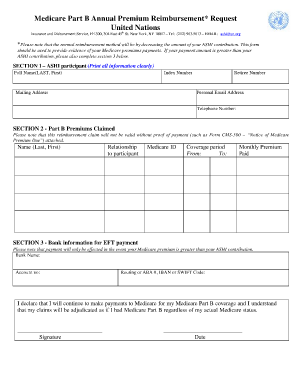

What happens if you don't get Social Security?

If the amount is greater than your monthly payment from Social Security, or you don’t get monthly payments, you’ll get a separate bill from another federal agency , such as the Centers for Medicare & Medicaid Services or the Railroad Retirement Board.

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

How much will Medicare premiums be in 2021?

There are six income tiers for Medicare premiums in 2021. As stated earlier, the standard Part B premium amount that most people are expected to pay is $148.50 month. But, if your MAGI exceeds an income bracket — even by just $1 — you are moved to the next tier and will have to pay the higher premium.

Why did Medicare Part B premiums increase in 2021?

That’s because 2021 Medicare Part B premiums increased across the board due to rising healthcare costs. Exactly how much your premiums increased though, isn’t based on your current health or Medicare plan or your income. Rather, it’s the soaring prices of overall healthcare.

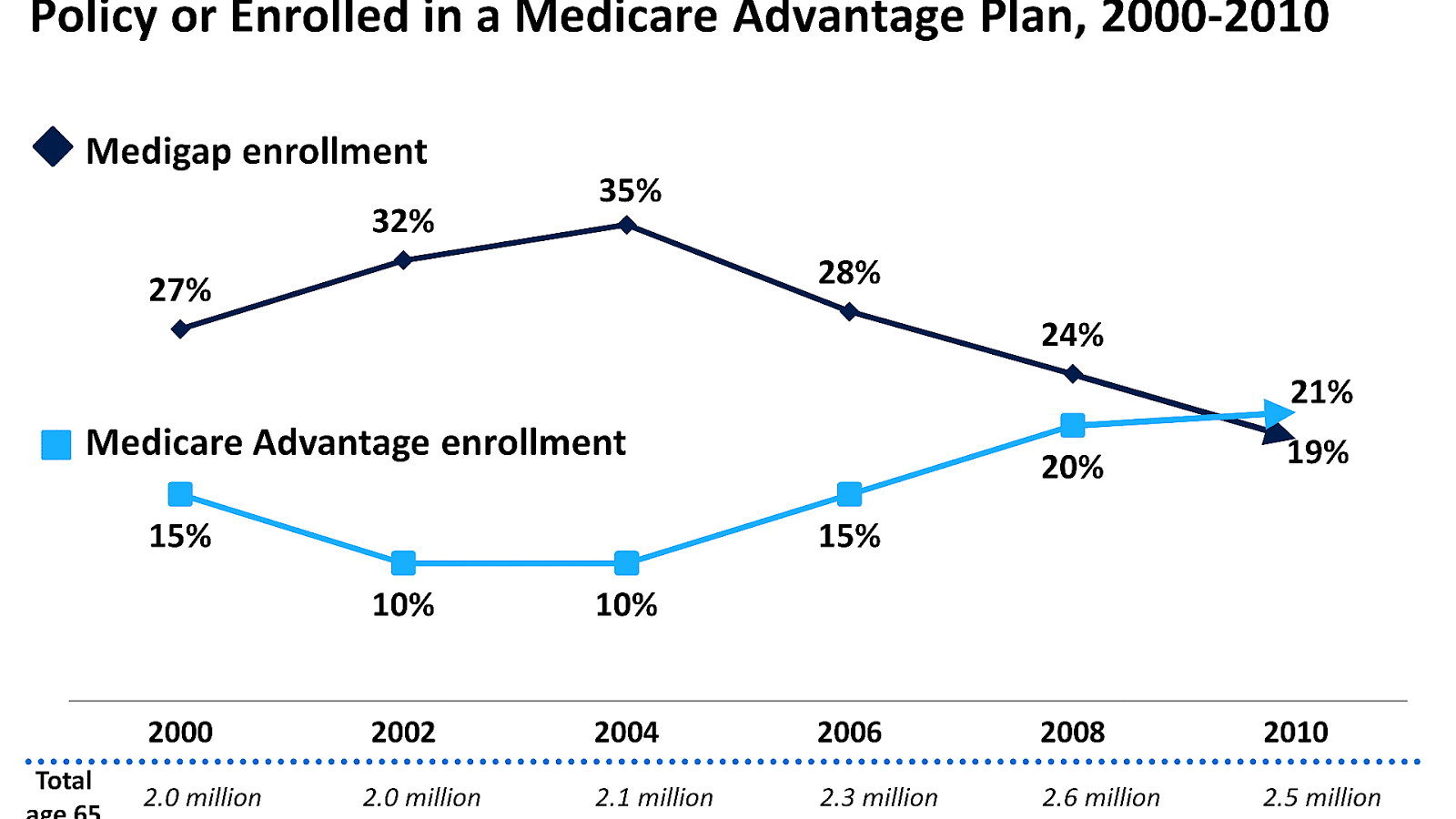

What is Medicare Advantage?

Essentially: Medicare Advantage – Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A.

How much of Medicare Part B is paid?

But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

What does IRMAA mean?

These additional Medicare premiums are all calculated through something called IRMAA, which stands for Income-Related Monthly Adjustment Amount. It is an additional amount that you may have to pay along with your Medicare premium if your modified adjusted gross income (MAGI) is higher than a certain threshold.

Can you deduct Medicare premiums on your taxes?

In fact, even if you do itemize, you can only deduct medical expenses, including Medicare premiums, that exceed 10% of your adjust gross income (AGI).

How much is Part B 2021?

So most beneficiaries are paying the standard $148.50/month for Part B in 2021. The hold harmless provision does NOT protect you if you are new to Medicare and/or Social Security, not receiving Social Security benefits, or are in a high-income bracket.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much will Medicare copay be in 2021?

The copay amounts for people who reach the catastrophic coverage level in 2021 will increase slightly, to $3.70 for generics and $9.20 for brand-name drugs. Medicare beneficiaries with Part D coverage (stand-alone or as part of a Medicare Advantage plan) will have access to insulin with a copay of $35/month in 2021.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

Is Medicare Advantage available for ESRD?

Under longstanding rules, Medicare Advantage plans have been unavailable to people with end-stage renal disease (ESRD) unless there was an ESRD Special Needs Plan available in their area. But starting in 2021, Medicare Advantage plans are guaranteed issue for all Medicare beneficiaries, including those with ESRD. This is a result of the 21st Century Cures Act, which gives people with ESRD access to any Medicare Advantage plan in their area as of 2021.

Is there a donut hole in Medicare?

The Affordable Care Act has closed the donut hole in Medicare Part D. As of 2020, there is no longer a “hole” for brand-name or generic drugs: Enrollees in standard Part D plans pay 25 percent of the cost (after meeting their deductible) until they reach the catastrophic coverage threshold.

What is the maximum deductible for Part D?

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans will be $445 in 2021, up from $435 in 2020. And the out-of-pocket threshold (where catastrophic coverage begins) will increase to $6,550 in 2021, up from $6,350 in 2020.

How much is the Part A deductible for 2021?

If the person needs additional inpatient coverage during that same benefit period, there’s a daily coinsurance charge. For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020).