What was the cost of Medicare Part B in 2015?

$104.90 per monthHow much will Medicare premiums cost in 2015? Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums.

What was the Medicare deductible for 2014?

$1,216The Medicare Part A deductible that beneficiaries pay when admitted to the hospital will be $1,216 in 2014, an increase of $32 from this year's $1,184 deductible. The deductible covers beneficiaries' costs for up to 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the deductible for Medicare each year?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

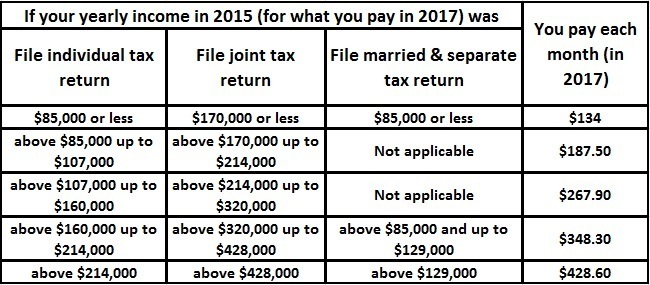

What was the Medicare Part B deductible for 2017?

$183 in 2017CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016).

What were Medicare premiums in 2013?

Today we announced that the actual rise will be lower—$5.00—bringing 2013 Part B premiums to $104.90 a month. By law, the premium must cover a percent of Medicare's expenses; premium increases are in line with projected cost increases.

What is the Medicare deductible for 2022?

$233 per yearIn 2022, the Medicare Part A deductible is $1,556 per benefit period, and the Medicare Part B deductible is $233 per year.

What is the annual Medicare deductible for 2022?

Medicare Deductibles. The 2022 deductible for Medicare Part A is $1,556 for each benefit period: $0 for days 1-60, $389 coinsurance per day for days 61-90 and $778 per each "lifetime reserve day" after 91 days. The Medicare Part B deductible is $233.

What is the Medicare Plan G deductible for 2022?

$2,490* Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of$2,490 in 2022 before your policy pays anything.

What was the cost of Medicare Part B in 2016?

If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What was the Medicare Part B premium for 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What is the Part B deductible for 2019?

$185 in 2019Medicare Part B Premiums/Deductibles The annual deductible for all Medicare Part B beneficiaries is $185 in 2019, an increase of $2 from the annual deductible $183 in 2018.

How much did Medicare Part A cost in 2015?

In the press release, CMS also announced that a small number of beneficiaries who pay Medicare Part A monthly premiums, will see their bill drop $19 in 2015 to $407. This will happen for people that haven’t earned enough work quarters for premium-free. Part A covers inpatient hospital, skilled nursing facility and some home health care services. However, Part A hospital deductibles will increase by $44 to $1,260 and co-payments for other services will also increase slightly.

Why is Medicare Part B premiums unchanged?

Secretary Burwell said in the announcement that slower health care cost growth within Medicare since the passage of the Affordable Care Act , is the main factor into Medicare Part B monthly premiums remaining unchanged. She added that the ACA is working to improve affordability and access to quality care for seniors and people with disabilities.

What is Medicare Part B?

Medicare Part B covers physicians’ services, outpatient hospital services, certain home health services, durable medical equipment and other items for approximately 49 million Americans. Premiums and deductibles will remain at $104.90 and $145 respectfully. This is $125 lower over the course of the year than the Congressional Budget Office projected in 2009.

When did the 1.7 percent increase in Social Security go into effect?

The 1.7 percent increase, which is mentioned above, will go into effect in January 2015 and the actual amount of an individual’s increase is based on their current benefit check.

How much is Medicare Part B in 2015?

Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums. The Part B deductible will also remain the same for 2015, at $147. The Medicare Part A deductible, which covers the first 60 days of Medicare-covered inpatient hospital care, will rise to $1,260 in 2015, a $44 increase from 2014.

How much is Medicare Advantage going up?

The average premium for a Medicare Advantage plan is going up by about 9.5%, to $33.90 per month (you’re still on the hook for Part B premiums). However, premiums will remain the same for about 61% of people if they elect to stay with the same Medicare Advantage plan.

How long can you open enrollment for Medicare Supplement?

Medicare supplement policies don’t have an annual open-enrollment period; you can buy them anytime. But you usually can be rejected or charged more because of your health if you get the policy more than six months after signing up for Medicare Part B.

2015 Medicare premiums stable but changes to deductibles and coinsurance

The Centers for Medicare and Medicaid has released data on 2015 Medicare premiums, deductibles and coinsurance amounts. Any change in these amounts can either directly or indirectly affect your healthcare costs.

Deductible and coinsurance changes

The Part A deductible will increase $19 in 2015 to $1,260. The Part A deductible must be paid in the event that you are hospitalized. If you are covered by Original Medicare only, this will be your responsibility.

How much is Medicare Part B deductible in 2015?

If you have to pay a higher amount for your Part B premium and you disagree, you can appeal the IRMAA. The 2015 Medicare Part B annual deductible remains $147 (unchanged from 2014 and 2013).

How much is Medicare Part A 2015?

The 2015 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $407.

How much is Medicare Advantage premium for 2015?

The 2015 Medicare Advantage plan premiums range from $0 to $348.

What is Medicare Part D 2015?

2015 Part D (Medicare Prescription Drug Plan) Monthly Premium & Deductible. Medicare Prescription Drug Plan (Part D) premiums*, deductibles, and benefits vary by plan and state. Remember that you can receive Part D prescription drug coverage from a stand-alone Medicare Part D plan (PDP) or a Medicare Advantage plan that includes drug coverage ...

How much is the 2015 Part D premium?

The 2015 Part D plan premiums range from $0 to $172. The 2015 standard Part D plan deductible is $320, however the actual plan deductible can be anywhere from $0 to $320 .