What is Medicare’s give Back benefit?

What are the qualifiying factors for 144.00 add back to my… Health (9 days ago) There are some states (hence the ask about your zip code) in which you can fully pay for Medicare-based insurance for no direct payment.The TV ads turn that into a way to 'return' $144 per month to you when you sign up for their Medicare insurance. You can start by doing a web search for …

Does your zip code matter for Medicare?

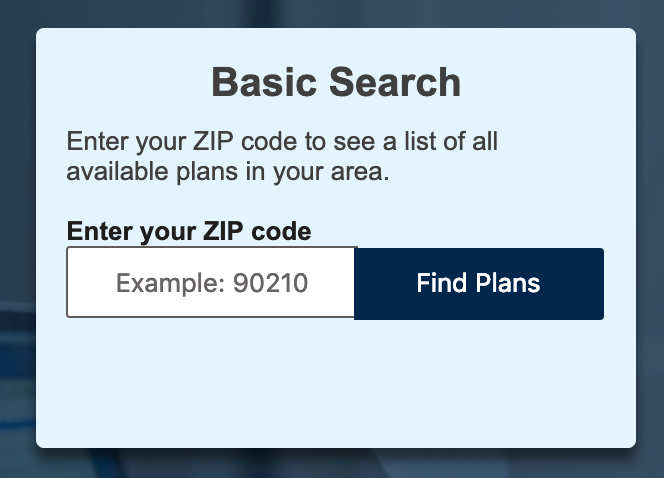

Answer (1 of 9): To answer your question directly… these giveback part b plans are ALWAYS Medicare advantage plans. To get a list… go to Medicare.gov, enter your zip code that you want to move to… and all available plans will pull up. Word of advice… I …

What is the Medicare Part B premium GiveBack Program?

To receive the Medicare give back benefit, you'll need to enroll in a plan that offers to pay your Part B monthly premium. 2. Location Is Key. According to …

How do I contact the Medicare GiveBack Program?

Sep 16, 2021 · The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans. If you enroll in a Medicare Advantage plan with this benefit, the plan carrier will pay some or all of your Part B monthly premium. The amount covered can range from 10 cents to the full Part B premium cost ($148.50 in 2021).

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

Why do certain ZIP codes get more Medicare benefits?

Location Is Key. According to the official U.S. government website for Medicare, the Medicare Advantage plans that are available to you differ according to your zip code. This is because Medicare Advantage plans are offered by private insurance companies who determine the specific service areas of their plans.

How do you qualify to get money back on Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.Jan 14, 2022

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

Is Social Security getting a $200 raise?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 6, 2022

How does the Medicare Give Back program work?

Medicare Advantage plans receive payments from the federal government (which cost the government more per-person than it spends on Original Medicare). But the plan can opt to receive a reduced payment and use the payment reduction to offset some of the Part B premium for its enrollees.Dec 1, 2021

How does zip code affect Social Security benefits?

Social security benefits are not impacted by geographic location but other federal benefits are. We took a look at these programs and how benefits vary. Social security benefits are calculated the same nationally.Dec 9, 2021

What is the income limit for extra help in 2021?

To qualify for Extra Help, your annual income must be limited to $20,385 for an individual or $27,465 for a married couple living together.

Does your zip code matter for Medicare?

This is where your zip code matters in terms of Medicare eligibility. You will always be eligible for Original Medicare, but eligibility for (4 day...

How do you qualify for $148 back from Medicare?

How do you qualify for $148.50 back from Medicare? If you have Parts A and B, you can enroll in an Advantage plan with a give-back option. These pl...

How do I find Medicare Part B Giveback plans?

You can use Medicare's Plan Finder to find plans in your area that offer the giveback benefit. If you look under the "premiums" section in the Plan...

How do I find out if my Medicare plan offers a premium reduction?

The best place to start is the Medicare Plan Finder. If a plan offers the Part B premium reduction, you’ll see that noted on the details page. Find...

How to get a Medicare Savings Program number?

To get the number for their State Medicaid office, they should visit Medicare.gov/contacts online.

How to apply for extra help with Medicare?

Medicare beneficiaries can apply for Extra Help online by completing the Social Security Application for Extra Help with Medicare Prescription Drug Plan Costs (SSA-1020) . Individuals may call SSA at 1-800-772-1213 (TTY 1-800-325-0778) to locate a local SSA office, to apply over the phone, or to request an application.

What is the L447 notice?

These datasets provide the number of L447 and L448 notices SSA mailed to beneficiaries who SSA found potentially eligible for either an MSP or Extra Help with Medicare Prescription Drug Plan Costs. The datasets include data at the zip code level. Zip codes with 10 or less mailed notices are indicated by an asterisk for privacy protection purposes.

What is SSA 1144?

Section 1144 of the Social Security Act requires SSA to notify low-income Medicare beneficiaries about specific programs that may be able to assist them with medical and prescription drug expenses. Each year, SSA mails notices about the Medicare Savings Programs (MSP) to provide information that may help beneficiaries with:

What are the different types of Medicare?

Medicare has four parts: 1 Hospital Insurance (Part A) helps pay for inpatient care in a hospital or skilled nursing facility (following a hospital stay), some home health care and hospice care. 2 Medical Insurance (Part B) helps pay for doctors’ services and many other medical services and supplies that are not covered by hospital insurance. 3 Medicare Advantage plans (Part C) are available in many areas. People with Parts A and B can choose to receive all of their health care services through a provider organization under Part C. 4 Prescription Drug plans (Part D) helps cover costs of medications.

What is Part D in Medicare?

People with Parts A and B can choose to receive all of their health care services through a provider organization under Part C. Prescription Drug plans (Part D) helps cover costs of medications. Medicare beneficiaries may be able to get help from their state to pay their Medicare premiums.

What is hospital insurance?

Hospital Insurance (Part A) helps pay for inpatient care in a hospital or skilled nursing facility (following a hospital stay), some home health care and hospice care. Medical Insurance (Part B) helps pay for doctors’ services and many other medical services and supplies that are not covered by hospital insurance.

What is the Medicare Part B Giveback Benefit?

The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C (Medicare Advantage) plans.

How do I receive the Medicare Giveback Benefit?

You will not receive checks directly from your Medicare Advantage plan carrier. You can get your reduction in 2 ways:

Is the Medicare Giveback Benefit a type of Medicare Savings Program?

No. The Medicare Giveback Benefit is only available to people enrolled in certain Medicare Advantage plans. Medicare Savings Programs (MSPs) are available to people enrolled in Original Medicare who have limited income and resources.

Learn more about Medicare

For more helpful information on Medicare, check out these 10 frequently asked questions about Medicare plans.

Is Medicare Different In Each State?

Before we begin our discussion of Medicare coverage by state, let’s consider basic eligibility for Medicare. The Centers for Medicare & Medicaid Services reports that the following factors make you eligible for Medicare:

Get started now

Interested in learning more about Medicare, Medigap, and Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.

How to qualify for Medicare premium reduction?

To qualify for a premium reduction, you must: Be a Medicare beneficiary enrolled in Part A and Part B, Be responsible for paying the Part B premium, and. Live in a service area of a plan that has chosen to participate in this program.

What happens if you call Medicare?

However, if you call (as noted in the commercial’s small print), your call will be transferred to a licensed insurance agent who may or may not sell plans in your area. And, if there is no plan in your area, you may hear about other plans that are available to you. The best place to start is the Medicare Plan Finder.

What is a reduction in Part B premium?

This is a reduction in the Part B premium you must pay. For example, if a beneficiary is on Social Security, the Part B premium comes out of the monthly benefit before it hits the individual’s bank account. The reduction in the plan’s payment reduces that premium, which means more money in the individual’s bank account.

Does SNP include prescription drug coverage?

A few of these plans do not include prescription drug coverage. Some Special Needs Plans (SNP) also offer this benefit. But, in these cases, the beneficiary may not qualify. For example, there is a SNP for those residing in nursing homes.

How much is Medicare giveback?

In some cases, the giveback may be as low as $10, while in others it may be the entire premium. Generally, it falls somewhere between $20 and $100. You will occasionally see above $100.

What is Medicare Part B premium giveback?

As we mentioned, the Medicare Part B Premium Giveback is a program in place to help you receive some money back on your Part B premium. The program is for Medicare Part C plans, also called Medicare Advantage plans, which are offered by private insurance companies but still approved and regulated by the Centers for Medicare & Medicaid Services ...

How much is Social Security giveback 2021?

Let’s say your monthly Social Security benefit is $1,543 (roughly the expected average for 2021) and your giveback is $80. Once the giveback kicks in, your check would begin to be $1,623, since that $80 would be added in.

How much is Medicare Part B 2021?

In 2021, the standard monthly Part B premium cost is $148.50. Most people have this premium taken directly out of their Social Security check each month. The carrier that offers ...

How long does it take for Social Security to kick in?

It can take a few months for the benefit to kick in once you’ve enrolled in a plan with the giveback, but this will be credited to you. If it takes two months for the benefit to begin, you’ll receive two months of giveback on your first Social Security check with the benefit.

Does Medicare Advantage give back premiums?

So, not only can some Medicare Advantage plans help you afford your health care, they can also reduce the monthly premium that covers the care, too. This makes the Medicare Part B Premium Giveback yet another way that Medicare can help make your health care available and affordable! Just like you, your health is one of a kind.

Does Medicare Advantage take out Social Security?

Most people have this premium taken directly out of their Social Security check each month. The carrier that offers the Medicare Advantage plan has notified CM S and the SSA that they’ll be covering all or a portion of the Part B premium.

For those who qualify, there are multiple ways to have your Medicare Part B premium paid

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

What is the Part B premium reduction benefit?

The giveback benefit, or Part B premium reduction, is when a Part C Medicare Advantage (MA) plan reduces the amount you pay toward your Part B monthly premium. Your reimbursement amount could range from less than $1 to the full premium amount, which is $170.10 in 2022.

How to find plans that offer the giveback benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2022, these plans are offered in nearly all states, so you may find one close to you.

Other Part B reimbursement options

There are other ways you can lower or eliminate how much you pay for the Medicare Part B premium. This includes certain Medicaid programs or benefits from some retiree health plans.

Background

- Section 1144 of the Social Security Act requires SSA to notify low-income Medicare beneficiaries about specific programs that may be able to assist them with medical and prescription drug expenses. Each year, SSA mails notices about the Medicare Savings Programs (MSP) to provide information that may help beneficiaries with: 1. Medicare expenses; and 2. Medicare Part D pres…

Agency Program Description

Dataset Description

Data Collection Description

Data Dictionary