If you qualify as a dual eligible enrollee with Medicare and Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

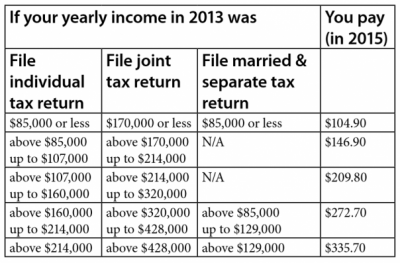

How much will my Medicare Part B premium be?

There's no limit to the number of benefit periods you can have. $170.10 each month (or higher depending on your income). The amount can change each year. You’ll pay the premium each month, even if you don’t get any Part B-covered services. Who pays a higher premium because of income? How do I pay my Part B premiums?

How much does Medicare Part B cost in 2022?

The Medicare Part B premium changes each year and is calculated based on data collected by the Centers for Medicare and Medicaid Services (CMS). The standard amount for Part B coverage in 2022 is $170.10 per month. If your income is high enough, you may pay more for your Part B premium each month.

Why do I have to pay more for Medicare Part B?

If your income is high enough, you may pay more for your Part B premium each month. Medicare measures your modified adjusted gross income to determine your income level. Depending on how much money you make, you may have to pay an Income Related Monthly Adjustment Amount (IRMAA) on top of your Part B premium.

How much is the standard Part B premium amount in 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Are Medicare Part B premiums the same for everyone?

Medicare premiums are calculated based on your modified adjusted gross income from two years prior. Thus, your premium can change if you receive a change in income. Does everyone pay the same for Medicare Part B? No, each beneficiary will pay a Medicare Part B premium that is based on their income.

Are there co pays with Medicare Part B?

Although Part B has no copayment, a person may pay the following costs in 2021: Premium: Everyone pays a premium for Part B. The standard premium is $148.50 per month, but this amount could be higher depending on a person's income. Deductible: The 2021 deductible is $203 per year.

What is the premium for Medicare Part B for 2021?

$148.50The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How much does Medicare Part B normally cost?

$170.10 each monthCosts for Part B (Medical Insurance) $170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services. Who pays a higher premium because of income?

Does Medicare charge a co pay?

Medicare functions somewhat differently than traditional private insurance when it comes to cost-sharing in that it does not charge copays for original Medicare services.

What is the cost of Medicare Part B for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How can I lower my Medicare Part B premium?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

Why is Medicare Part B so expensive?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How much will be deducted from my Social Security check for Medicare in 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What is the deductible for Part B for 2022?

$233The 2022 Medicare deductible for Part B is $233. This reflects an increase of $30 from the deductible of $203 in 2021.

Is Medicare free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What Is the Cost of Medicare Part B for 2022?

Have you ever asked a friend or family member: “How much does Medicare Part B cost?” If so, they probably responded with their monthly premium amou...

What is the Maximum Cost of Medicare Part B?

Typically, the cost of your Medicare Part B coverage comes down to several costs, starting with your monthly premium and annual Medicare Part B ded...

Is Medicare Part B Free for Seniors?

If you have Original Medicare (Parts A and B), you’ll likely pay for your Part B plan. Medicare beneficiaries that worked 10 or more years often re...

How is Medicare Part B premium calculated?

The Medicare Part B premium changes each year and is calculated based on data collected by the Centers for Medicare and Medicaid Services (CMS). Th...

How do I pay my Part B premium?

Your Medicare Part B premium is a monthly payment. It may be deducted automatically for you if you receive the following benefits:

What does Medicare Part B cover exactly?

Medicare Part B generally covers the medical treatments you receive. But Part B won’t cover everything — your treatments or services must either be:

How to enroll in Medicare Part B?

Are you or a loved one turning 65 and looking to enroll in Medicare? You’ll want to know when to enroll, and how. As a starting point, find your In...

How does Medicare calculate my Part B premium and Income Related Monthly Adjustment Amount (IRMAA)?

When you enroll, your IRMAA, if you pay one, will be based on your tax returns from two years prior. That year’s income will be used to determine h...

Do Part B costs remain the same after I enroll? Or do they increase each year?

Your Part B costs will change each year based on data collected by the Centers for Medicare and Medicaid Services (CMS). This generally means incre...

If I enroll in Medicare Advantage, will I still pay a Part B premium?

This depends on your plan. Some insurance companies will include the Part B premium in what you pay each month for your Medicare Advantage policy....

Can I get financial help for the cost of Medicare Part B?

Your state may be able to help you pay your Medicare Part B premium through programs such as Medicaid, the Medicare Savings Programs (MSP) and the...

Can I enroll in Part B during a Special Enrollment Period (SEP)?

You may be able to enroll in Part B during an SEP if you postponed Medicare due to having employer-sponsored coverage, whether on your own or throu...

How can I avoid Part B late enrollment penalties?

You can avoid Medicare Part B late enrollment penalties by making sure you apply for Medicare when you first become eligible, during your initial e...

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

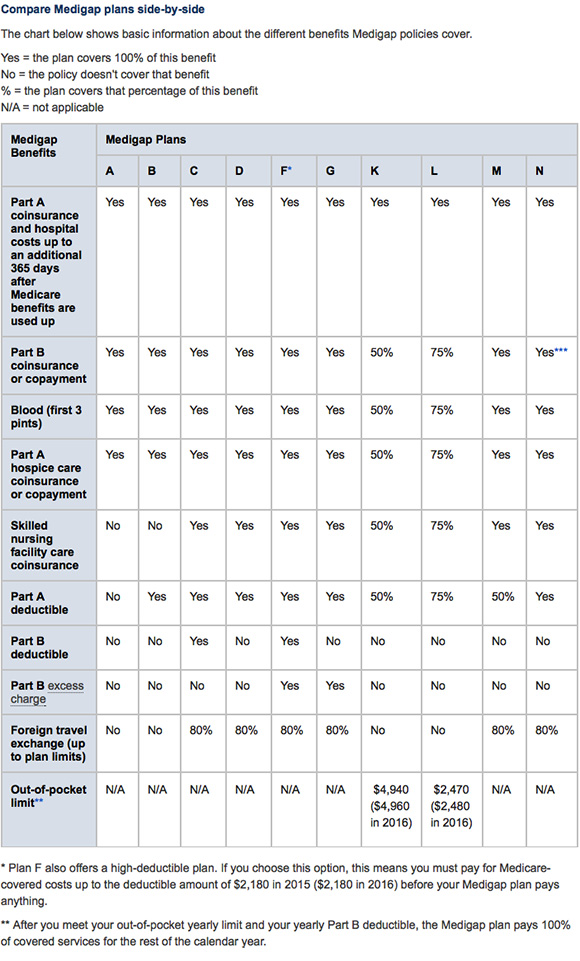

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How does Medicare Part B work?

How it Works Premiums & Deductibles Coverage & Enrollment FAQs. Medicare Part B provides the medical portion of your Medicare coverage . Part B has costs, including a premium, deductible and coinsurance. Together, they make up the overall cost of Medicare Part B. But the costs aren’t the same for everyone.

What is Medicare premium?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. A deductible is the amount you pay out of pocket before your insurance company covers its ...

What is premium insurance?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. and annual deductible. A deductible is the amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs ...

Does Medicare Supplement Insurance cover Part B?

Medicare Supplement Insurance (Medigap) has several policies that will help cover your Part B costs, including premiums, deductibles and out-of-pocket costs.

Is Medicare Part B based on income?

Unlike the Part B premium, this amount isn’t based on income. Everyone enrolled in Original Medicare pays the same Part B deductible. That means no matter how high your income is, you’ll pay the standard Medicare Part B deductible amount.

Is Medicare Part B the same as Medicare Advantage?

But Part B coverage isn’t exclusive to Original Medicare; you’ll receive at least the same benefits with Medicare Advantage (Part C).

Does Medicare cover wheelchairs?

Medically necessary: Your doctor must deem your treatment is required to improve or maintain your health. Preventive services: Medicare-approved screenings and other preventive services are covered and generally at no-cost. Part B can also cover wheelchairs and other medically necessary equipment.

What is Medicare Part B?

Medicare Part B provides coverage for medical needs such as outpatient care and doctor visits. This health insurance policy and Medicare Part A combine to make up what is known as Original Medicare. Eligibility for the federal health insurance program requires you to be over the age of 65, to have a disability or to have a life-threatening disease.

How much is Medicare Part B deductible in 2021?

Medicare Part B comes with an annual deductible amount that must be met before coinsurance or copay benefits kick in. In 2021, the deductible amount is $203, meaning after you pay out of pocket for expenses that total $203, cost sharing will begin.

Your Medicare Part B costs should include monthly premiums, an annual deductible, and co-insurance for covered services

Whether you are automatically enrolled in Medicare Part B (medical insurance) or you sign up, you will have several costs associated with your coverage. This includes deductibles, premiums, and coinsurance.

How Much Does Part B Cost?

Medicare Part B covers a variety of doctor and medical services and supplies you may need. Costs include a monthly premium, an annual deductible, and coinsurance for most services and supplies.

Medicare Part B Premium Give-Back Plan

Some Medicare Advantage Plans offer a Part B premium reduction benefit, or premium give back. When you enroll in the policy, the carrier either pays part of or the whole premium for your Part B outpatient coverage. This reduces the amount you pay for your Part B premium, and the MA plan covers the remainder.

What Is Medicare Part B?

Part B covers medically necessary services or supplies that are needed to diagnose or treat a medical condition, as well as preventive services to help keep you healthy longer. Typically, this includes:

How to Apply for Medicare Part B

There are a few times per year you can enroll in Medicare called enrollment periods.

Eligibility for Medicare Part B

If you are eligible for premium-free Part A, you are also eligible for enrollment in Part A as soon as you are entitled to Part A.

What is Medicare Part A?

When you enroll in Original Medicare, you'll notice that your health benefits are divided into two parts — Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). Many beneficiaries receive Part A benefits premium-free, but everyone typically pays a monthly premium for Part B.

How much will Medicare pay in 2021?

In addition to your monthly premium, you pay $203 per year in 2021 for your Part B deductible. Once your deductible is met, you generally pay a coinsurance of 20% of the Medicare-approved amount for medically necessary care and services.

What is the income related monthly adjustment amount?

If your yearly income is above $88,000 (or above $176,000 if you file taxes jointly with your spouse), you will most likely pay more than the standard Part B premium , based on the income you report to the IRS on your federal tax return. This additional amount is called the Income-Related Monthly Adjustment Amount (IRMAA).

How Does Medicare Part B Work?

Before getting into the weeds of Medicare Part B premiums, let’s do a quick review of Medicare Part B and its role in federal retirement health insurance.

Medicare Part B Premiums

Medicare Part B premiums are calculated based on a person’s modified adjusted gross income (MAGI). For purposes of Part B premiums, your MAGI is the adjusted gross income you report on line 11 of your federal tax return, plus any tax-exempt interest income, such as municipal bonds (line 2a) earnings.

Who Pays More for Medicare Part B?

Each year the government crunches the numbers to determine total costs for providing Medicare Part B coverage. For most enrollees, the government agrees to cover 75% of the cost and charges enrollees the Medicare Part B premium to cover the other 25%.

How to Apply for Medicare Part B

If you are already receiving Social Security benefits when you turn 65, you will automatically be signed up for Medicare Part A and Medicare Part B by the Social Security program. Your Part B premium will be deducted from your retirement benefit each month.

The Bottom Line

Once you turn 65, the government agrees to cover the majority of your health insurance costs. But Medicare is not free. The Medicare Part B premium alone—irrespective of other Medicare out-of-pocket costs—is an important line-item expense you will want to plan for in retirement.

How Do Medicare Deductibles Work

A deductible is an out-of-pocket amount beneficiaries must pay before the policy starts to pay. Part A has a deductible per benefit period, and Part B has a deductible that changes each year. Part D also has an annual deductible you must pay before benefits kick in.

Medicare Advantage Out-Of-Pocket Costs

When you enroll in an Advantage plan, the carrier determines what the cost-sharing will be. So, instead of the 20% coinsurance, you have to pay under Medicare, it could be more.

Medigap Cost-Sharing Plans

Three Medigap plans involve cost-sharing. These plans are Plan K, Plan L, and Plan M. The cost-sharing helps keep the premiums for these plans lower.

Get Quote

Compare rates side by side with plans & carriers available in your area.