When can I buy Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

What to consider when selling Medicare supplement insurance?

if you are looking to grow your business, you should consider selling Medicare Supplement plans, especially if you are already selling other Medicare products. If you have only worked in other types of insurance, like health or life insurance, Medicare Supplement sales can be a great way to get involved in the Medicare market.

How to find best Medicare supplement insurance?

Best for Comparison Shopping. United Medicare Advisors is an online marketplace that lets you search for Medicare Supplement Insurance quotes from multiple companies. By entering your address, zip code, and phone number, you can view policy rates from companies like Cigna, Aetna, and Mutual of Omaha, among others.

What does supplemental insurance cover with Medicare?

Medicare Advantage Plans became available in the early 2000s and allow seniors to purchase coverage for dental, hearing, vision, and other health related services. These plans have grown in popularity and now around a third of Medicare members purchase an ...

How much do Medicare Supplement plans usually cost?

Medicare Supplement Plans have premiums that cost anywhere from around $70/month to around $270/month. Typically, plans with higher monthly premiums will have lower deductibles.

Can a Medicare Supplement plan be purchased at any time of the year?

Generally, there is no type of Medicare plan that you can get “any time.” All Medicare coverage, including Medicare Supplement (Medigap) plans, is subject to enrollment periods. Other types of Medicare plans, like Medicare Advantage and Medicare Part D prescription drug plans, have open enrollment periods every year.

What is the most comprehensive Medicare Supplement plan?

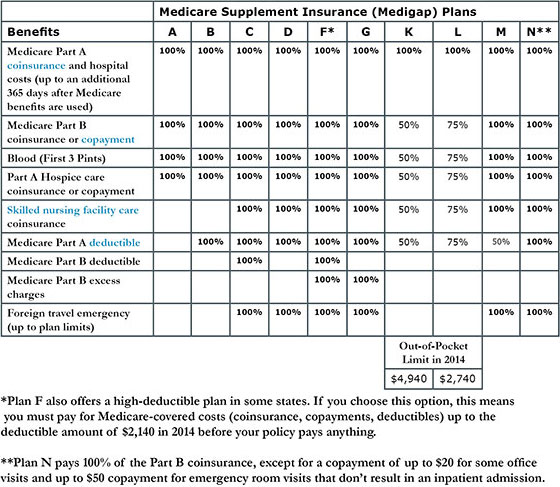

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What is the difference between Medicare and a supplemental plan?

When you buy a Medicare Supplement insurance plan, you are still enrolled in Original Medicare, Part A and Part B. Medicare pays for your health-care bills primarily, while the Medigap plan simply covers certain cost-sharing expenses required by Medicare, such as copayments or deductibles.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

How do I choose a Medicare Supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

Is plan F better than plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

When does Medigap coverage start?

Ask for your policy to become effective when you want coverage to start. Generally, Medigap policies begin the first of the month after you apply. If, for any reason, the insurance company won't give you the effective date for the month you want, call your State Insurance Department.

How to fill out a medical application?

Tips for filling out your application 1 Fill out the application carefully and completely, including medical questions. The answers you give will determine your eligibility for open enrollment or guaranteed issue rights (also called "Medigap protections"). 2 If your insurance agent fills out the application, check to make sure it's correct. 3 Remember that the insurance company can't ask you any questions about your family history or require you to take a genetic test. 4 If you buy a Medigap policy during your#N#Medigap Open Enrollment Period#N#A one-time only, 6-month period when federal law allows you to buy any Medigap policy you want that's sold in your state. It starts in the first month that you're covered under Part B and you're age 65 or older. During this period, you can't be denied a Medigap policy or charged more due to past or present health problems. Some states may have additional open enrollment rights under state law.#N#, the insurance company can’t use any medical answers you give to deny you a Medigap policy or change the price. 5 If you provide evidence that you're entitled to a guaranteed issue right, the insurance company can't use any medical answers you give to deny you a Medigap policy or change the price.

What to do if you didn't get your Medigap policy?

If it's been 30 days and you didn't get your Medigap policy, call your insurance company.

How long is the open enrollment period for Medigap?

Medigap Open Enrollment Period. A one-time only, 6-month period when federal law allows you to buy any Medigap policy you want that's sold in your state. It starts in the first month that you're covered under Part B and you're age 65 or older.

Can insurance companies use medical answers to deny you a Medigap policy?

If you provide evidence that you're entitled to a guaranteed issue right , the insurance company can't use any medical answers you give to de ny you a Medigap policy or change the price.

How to find a Medigap policy?

Do any of the following: 1 Use our site to find a Medigap policy. 2 Call your State Health Insurance Assistance Program (SHIP). Ask if they have a "Medigap rate comparison shopping guide" for your state. SHIPs can give you free help choosing a policy. 3 Call your State Insurance Department . Ask if they keep a record of complaints against insurance companies that can be shared with you. Consider any complaints against the insurance company when deciding which Medigap policy is right for you. 4 Look online for information about the insurance companies. 5 Talk to someone you trust, like:#N#A family member#N#Your insurance agent#N#A friend who has a Medigap policy from the same Medigap insurance company 6 Call the insurance companies.

What is covered benefits and excluded services?

Covered benefits and excluded services are defined in the health insurance plan's coverage documents. you need and want while considering your current and future health care needs. You might not be able to switch policies later. Select which type of Medigap plan (A-N) ...

Can you contact more than one insurance company that sells Medigap policies in your state?

Since costs vary between companies, contact more than one insurance company that sells Medigap policies in your state.

What if I already have Medicare, and someone tries to sell me a Marketplace plan?

It’s against the law for someone who knows that you have Medicare to sell you a Marketplace plan.

What is Medicare health plan?

Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan. Medicare health plans include all Medicare Advantage Plans, Medicare Cost Plans, and Demonstration/Pilot Programs.

What is the health insurance marketplace?

The Health Insurance Marketplace is designed for people who don’t have health coverage. If you have health coverage through Medicare, the Marketplace doesn't affect your Medicare choices or benefits. This means that no matter how you get Medicare, whether through.

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

When does Medicare enrollment end?

For most people, the Initial Enrollment Period starts 3 months before their 65th birthday and ends 3 months after their 65th birthday month.

When is open enrollment for Medicare?

During the Medicare Open Enrollment Period (October 15–December 7) , you can review your current Medicare health and prescription drug coverage to see if it still meets your needs. Take a look at any cost, coverage, and benefit changes that'll take effect next year.

Does Medicare qualify for federal tax?

Important tax information for plan years through 2018. Medicare counts as qualifying health coverage and meets the law (called the individual Shared Responsibility Payment) that required people to have health coverage if they can afford it. If you had Medicare for all of 2018 (or for earlier plan years), check the box on your federal income tax ...

What age do you have to be to get Medicare Supplement?

Disabled Under 65 . In 27 states, Medicare Supplement Insurance companies are required to sell policies to people under age 65 who receive Medicare benefits because of a qualifying disability or medical condition.

How long after you are 65 can you sign up for Medicare?

Signing up during your open enrollment period (the six months after you are both 65 and enrolled in Medicare Part B) also prohibits insurance companies from charging you extra for your policy for having a pre-existing condition.

How to contact Medigap?

Speak with a licensed agent at 1-800-995-4219 for help finding a Medigap plan that works for you.

Do you have to have Medicare to be under 65?

State laws vary, but some states only require insurance companies to offer certain plans to people under 65. For example, Texas only requires companies to offer Medigap Plan A, which is the least comprehensive plan available. If you live in a different state, you may be denied altogether. Only the 27 states above are required to offer any Medicare ...

Do you pay more for Medigap than over 65?

You will probably pay more for your plan than people over 65. Some states require insurance companies to sell you a Medigap policy for the same price as people over 65, but most states allow companies to charge you more if you are under 65 and disabled. You may have to settle on a less comprehensive plan. State laws vary, but some states only ...

What is a select Medicare policy?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. . If you buy a Medicare SELECT policy, you have rights to change your mind within 12 months and switch to a standard Medigap policy.

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

What is coinsurance percentage?

An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).

Can you charge more for a Medigap policy?

Charge you more for a Medigap policy. In some cases, an insurance company must sell you a Medigap policy, even if you have health problems. You're guaranteed the right to buy a Medigap policy: When you're in your Medigap open enrollment period. If you have a guaranteed issue right.

Can Medigap refuse to cover out-of-pocket costs?

A health problem you had before the date that new health coverage starts. . In some cases, the Medigap insurance company can refuse to cover your. out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance.

Can you get Medicare if you are 65?

Some states provide these rights to all people with Medicare under 65. Other states provide these rights only to people eligible for Medicare because of disability or only to people with ESRD. Check with your State Insurance Department about what rights you might have under state law.

How many Medicare Supplement Plans are there?

There are 10 Medicare Supplement plans to choose from. Each has a specific letter, such as Plan F and Plan A. You pay the insurer a monthly premium for the policy.

When is the best time to buy a medicare supplement?

The best time to buy a Medicare Supplement plan, or Medigap, is during your six-month open enrollment period. During this time, an insurance company cannot deny you coverage based on your health. After this period, you may pay more for a Medigap policy or get denied coverage due to poor health.

How old do you have to be to get a guaranteed Medigap?

However, only a handful of states require continuous or annual guaranteed issue Medigap protections to all Original Medicare beneficiaries ages 65 and older, regardless of medical history.

How long do you have to wait to get Medicare Part B?

Within six months of starting Medicare Part B benefits. You can either enroll in Part B when you’re first eligible at age 65 or you may choose to delay Part B enrollment until you or your spouse stops working for an employer that provides health insurance.

Why are my insurance premiums higher?

Your premiums may be higher if you have health problems — or your application may be denied outright.

How long do you have to switch insurance plans?

You have a 60-day window around your plan anniversary each year when you can switch to the same plan offered by a different insurance company with guaranteed issue rights.

When is the best time to buy Medigap?

The best time to buy Medigap is when you are first eligible.