Does UnitedHealthcare insure plans?

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract. Enrollment in the plan depends on the plan’s contract renewal with Medicare.

Are the Medicare Advantage policy guidelines applicable to UnitedHealthcare?

The Medicare Advantage Policy Guidelines are applicable to UnitedHealthcare Medicare Advantage Plans offered by UnitedHealthcare and its affiliates. UnitedHealthcare has developed Medicare Advantage Policy Guidelines to assist us in administering health benefits.

How can I use the UnitedHealthcare app to manage my medications?

UnitedHealthcare members with health plans through an employer may use the UnitedHealthcare app to help manage their medications. You can use the app to: Here are a few ideas that may help you save on your medications. A requirement that your doctor explains why you need a certain medication before your plan decides how and if it will be covered.

Is Medicare and UHC the same?

UnitedHealthcare offers Medicare coverage for medical, prescription drugs, and other benefits like dental — and we offer the only Medicare plans with the AARP name. Here are the different types of medicare plans you can choose from — and what they cover.

Is UnitedHealthcare dual complete a Medicare Advantage plan?

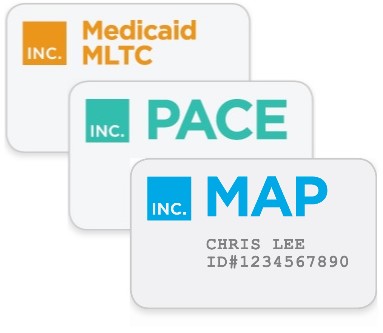

UnitedHealthcare offers a Medicare Advantage plan in your area known as UnitedHealthcare Dual Complete® (HMO D-SNP). It is a Dual Special Needs Plan (D-SNP) for individuals who are eligible for both Medicaid and Medicare.

Is AARP Medicare Complete the same as Medicare Advantage?

The takeaway AARP offers Medicare Part C (Medicare Advantage) plans. Like other Medicare Advantage products, these plans offer the same basic coverage as original Medicare plans but with additional benefits like vision, dental, and preventive care services.

What is the difference between Medicare Advantage and Medigap?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

What does UHC Dual Complete mean?

A UnitedHealthcare Dual Complete plan is a DSNP that provides health benefits for people who are “dually-eligible,” meaning they qualify for both Medicare and Medicaid. Who qualifies? Anyone who meets the eligibility criteria for both Medicare and Medicaid is qualified to enroll in a DSNP.

What are the benefits of UnitedHealthcare dual complete?

Dual plans offer extra benefits and features at no extra costDental care, plus credit for restorative work.Eye exams, plus credit for eyewear.Hearing exams, plus credit for hearing devices.Rides to health care visits and the pharmacy.Credits to buy hundreds of health-related products.

Why does AARP recommend UnitedHealthcare?

AARP UnitedHealthcare Medicare Advantage plans have extensive disease management programs to help beneficiaries stay on top of chronic conditions — hopefully reducing future health-care costs. Many plans also feature a lengthy roster of preventive care services with a $0 copay.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

How Much Is Medigap per month?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

What is Medicare insurance?

Medicaid. Medicare insurance plans. Medicare insurance plans are for people 65 or older — or for those who may qualify because of a disability or special condition.

What is Medicare Supplement Insurance Plan?

Medicare Supplement Insurance Plan. Also called Medigap, these plans help cover some out-of-pocket costs not paid by Original Medicare. Medicare Prescription Drug Plans (Part D) This plan helps pay for prescription drugs and can be used with Original Medicare or Medicare Supplement plans. Get to know Medicare.

Is UnitedHealthcare an insurance company?

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract. Enrollment in the plan depends on the plan’s contract renewal with Medicare. Contact us. Careers.

How long does Medicare coverage last after SEP?

The 8-month period begins after the month your employment or employer coverage ends, whichever comes first. This is also true if you are covered under your spouse's employer coverage. If you want a Medicare Advantage (Part C) plan or a Medicare prescription drug (Part D) plan after an SEP, you need to act quickly.

What is Medicare Part B?

Under Medicare Part B, you are covered for outpatient services for the prevention, diagnosis, and treatment of medical conditions. Part B also covers you for mental health services, durable medical equipment, and some medications and vaccines. Learn more about what’s covered by Medicare Part B.

How long do you have to wait to enroll in Medicare?

For example, you might wait to enroll if you're still working. Timing depends on when those life changes happen. After you retire, you have 8 months to enroll in Original Medicare without a late penalty. The 8-month period begins after the month your employment or employer coverage ends, whichever comes first.

Can Medicare be combined?

Once you have a handle on that, the rest may begin to fall into place. Medicare parts and plans can be combined for the coverage you want. Learn more about how to choose Medicare coverage options that may be right for you.

Can you combine Medicare Parts and Plans?

Medicare parts and plans can be combined for the coverage you want. The combinations depend on whether you stay with Original Medicare or choose a Medicare Advantage plan.

Does Medicare cover macular degeneration?

Medicare Part B may cover some things for vision including preventive or diagnostic eye exams, including glaucoma tests, yearly eye exams to test for diabetic retinopathy and eye tests for macular degeneration, cataract surgery and prescription lenses or eyeglasses in certain situations. In addition, Medicare Advantage (Part C) ...

Does Medicare work with tricare?

If you're a veteran and you become eligible for Medicare, you may already have other insurance such as from an employer, the Veterans Administration (VA) benefits or TRICARE. There a number of details to know about how Medicare may work with VA benefits and TRICARE.

What is UnitedHealthcare's Medicare Advantage Policy?

UnitedHealthcare has developed Medicare Advantage Policy Guidelines to assist us in administering health benefits. These Policy Guidelines are provided for informational purposes, and do not constitute medical advice.

What is Medicare Advantage Policy?

Medicare Advantage Policy Guidelines are intended to ensure that coverage decisions are made accurately based on the code or codes that correctly describe the health care services provided.

What is a member specific benefit plan?

The member specific benefit plan document identifies which services are covered, which are excluded, and which are subject to limitations. In the event of a conflict, the member specific benefit plan document supersedes the Medicare Advantage Policy Guidelines.

What is a Medicare coverage summary?

The Coverage Summaries are based upon: (1) Medicare publications relating to coverage determinations; (2) laws and regulations which may be applicable to UnitedHealthcare Medicare Advantage Plans; and (3) research, studies and evidence from other sources including, but not limited to, the U.S. Food and Drug Administration (FDA).

Who makes medical necessity determinations?

Medical necessity determinations must be made by trained and/or licensed professional medical personnel only . UnitedHealthcare Medicare Advantage Plan members have the right to appeal benefit decisions in accordance with Medicare guidelines as outlined in the UnitedHealthcare Medicare Advantage Plans EOC or SOB.

Does United Healthcare make medical decisions?

UnitedHealthcare does not practice medicine and does not make medical decisions for UnitedHealthcare Medicare Advantage Plan Members. Medical decisions for UnitedHealthcare Medicare Advantage Plan Members are made by the treating physician in conjunction with the member.

Does United Healthcare have to apply the medical review policies of the contractor?

In cases where services are covered by UnitedHealthcare in an area that includes jurisdictions of more than one contractor for original Medicare, and the contractors have different medical review policies, UnitedHealthcare must apply the medical review policies of the contractor in the area where the beneficiary lives.