What is the maximum income taxed for Medicare?

- When it comes to receiving Medicare benefits, there are no income restrictions.

- You may be asked to pay more money for a premium depending on your income.

- If you have a minimal income, you may be eligible for Medicare premium assistance.

What income is subject to Medicare tax?

Typically, self-employment tax is required if you earned over $400 per year from self-employment. Taxes on self-employment usually require an amount of 92 dollars. Self-employment earnings are subject to a 35% tax. Even if you are receiving social security benefits, you will still be responsible for paying self-employment tax.

What is Medicare tax withheld for maximum salary?

The Additional Medicare Tax has been in effect since 2013. Taxpayers who make over $200,000 as individuals or $250,000 for married couples are subject to an additional 0.9 percent tax on Medicare.

What is exempt from Medicare tax?

Who is exempt from paying Medicare tax? Nonresident aliens who meet specific criteria are exempt from the Medicare Tax. For example Nonresident alien students, teachers, researchers, and other people who hold an F-1, J-1, M-1, Q-1, or Q-2 nonimmigrant visa and whose stay in the U.S. is temporary do not have to pay.

What is the Medicare tax limit for 2020?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

What is the maximum wage limit for Medicare taxes?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.

What is the minimum income for Medicare tax?

So your total Medicare tax will equal 2.35% of your salary on everything you earn over $200,000....When Are You Liable for Additional Medicare Tax?Tax Filing StatusMinimum IncomeSingle$200,000Married filing jointly$250,000Married filing separate$125,000Head of household (with qualifying person)$200,0001 more row

Who is exempt from paying Medicare tax?

The Code grants an exemption from Social Security and Medicare taxes to nonimmigrant scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other non-students temporarily present in the United States in J-1, Q-1 or Q-2 status.

What income is subject to the 3.8 Medicare tax?

The tax applies only to people with relatively high incomes. If you're single, you must pay the tax only if your adjusted gross income (AGI) is over $200,000. Married taxpayers filing jointly must have an AGI over $250,000 to be subject to the tax.

How do I avoid paying the Medicare levy surcharge?

How do I avoid paying the Medicare Levy Surcharge (MLS)? If your income is less than $90,000 (singles) or $180,000 (couples, families and single parents), then you won't need to pay the MLS at all.

What is the Medicare tax rate for 2021?

1.45%FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

Why do I have to pay Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

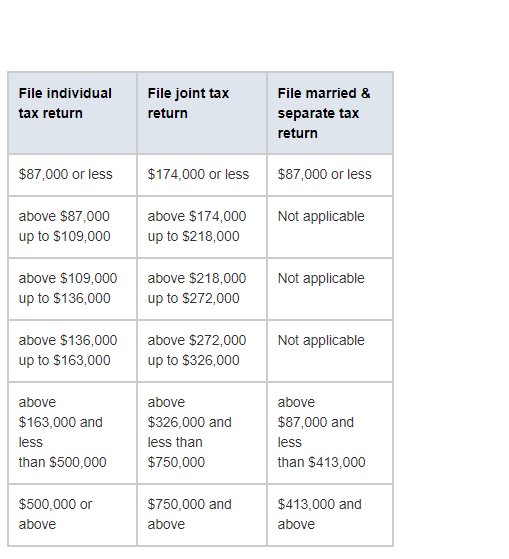

What are Medicare income limits?

Medicare beneficiaries with incomes above a certain threshold are charged higher premiums for Medicare Part B and Part D. The premium surcharge is...

Why does Medicare impose income limits?

The higher premiums for Part B took effect in 2007, under the Medicare Modernization Act. And for Part D, they took effect in 2011, under the Affor...

Who is affected by the IRMAA surcharges and how does this change over time?

There have been a few recent changes that affect high-income Medicare beneficiaries: In 2019, a new income bracket was added at the high end of the...

Will there be a rate increase in 2022?

We don’t yet have concrete details from CMS. But the Medicare Trustees Report, which was published in late August, projects that the standard Part...

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How much Medicare tax is on 80,000?

They would be liable for the additional Medicare tax only on $80,000, which is the amount in excess of $250,000. The total Medicare tax payment would be 1.45% or $3,625 on the $250,000, plus 2.35% or $1,880 on the $80,000, totalling $5,505 in Medicare taxes for the year.

What is Medicare tax?

The standard Medicare tax applies to all earned income, with no minimum income limit.

What is the threshold for Medicare 2020?

The 2020 tax year thresholds are as follows: Status. Tax threshold. single , head of household, or a qualifying widow (er) $200,000. married tax filers, filing jointly.

How much Medicare tax do self employed people pay?

A person who is self-employed will pay 2.9% standard Medicare tax, and an additional Medicare tax of 0.9%, for a total of 3.8%. Employers do not have to contribute any amounts through the additional Medicare tax. A person is liable for the additional Medicare tax after their total income goes above the threshold for their filing status.

How much is Medicare for married couples?

The limit is $250,000 for married couples. This article explains the Medicare standard tax and the Medicare additional tax. It also looks at who pays the additional tax, how the IRS calculates it, and how the government uses the money.

What is the donut hole in Medicare?

With the Affordable Care Act, a person enrolled in Medicare no longer had to worry about the Medicare Part D coverage gap, also known as the donut hole. The Affordable Care Act also expanded Medicare Part B preventive services to include: abdominal aortic aneurysm and cardiovascular disease screenings.

Do higher earners have to pay more for Medicare?

In 2013, the IRS announced that some higher-earning taxpayers would have to pay more money into Medicare through the additional Medicare tax, as part of the Affordable Care Act.

What is the Medicare tax rate?

The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

How much Medicare do self employed people pay in 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

How much tax do you pay on income above the threshold?

For example, if you’re a single tax filer with an employment income of $250,000, you’d pay the standard 1.45 percent on $200,000 of your income, and then 2.35 percent on the remaining $50,000.

Does RRTA count toward income tax?

Incomes from wages, self-employment, and other compensation, including Railroad Retirement (RRTA) compensation, all count toward the income the IRS measures. If you’re subject to this tax, your employer can withhold it from your paychecks, or you can make estimated payments to the IRS throughout the year.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Can an employer withhold AMT?

Any shortfall to withholding must be paid by the taxpayer at tax time. Employers can be subject to penalties and interest for not withholding the AMT, even if the oversight was due to understandable circumstances.

Does Everyone Pay Medicare Tax?

If your income is reported for tax filing purposes, then you will typically pay the Medicare tax.

Is There a Limit on Medicare Tax?

Unlike Social Security taxes, there is no limit on how much of your income is subject to Medicare taxes. The Medicare tax rate applies to all earned income and taxable wages, and there is no minimum income required to be subject to Medicare taxes.

How Is Medicare Tax Calculated?

The Medicare tax rate is determined by the IRS and is subject to change. To calculate the Medicare tax, multiply your earnings by 0.0145. So if your biweekly pay is $2,000, your Medicare tax will be $29 (2,000 x 0.0145 = 29).