How to report uncollected Medicare tax?

Uncollected Tax Reported in Form W-2 Box 12. If an employer could not collect all the Social Security tax, Medicare tax, or Railroad Retirement tax on either tips or the taxable cost of group term life insurance, the uncollected taxes will be shown in Box 12 of Form W-2 with codes A, B, M, or N as follows: Code A - Uncollected Social Security ...

Why do I pay Social Security and Medicare tax?

pay a 6.2 percent Social Security tax on up to $142,800 of your earnings and a 1.45 percent Medicare tax on all earnings. If you’re self-employed, you pay the combined employee and employer amount, which is a 12.4 percent Social Security tax on up to $142,800 of your net earnings and a 2.9 percent Medicare tax on your entire net earnings.

What percent is Social Security and Medicare tax?

The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, Social Security tax, or railroad retirement (tier 1) tax.

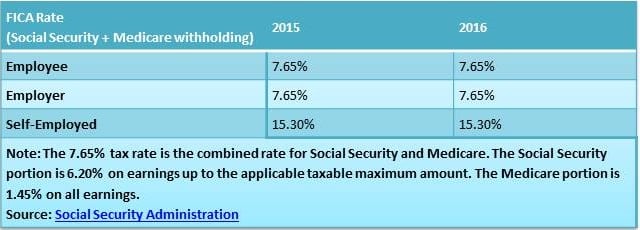

What is current FICA percentage?

What is FICA tax? FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2020, only the first $137,700 of earnings was subject to the Social Security tax ($142,800 in...

What is unreported Social Security tax?

By Andrew. Line 57 of Form 1040 is used by the IRS to ensure no taxpayer earnings escape the reach of Social Security and Medicare taxation.

Do I need to fill out form 8919?

You may need to file Form 8919 if you: Perform services for a company that aren't those of an independent contractor as defined by the IRS, and Social Security and Medicare taxes were not withheld from your pay.

What is a 8995 tax form?

Form 8995 is the IRS tax form that owners of pass-through entities—sole proprietorships, partnerships, LLCs, or S corporations—use to take the qualified business income (QBI) deduction, also known as the pass-through or Section 199A deduction.

Which form is used to report wage for Social Security and Medicare taxes to the IRS and how often is it filed?

Generally, you must file Form 941, Employer's QUARTERLY Federal Tax Return or Form 944, Employer's ANNUAL Federal Tax Return to report wages you've paid and tips your employees have reported to you, as well as employment taxes (federal income tax withheld, social security and Medicare taxes withheld, and your share of ...

What is the purpose of form 8919?

Purpose of form. Use Form 8919 to figure and report your share of the uncollected social security and Medicare taxes due on your compensation if you were an employee but were treated as an independent contractor by your employer.

What is Uncollected Social Security or RRTA tax on tips reported to your employer?

Code A – Uncollected SSA or RRTA tax on tips. This shows the employee Social Security or Railroad Retirement Tax Act (RRTA) tax on tips that were not collect because the employee did not have enough funds from which to deduct it.

Do I have to fill out form 8995?

If your income is more than the threshold, you must use Form 8995-A. Your QBI includes qualified items of income, gain, deduction, and loss from your trades or businesses that are effectively connected with the conduct of a trade or business in the United States.

Do I qualify for form 8995?

According to the IRS: Form 8995-A must be used if taxable income is over the [minimum income] threshold or if you or any of your trades or businesses are patrons of a specified cooperative.

Do I use form 8995 or 8995-a?

Form 8995-A is the long form for those taxpayers not eligible for short Form 8995. For the 2019 tax year, Form 8995 or 8995-A will be required to be attached to the taxpayer's return and submitted to the IRS.

What is form w3?

The W-3 form, officially the Transmittal of Wage and Tax Statements, is a summary for the SSA of all the business' employee wages and contributions for the previous year. This summary document provides a quick overview of the W-2 forms that are attached and sent with the form every January.

Who gets a 1099 NEC?

Independent contractorsIndependent contractors, freelancers, sole proprietors, and self-employed individuals are examples of “nonemployees” who would receive a 1099-NEC. The recipient uses the information on a 1099-NEC to complete the appropriate sections of their tax return.

What happens if employer does not deduct taxes?

If your employer doesn't take out enough taxes, you'll likely have to pay them yourself when you file your tax return. However, you have some recourse if your employer deliberately misclassified you as an independent contractor instead of an employee.

What is IRS Form 4137?

Before you fill out IRS Form 4137, it’s important to understand what it is and why you’re filling it out. When you work a service job where tip money is a portion of your income, you have to pay Social Security and Medicare taxes on that income.

Why Should I File Form 4137?

If applicable to you, you should file Form 4137 for the same reason you file your income taxes every year—because if you don’t, you could potentially end up in legal trouble or be subject to monetary penalties.

When to File Form 4137

IRS Form 4137 should be submitted alongside your individual income tax return. This means that Form 4137 and Form 1040 should be sent to the IRS at the same time. The deadline to submit Form 4137 is the same as the deadline to submit your federal income tax return.

How to File Form 4137

Don’t get too stressed out over Form 4137—this is a relatively easy tax form to file. If you wish to file the form yourself, here are step-by-step Form 4137 instructions. However, if you need assistance or would like advice on your tax filing, you can always contact Community Tax.

Final Thoughts

When you work a service job, your employer is required to report all of your wages, including tips, to the federal government. However, sometimes things can get complicated and, as a result, you either fail to report all of your wages to your employer or your employer fails to report all of your wages to the federal government.