Recipients who have MAP coverage on the system but are not participating in a Managed Care Program will send claims directly to HFS as a straight Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Full Answer

How is the TPL paid amount entered for claims?

For claims associated with a TPL, the provider must enter in how much the first or third party payer actually paid for the total claim, in Field 54, Prior Payments. For TPL, the TPL PAID amount is entered in as follows:

Are there any exceptions to TPL for Medicaid enrollee?

Benefit exceptions. In some cases, a Medicaid enrollee has TPL but the policy does not cover the specific Medicaid services provided (e.g., dental). Once a provider demonstrates that TPL does not apply to payment for certain Medicaid-covered services, future claims for those services can be paid by the state without first pursuing TPL.

What is third party liability (TPL)?

Federal regulation refers to this requirement as third party liability (TPL), meaning payment is the responsibility of a third party other than the individual or Medicaid. To implement the Medicaid TPL requirements, federal rules require states to take reasonable measures to identify potentially liable third parties and process claims accordingly.

How do I get my Medicare claims paid correctly?

To ensure correct payment of your Medicare claims, you should contact the Benefits Coordination & Recovery Center (BCRC) if you: Take legal action or an attorney takes legal action on your behalf for a medical claim, Are involved in a workers' compensation case.

What is Medicare TPL?

If another insurer or program has the responsibility to pay for medical costs incurred by a Medicaid-eligible individual, that entity is generally required to pay all or part of the cost of the claim prior to Medicaid making any payment. This is known as “third party liability” or TPL.

How do I submit a claim to Medicare?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

What address are Medicare claims sent to?

Medicare claim address, phone numbers, payor id – revised listStateAppeal addressArizonaAZMedicare Part B PO Box 6704 Fargo, ND 58108-6704MontanaMTMedicare Part B PO Box 6735 Fargo, ND 58108-6735North DakotaNDMedicare Part B PO Box 6706 Fargo, ND 58108-6706South DakotaSDMedicare Part B PO Box 6707 Fargo, ND 58108-670719 more rows

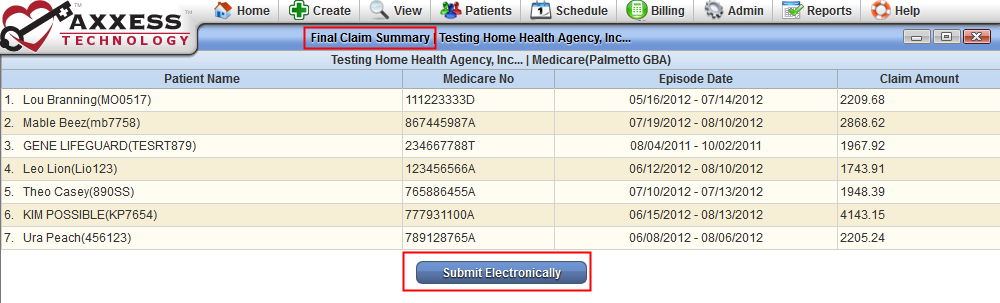

Can you submit claims to Medicare electronically?

How to Submit Claims: Claims may be electronically submitted to a Medicare Administrative Contractor (MAC) from a provider using a computer with software that meets electronic filing requirements as established by the HIPAA claim standard and by meeting CMS requirements contained in the provider enrollment & ...

What form is used to send claims to Medicare?

Form CMS-1500Providers sending professional and supplier claims to Medicare on paper must use Form CMS-1500 in a valid version. This form is maintained by the National Uniform Claim Committee (NUCC), an industry organization in which CMS participates.

How do I submit a claim to CMS-1500?

CMS does not supply the form to providers for claim submission. In order to purchase claim forms, you should contact the U.S. Government Printing Office at 1-866-512-1800, local printing companies in your area, and/or office supply stores.

Where do I send my Medicare form CMS 1490s?

MEDICARE ADMINISTRATIVE CONTRACTOR ADDRESS TABLEIf you received a service in:Mail your claim form, itemized bill, and supporting documents to::California Southern (For Part B)Noridian Healthcare Solutions, LLC P.O. Box 6775 Fargo, ND 58108-677554 more rows

How are Medicare claims processed?

Your provider sends your claim to Medicare and your insurer. Medicare is primary payer and sends payment directly to the provider. The insurer is secondary payer and pays what they owe directly to the provider. Then the insurer sends you an Explanation of Benefits (EOB) saying what you owe, if anything.

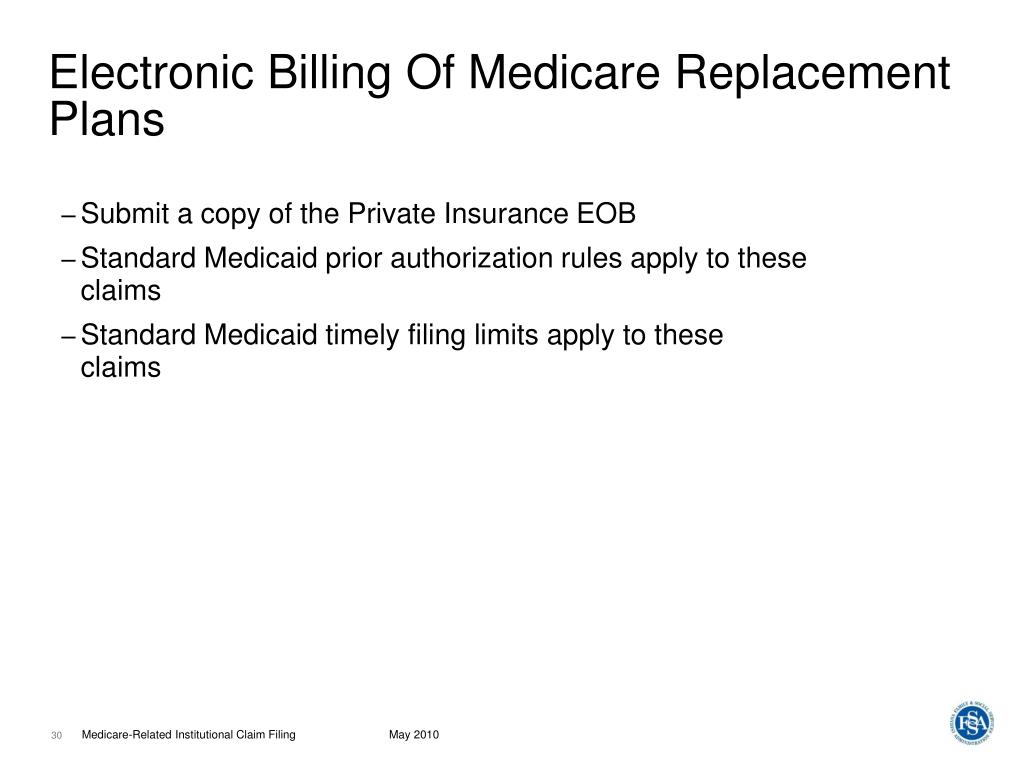

How do I file Medicare secondary claims electronically?

Medicare Secondary Payer (MSP) claims can be submitted electronically to Novitas Solutions via your billing service/clearinghouse, directly through a Secure File Transfer Protocol (SFTP) connection, or via Novitasphere portal's batch claim submission.

How are claims submitted electronically?

Electronic claims may be transmitted by: Dial-up method, which uses a telephone line or digital subscriber line for claims submission. (Clearinghouses typically supply the physician practice with the software required for communication between the physician practice's computer and the clearinghouse's system.)

What is the difference between paper and electronic claims?

An “electronic claim" is a paperless patient claim form generated by computer software that is transmitted electronically over the telephone or computer connected to a health insurer or other third-party payer (payer) for processing and payment, while A “manual claim” is a paper claim form that refers to either the ...

What are two ways electronic claims can be submitted?

These claims can be stored on a data server and submitted either directly to the payer through direct data entry or via a clearinghouse. Both methods are more accessible and less fragmented than the use of paper claims, especially when shared among specialists.

Third Party Liability in Health Insurance

In the United States there are many sources of health coverage, including indemnity health insurers, group health plans, managed care organizations...

Coordination of Benefits: Special Situations

There are two situations in which state Medicaid agencies follow different rules for avoiding and recovering Medicaid expenditures: (1) when the st...

Federal Role in Medicaid TPL

Although Medicaid is jointly funded by states and the federal government, states are responsible for administering eligibility and claims processin...

What is TPL in Medicaid?

Federal regulation refers to this requirement as third party liability (TPL), meaning payment is the responsibility of a third party other than the individual or Medicaid. To implement the Medicaid TPL requirements, federal rules require states to take reasonable measures to identify potentially liable third parties and process claims accordingly.

What is the TPL policy?

Medicaid TPL policies are governed by Medicaid statute and regulation. The implementing regulations for Medicaid TPL are described in Subpart D of 42 CFR Part 433. Congress has made additions and clarifications to the statute over time to further protect Medicaid from improper payment of claims that are the responsibility of a third party.

How does Medicaid coordinate benefits?

Insurers routinely coordinate benefits by determining whether a third party is liable for payment of a particular service provided to a covered member and then denying payment up front or collecting reimbursement from the third party. Medicaid coordinates benefits with other insurers as a secondary payer to all other payers.

What are the two sources of information on whether there may be a liable third party for a particular claim?

States have two main sources of information on whether there may be a liable third party for a particular claim: (1) Medicaid enrollees themselves and (2) data matches with other insurers or data clearinghouses.

How much did TPL save in 2011?

Department of Health and Human Services Office of the Inspector General (OIG) estimated that state and federal Medicaid savings from TPL totaled $13.6 billion in 2011, up from $3.7 billion in 2001 (OIG 2013).

What information is needed for Medicaid renewal?

Such information may include the name of the policyholder, his or her relationship to the applicant or enrollee, Social Security Number (SSN), and the name and address of the insurance company and policy number. For child applicants, the state must collect and include in the case file the names and SSNs of absent or custodial parents, to the extent such information is available. 2 In addition, state child support agencies are required to notify the Medicaid agency whenever a parent has acquired health coverage for a child as a result of a court order.

What are the four data elements required to identify a TPL?

States are required by federal statute to have laws that compel health insurers in the state to provide at least four data elements to support identification of TPL: the insured’s name, address, group or member ID number, and periods of coverage (§1902 (a) (25) of the Act).

What is TPL in Medicaid?

It is possible for Medicaid beneficiaries to have one or more additional sources of coverage for health care services. Third Party Liability (TPL) refers to the legal obligation of third parties (for example, certain individuals, entities, insurers, or programs) to pay part or all of the expenditures for medical assistance furnished ...

Can a third party request Medicaid?

Third parties should treat a request from the contractor as a request from the state Medicaid agency. Third parties may request verification from the State Medicaid agency that the contractor is working on behalf of the agency and the scope of the delegated work.

Can Medicaid be contracted with MCO?

State Medicaid programs may contract with MCOs to provide health care to Medicaid beneficiaries, and may delegate responsibility and authority to the MCOs to perform third party discovery and recovery activities. The Medicaid program may authorize the MCO to use a contractor to complete these activities.

Coordination of Benefits

The Benefits Coordination & Recovery Center (BCRC) consolidates the activities that support the collection, management, and reporting of other insurance coverage for Medicare beneficiaries.

Medicare Secondary Payer (MSP) Recovery

MSP is the term used by Medicare when Medicare is not responsible for paying first. The MSP statute and regulations require Medicare to recover primary payments it mistakenly made for which a GHP is the proper primary payer.

Mandatory Insurer Reporting

Section 111 of the Medicare, Medicaid, and SCHIP Extension Act of 2007 (MMSEA) (P.L.110-173) sets forth new mandatory reporting requirements for GHP arrangements and for liability insurance (including self-insurance), no-fault insurance, and workers' compensation (also referred to as Non-Group Health Plans or NGHPs). See 42 U.S.C.

What happens if a third party is not liable for Medicaid?

If there is no established liable third party, the SMA may pay claims to the maximum Medicaid payment amount established for the service in the state plan. If the SMA later establishes that a third party was liable for the claim, it must seek to recover the payment. This may occur when the Medicaid beneficiary requires medical services in casualty/tort, medical malpractice, Worker’s Compensation, or other cases where the third party’s liability is not determined before medical care is provided. It may also occur when the SMA learns of the existence of health insurance coverage after medical care is provided.

What is a TAG in Medicaid?

The COB/TPL TAG is a forum for state Medicaid senior COB/TPL managers to discuss technical and operational issues and share best practices with CMS, relating to Medicaid policy issues. The purpose of the TAG is to inform and advise CMS as it prepares guidance, identifies and resolves issues, reviews operational policies, and carries out its responsibilities with respect to Medicaid COB/TPL requirements. The TAG also enables CMS to apprise members of current and planned initiatives in areas of interest. State members of the TAG include a Chairperson and 10 State Representatives, one for each of the 10 CMS regions. Each State Representative is responsible to solicit subjects for discussion from the states in his region and share TAG meeting summaries and other communications with the states. The COB/TPL team and Regional Office staff attend monthly conference calls, and other program and state staff attend the TAG meetings, as appropriate.

Is Medicaid a payer of last resort?

There are a few exceptions to the general rule that Medicaid is the payer of last resort and these exceptions generally relate to federal-administered health programs. For a federal-administered program to be an exception to the Medicaid payer of last resort rule, the statute creating the program must expressly state that the other program pays only for claims not covered by Medicaid; or, is allowed, but not required, to pay for health care items or services.

Is Medicaid a third party payer?

Medicaid is generally the “payer of last resort,” meaning that Medicaid only pays claims for covered items and services if there are no other liable third party payers for the same items and services. This concept is implied in statute and regulation, and has been cited by the U.S. Congress and the U.S. Supreme Court.

Is Medicaid a federal or state partnership?

Medicaid’s COB/TPL activities—like the rest of the Medicaid program—are administered through a federal–state partnership. Both the federal and state governments have the responsibility to ensure that Medicaid is appropriately identifying potentially liable third parties and coordinating benefits to reduce Medicaid program costs.

Who is liable for Medicaid?

Medicaid and Other Coverage: A Medicaid beneficiary may have a third party resource (health insurance, or another person or entity) that is liable to pay for the beneficiary’s health care.

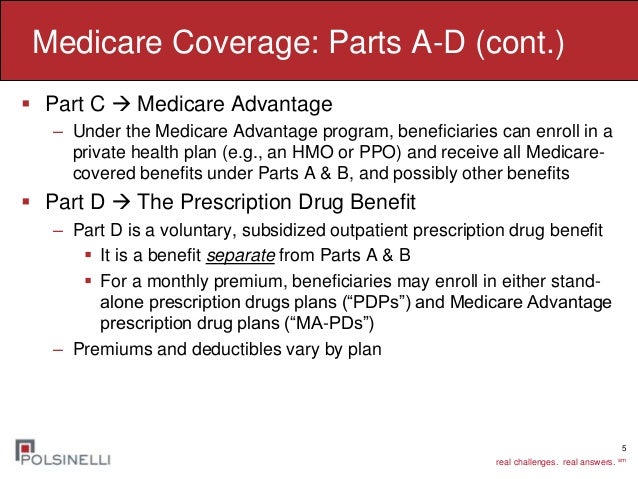

Can SMAs make capitated payments to Medicare Advantage?

For beneficiaries enrolled in Part C plans entitled to Medicaid payment of cost-sharing, SMAs may make capitated payments to Medicare Advantage plans to cover the enrollee’s cost-sharing. SMAs must outline in their state plans a methodology for calculating the capitation payments, and that methodology must be consistent with the cost-sharing levels for dually eligible beneficiaries outlined in the state plan.

How to ensure correct payment of Medicare claims?

To ensure correct payment of your Medicare claims, you should contact the Benefits Coordination & Recovery Center (BCRC) if you: Take legal action or an attorney takes legal action on your behalf for a medical claim, Are involved in an automobile accident, or. Are involved in a workers' compensation case.

What is Medicare primary payer?

The first or “primary payer” pays what it owes on your bills, and then the remainder of the bill is sent to the second or “secondary payer.” In some cases, there may also be a third payer.

When Do I Need to File A Claim?

- You should only need to file a claim in very rare cases

Medicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. If a claim isn't filed within this time limit, Medicare can't pay its share. For example, if you see your doctor on March 22, 2019, your doctor must file the Medicar…

How Do I File A Claim?

- Fill out the claim form, called the Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB). You can also fill out the CMS-1490S claim form in Spanish.

What Do I Submit with The Claim?

- Follow the instructions for the type of claim you're filing (listed above under "How do I file a claim?"). Generally, you’ll need to submit these items: 1. The completed claim form (Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB]) 2. The itemized bill from your doctor, supplier, or other health care provider 3. A letter explaining in detail your reason for subm…