When does my spouse become eligible to receive Medicare?

If your spouse is younger than 65 and receives disability benefits from Social Security for a period of 24 months, they automatically become eligible for Medicare on the 25th month. What Happens if Your Spouse is Older Than You?

Can I enroll in Medicare Part A under my spouse's work history?

However, you can enroll in premium-free Part A under your spouse’s work history if he or she has the necessary 40 quarters of Medicare earnings required, is at least age 62, and you have been married at least 1 year. NOTE: Your spouse does NOT have to be receiving Social Security retirement benefits for this to work.

When can I enroll in Medicare Part A?

You can: 1 Enroll in Medicare when you turn 65 2 Enroll in only Medicare Part A when you turn 65 3 Delay Medicare until you lose your coverage

Do I have to get Medicare if I'm covered by my spouse's plan?

Do I Have to Get Medicare If I’m Covered by My Spouse’s Employer Plan? Most people are first eligible to sign up for Medicare when they turn 65, and many choose to enroll during this time. For individuals who are covered by a spouse’s employer health care plan, it may not be necessary, or ideal, to enroll in Medicare immediately upon turning 65.

When can my spouse start Medicare?

age 65When you turn age 62 and your spouse is age 65, your spouse can usually receive premium-free Medicare benefits. Until you're age 62, your spouse can receive Medicare Part A, but will have to pay the premiums if they don't meet the 40 quarters of work requirement.

Can I enroll in Medicare under my spouse?

To qualify for Medicare, you need to have paid into the Social Security system. Just like with Social Security benefits, you can qualify for Medicare coverage under your spouse's record.

Is my spouse eligible for Medicare when I turn 65?

Your spouse is eligible for Medicare when he or she turns 65. Your eligibility for Medicare has no impact on the date that your spouse is eligible for Medicare. Continue reading for more answers to your questions about Medicare, individual health insurance, and coverage options for your spouse after you enroll.

Can my younger spouse get Medicare when I retire?

Your Medicare insurance doesn't cover your spouse – no matter whether your spouse is 62, 65, or any age. But in some cases, a younger spouse can help you get Medicare Part A with no monthly premium. Traditional Medicare includes Part A (hospital insurance) and Part B (medical insurance).

Can my wife get Medicare at 62?

Traditional Medicare includes Part A (hospital insurance) and Part B (medical insurance). To qualify for Medicare, your spouse must be age 65 or older. If your spouse is age 62 (or any age under 65), he or she could only qualify for Medicare by disability.

How does Medicare work for married couples?

Medicare has no family plans, meaning that you and your spouse must enroll for Medicare benefits separately. This also means husbands, wives, spouses and partners pay separate Medicare premiums.

How do I add my partner to Medicare?

Medicare online account help - Add someone to your Medicare cardStep 1: sign in.Step 2: before you start.Step 3: tell us who you're inviting.Step 4: confirm or update your address.Step 5: confirm or update your bank details.Step 6: review and submit.Step 7: you've created an invite code.Step 8: sign out.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

Can I get Medicare at age 62?

The typical age requirement for Medicare is 65, unless you qualify because you have a disability. 2. If you retire before 65, you may be eligible for Social Security benefits starting at age 62, but you are not eligible for Medicare.

Can I get Obama care if my husband in on Medicare?

Can I enroll in Medicare as his spouse? No. Although your husband now qualifies for Medicare, you will not qualify for Medicare until you turn 65. If you do not have health insurance now, you can consider signing up for health insurance coverage through a Marketplace plan.

Can I get AARP health insurance at 62?

Full AARP membership is available to anyone age 50 and over.

Can you collect 1/2 of spouse's Social Security and then your full amount?

Your full spouse's benefit could be up to one-half the amount your spouse is entitled to receive at their full retirement age. If you choose to begin receiving spouse's benefits before you reach full retirement age, your benefit amount will be permanently reduced.

Can I add my wife to my Medicare Advantage plan?

Medicare Advantage plans don't cover both you and your spouse together under one policy. Just as Medicare Part A and Part B cover each Medicare beneficiary separately, you can't share a Medicare Advantage plan with your spouse.

Why is my Medicare premium higher than my husbands?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $170,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $85,000, you'll pay higher premiums.

Does a non working spouse get Social Security?

Even if they have never worked under Social Security, your spouse may be eligible for benefits if they are at least 62 years of age and you are receiving retirement or disability benefits. Your spouse can also qualify for Medicare at age 65.

What happens to a couples premium with one turning 65 and on the Affordable Care Act with a subsidy?

Individual market plans no longer terminate automatically when you turn 65. You can keep your individual market plan, but premium subsidies will terminate when you become eligible for premium-free Medicare Part A (there is some flexibility here, and the date the subsidy terminates will depend on when you enroll).

When does Medicare start?

If you want Medicare coverage to start when your job-based health insurance ends, you need to sign up for Part B the month before you or your spouse plan to retire. Your coverage will start the month after Social Security (or the Railroad Retirement Board) gets your completed forms. You’ll need to fill out an extra form showing you had job-based health coverage while you or your spouse were working.

What happens if you don't sign up for Medicare?

If you don’t sign up when you’re first eligible, you’ll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up.

When does Part B start?

If you sign up during this 8-month period, your Part B coverage will start the month after Social Security (or the Railroad Retirement Board) gets your completed forms. You’ll need to fill out an extra form showing you had job-based health coverage while you or your spouse were working.

Can you get help with Medicare if you have medicaid?

Depending on the type of Medicaid you have, you may also qualify to get help paying your share of Medicare costs. Get details about cost saving programs.

Does Medicare cover hospital visits?

Medicare can help cover your costs for health care, like hospital visits and doctors’ services.

Does my state sign me up for Medicare?

Your state will sign you up for Medicare (or if you need to sign up).

Do you have health insurance now?

Are you or your spouse still working for the employer that provides your health insurance coverage?

How to enroll in Social Security by phone?

Enroll By Phone. Contact Social Security to schedule a phone appointment for this enrollment. You can call the main line at 800-772-1213 or a local Social Security office to schedule ( Social Security office locator ). We recommend initiating the request 3-4 months prior to your planned start date.

How long does it take to get SSA enrollment confirmation?

If you need to send any documents, the SSA rep will ask you to either mail or fax them. After that, it’s usually a 3-6 week timeframe for processing. You will receive confirmation of the enrollment being complete by US mail.

Is Medicare Mindset LLC affiliated with Medicare?

Neither Medicare Mindset LLC nor its agents are affiliated with the Federal Medicare program.

How long do you have to sign up for Medicare at 65?

You have a seven-month window around your 65th birthday to sign up for Medicare and that date may overlap with your spouse’s sign-up window. Even if that occurs, you can select the same type of plan at the same time but you can’t be on the same plan.

Does Medicare cover couples?

Rest assured, you’re not missing out on any special discounts or rates for couples. Medicare only offers plans for individuals. You’ll each pay the same rates as individuals.

Enrolling in Medicare at 65

If you want to enroll when you are turning 65, you can enroll in Medicare Parts A & B, Part D prescription drug coverage or a Medicare Advantage (Part C) plan. You can also look at adding a Medicare supplement insurance plan to Original Medicare (Parts A & B) to help with the out-of-pocket costs of Medicare.

Enrolling in Medicare Part A at 65

Many people who are covered by a spouse’s employer plan choose to either wait to enroll until they lose their spouse’s employer coverage or choose to only enroll in Part A since Part A usually has no premium.

Delaying Medicare Enrollment

Just because you are turning 65, doesn’t necessarily mean you have to get Medicare right now. If you decide that waiting to enroll in Medicare is the best option both financially and in terms of healthcare coverage for you, just follow Medicare’s rules, and you’ll avoid enrollment penalties when you do enroll.

When Would I Enroll If I Delay or Only Take Part A?

If you are able to delay enrolling in either all or part of Medicare, you will have a Special Enrollment Period of eight months that begins when the employer coverage is lost or when your spouse retires. During this time, you’ll be able to enroll in Medicare Parts A & B. You can also enroll in a Part D prescription drug plan.

Medicare Made Clear

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Medicare Made Clear

Whether you're just starting out with Medicare, need to brush up on the facts, or are helping a loved one, start your journey here.

How long can you join a health insurance plan?

You can join a plan anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

When does the 8 month special enrollment period start?

Your 8-month Special Enrollment Period starts when you stop working, even if you choose COBRA or other coverage that’s not Medicare.

What happens if you miss the 8 month special enrollment period?

If you miss this 8-month Special Enrollment Period, you’ll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up.

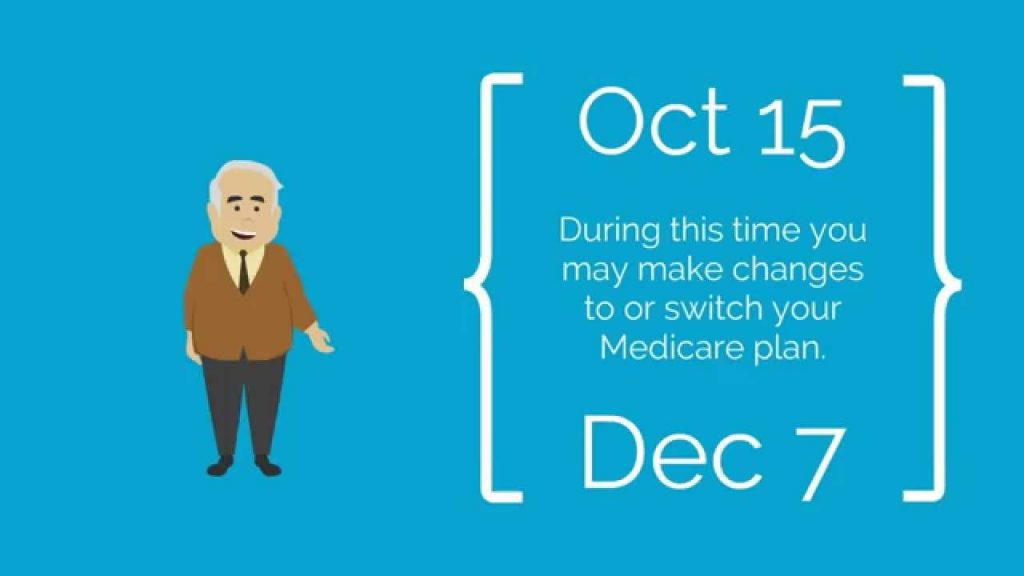

What is a Medicare leave period?

A period of time when you can join or leave a Medicare-approved plan.

Do you have to tell Medicare if you have non-Medicare coverage?

Each year your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information — you may need it when you’re ready to join a Medicare drug plan. (Don’t send this information to Medicare.)

Does Cobra end with Medicare?

Your COBRA coverage will probably end when you sign up for Medicare. (If you get Medicare because you have End-Stage Renal Disease and your COBRA coverage continues, it will pay first.)

Do I need to get Medicare drug coverage (Part D)?

Prescription drug coverage that provides the same value to Medicare Part D. It could include drug coverage from a current or former employer or union, TRICARE, Indian Health Service, VA, or individual health insurance coverage.

When do spouses have to enroll in Medicare?

Check whether your spouse’s employer plan requires you, as a covered dependent, to enroll in Medicare when you turn 65. Some plans — notably the military’s TriCare-for-Life coverage and health benefits provided by an employer with fewer than 20 employees — automatically become secondary to Medicare when an enrollee becomes entitled to Medicare.

How long does a spouse have to sign up for a new employer?

This period lasts for up to eight months after employer coverage comes to an end.

How to disenroll in Social Security?

You'll need to fill out a CMS-1763 form (pdf) and submit it to SSA. A personal interview with a Social Security representative is also required to disenroll; call 800-772-1213 or contact your local SSA office to arrange one.

How long does it take for Medigap to sell?

After six months, Medigap providers can deny to sell you a plan, or can alter your premiums, based on preexisting conditions. Under various laws, employers with 20 or more workers must offer exactly the same health benefits to employees and their spouses over age 65 as are offered to younger workers and spouses.

What happens if you don't have Medicare?

In this case, if you’re not enrolled in Medicare, you would receive almost no coverage from the employer plan. If you are not married but living in a domestic partnership and you are covered by your partner's health insurance at work, you should enroll in Part A and Part B during your initial enrollment period at age 65 to avoid late penalties. ...

Do you have to enroll in a special enrollment period?

You’re not obligated to enroll, of course. But if you don’t, and some years down the line those retiree benefits come to an end for some reason, you would not then be entitled to a special enrollment period and would therefore be liable for permanent late penalties.

How long do you have to be on disability to receive Social Security?

You have been entitled to Social Security or Railroad Retirement Board disability benefits for 24 months. ( Note: If you have Lou Gehrig's disease, your Medicare benefits begin the first month you get disability benefits.)

When did Medicare start providing prescription drugs?

Since January 1, 2006, everyone with Medicare, regardless of income, health status, or prescription drug usage has had access to prescription drug coverage. For more information, you may wish to visit the Prescription Drug Coverage site.