While Medicare for All proponents have emphasized the lack of premiums in their plan, the report notes that an average $7,500 mandatory premium per U.S. resident could pay for it. The premium would rise to an average of $12,000 if it exempted current Medicare, Medicaid and CHIP recipients.

Full Answer

How much can you make to qualify for Medicare?

What Are the Medicare Income Limits in 2021?

- There are no income limits to receive Medicare benefits.

- You may pay more for your premiums based on your level of income.

- If you have limited income, you might qualify for assistance in paying Medicare premiums.

How much do tax payers pay for Medicare?

MEDICARE premiums are set to jump by far more than what experts had estimated next year. The new rates were announced by the Centers for Medicare & Medicaid Services (CMS) on November 12, 2021 - we explain what you need to know. Medicare's Part B standard ...

Does Medicare have monthly premiums?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021 ($499 in 2022). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 ($499 in 2022).

Is there a monthly premium for Medicare?

What does Medicare cost? Generally, you pay a monthly premium for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance (

How much does Medicare all in one cost?

The Cost of All-in-One Medicare Plans In many states, Medicare Advantage can cost as little as $0 a month. But, you still pay your Part B premium in most cases. Now, Medicare Advantage can cost up to $200+ each month.

Does everyone pay the same price for Medicare?

Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much is the Medicare deductible for 2022?

$233The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What percent of charges does Medicare pay?

According to the AHA, private insurance payments average 144.8 percent of cost, while payments from Medicare average 86.8 percent of cost.

Do high income earners pay more for Medicare?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don't pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI.

Why do some people pay nothing for Medicare?

Who doesn't have to pay a premium for Medicare Part A? A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you don't pay a premium for Part A.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

How do I find out my Medicare reimbursement rate?

You can search the MPFS on the federal Medicare website to find out the Medicare reimbursement rate for specific services, treatments or devices. Simply enter the HCPCS code and click “Search fees” to view Medicare's reimbursement rate for the given service or item.

Do doctors lose money on Medicare patients?

Summarizing, we do find corroborative evidence (admittedly based on physician self-reports) that both Medicare and Medicaid pay significantly less (e.g., 30-50 percent) than the physician's usual fee for office and inpatient visits as well as for surgical and diagnostic procedures.

Why do doctors charge more than Medicare pays?

Why is this? A: It sounds as though your doctor has stopped participating with Medicare. This means that, while she still accepts patients with Medicare coverage, she no longer is accepting “assignment,” that is, the Medicare-approved amount.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much does Medicare cost?

The most pessimistic estimate of costs comes from a 2018 paper by Charles Blahous of the Mercatus Center at George Mason University, which put the 10-year cost of Medicare for All at about $32.6 trillion over current levels.

What is Medicare today?

Medicare Today. Medicare is a program that benefits Americans who are age 65 or older or who have disabilities. The current program has two parts: Part A for hospital care and Part B for doctors’ visits, outpatient care, and some forms of medical equipment.

How much of healthcare costs go to administration?

According to the JAMA study, 8% of all health care costs in the U.S. went toward administration — that is, planning, regulating, billing, and managing health care services and systems. By contrast, the 10 other countries in the study spent only 1% to 3% of total costs on administration.

How many Americans have no health insurance?

Under the current system, approximately 29.6 million Americans have no health insurance, according to the U.S. Census Bureau. Moreover, a 2020 study by The Commonwealth Fund concluded that another 41 million Americans — about 21% of working-age adults — are underinsured, without enough coverage to protect them from devastatingly high medical expenses.

Why are generalist doctors paid higher?

One reason health care prices are higher in the U.S. is that most Americans get their coverage from private insurers, and these companies pay much higher rates for the same health care services than public programs such as Medicare.

Is Medicare for All a universal health care plan?

However, no other nation currently has a system quite like the Medicare for All plan with virtually zero out-of-pocket costs for patients.

Is Canada a single payer country?

The single-payer health care system in Canada is probably closer to Medicare for All than any other national system. Under this system, the government provides health insurance coverage, but most of the actual care comes from private doctors and hospitals.

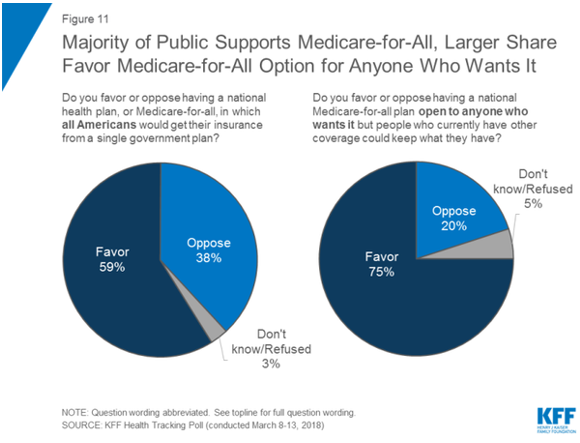

What percentage of Americans support Medicare for All?

A Kaiser Family Foundation tracking poll published in November 2019 shows public perception of Medicare for All shifts depending on what detail they hear. For instance 53 percent of adults overall support Medicare for All and 65 percent support a public option. Among Democrats, specifically, 88 percent support a public option while 77 percent want ...

What is the idea of Medicare for All?

Ask someone what they think about the idea of “Medicare for All” — that is, one national health insurance plan for all Americans — and you’ll likely hear one of two opinions: One , that it sounds great and could potentially fix the country’s broken healthcare system.

What would happen if we eliminated all private insurance and gave everyone a Medicare card?

“If we literally eliminate all private insurance and give everyone a Medicare card, it would probably be implemented by age groups ,” Weil said.

What is single payer healthcare?

Single-payer is an umbrella term for multiple approaches.

How many people in the US are without health insurance?

The number of Americans without health insurance also increased in 2018 to 27.5 million people, according to a report issued in September by the U.S. Census Bureau. This is the first increase in uninsured people since the ACA took effect in 2013.

Is Medicare for All funded by the government?

In Jayapal’s bill, for instance, Medicare for All would be funded by the federal government, using money that otherwise would go to Medicare, Medicaid, and other federal programs that pay for health services. But when you get right down to it, the funding for all the plans comes down to taxes.

Is Medicare Advantage open enrollment?

While it covers basic costs, many people still pay extra for Medicare Advantage, which is similar to a private health insurance plan. If legislators decide to keep that around, open enrollment will be necessary. “You’re not just being mailed a card, but you could also have a choice of five plans,” said Weil.

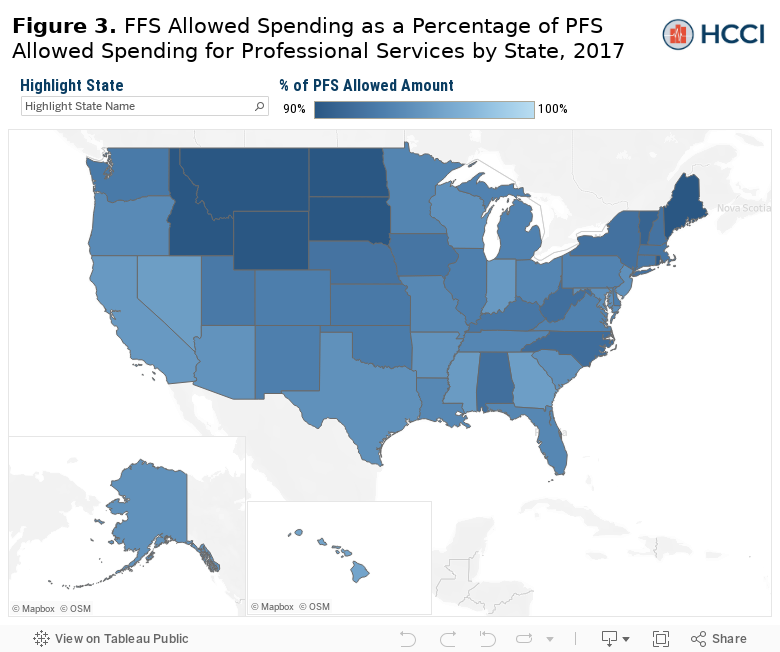

What percentage of Medicare reimbursement is for social workers?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1. Not all types of health care providers are reimbursed at the same rate. For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1.

What is Medicare reimbursement?

Medicare reimburses health care providers for services and devices they provide to beneficiaries. Learn more about Medicare reimbursement rates and how they may affect you. Medicare reimbursement rates refer to the amount of money that Medicare pays to doctors and other health care providers when they provide medical services to a Medicare ...

How many cosponsors did the Medicare bill have?

The bill, which has 16 Democratic cosponsors, would expand Medicare into a universal health insurance program, phased in over four years. (The bill hasn’t gone anywhere in a Republican-controlled Senate.)

Will Medicare have negative margins in 2040?

The Centers for Medicare and Medicaid Services (CMS) Office of the Actuary has projected that even upholding current-law reimbursement rates for treat ing Medicare beneficiaries alone would cause nearly half of all hospitals to have negative total facility margins by 2040. The same study found that by 2019, over 80 percent ...

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

Does Medicare Part D cover copayments?

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage. Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

Does Medicare Part B and D have to be higher?

Learn more about what you may pay for Medicare, depending on your income. Medicare Part B and Part D require higher income earners to pay higher premiums for their plan.

Does Medicare Advantage have a monthly premium?

Some of these additional benefits – such as prescription drug coverage or dental benefits – can help you save some costs on your health care, no matter what your income level may be. Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations.

How many people are in Medicare for All?

If enacted, Medicare for All would change Medicare as we know it, which will have a huge effect on the roughly 168 million Americans who are currently enrolled in Medicare.

How many people are in Medicare Advantage 2019?

In 2019, 34 percent, or nearly one third of all Medicare recipients, were enrolled in a Medicare Advantage plan. The elimination of this type of plan would impact a huge portion of beneficiaries, some of whom enjoy Medicare Advantage simply because it is a private option.

What would eliminate many of the elements associated withour current Medicare system?

dental care. vision care. hearing care. prescription drugs. Medicarefor All, which would be run and funded by the government and available to everysingle American citizen, would eliminate many of the elements associated withour current Medicare system, such as: private insurance plans. age requirements for enrollment.

What is Medicare Advantage Plan?

Medicare Advantage plans are Medicare plansthat are sold by private insurance companies contracted with Medicare. Withoutprivate insurance under Medicare for All, Medicare Part C would no longer be anoption. In 2019, 34 percent, or nearly one third of all Medicare recipients, were enrolled in a Medicare Advantage plan.

What is the ACA?

The Patient Protection and Affordable Care Act or simply the Affordable Care Act (ACA), often referred to as Obamacare, was designed to create affordable healthcare options for more Americans. As an alternative to Medicare for All, the changes according to Joe Biden, to the ACA would include:

What is Joe Biden's alternative to Medicare?

Joe Biden’s alternative to Medicare for All includes an expansion of the Affordable Care Act (ACA) that was enacted under President Obama in 2010. These changes would not impact Medicare beneficiaries in the same way that Medicare for All would.

Is Medicare for all a tax financed system?

The Medicare for All proposal calls for a healthcare system similar to Canada through an expansion of Medicare. This expansion would include all necessary healthcare services, with no up-front cost to beneficiaries. Like most other tax-financed, single-payer systems, the cost of all healthcare services would be paid for through taxes.

How much less does Medicare pay hospitals?

But Medicare pays hospitals about 40% less than private insurance for inpatient services and doctors about 30% less for their treatment, according to Charles Blahous, a senior research strategist at the conservative Mercatus Center at George Mason University and a former trustee for Social Security and Medicare.

What does private insurance pay for?

Private insurance payments provide the funding hospitals need to offer the care that Americans expect, said Chip Kahn, chief executive of the Federation of American Hospitals, which represents for-profit institutions.

Is Medicare for all a national coalition?

The renewed interest in Medicare for all has prompted the American Hospital Association, Federation of American Hospitals and American Medical Association to join a national coalition seeking to chill the growing fervor. Instead, they are pushing to strengthen employer-based policies, which currently cover roughly half of Americans.

Do Americans like to give up their health insurance?

CNN —. Americans generally don’t like the idea of giving up their private health insurance. Hospitals and doctors don’t want them to, either. Private insurers typically pay medical providers a whole lot more than Medicare and Medicaid.

Does Jayapal pay for hospitals?

To contain health care costs, Jayapal wants to pay hospitals under a so-called global budget system, which other developed countries use. So does Maryland, which has specified the amount of annual revenue hospitals can receive from Medicare, Medicaid and private insurers since 2014.