The 10 Best Medicare Supplement Insurance Companies of 2022

| Number of States Covered | Plans Offered | Available Discounts | |

| Humana | 50 | A, B, C, F, HD-F, K, L, N | Online discount |

| Aetna | 42 | A, B, F, HD-F G, N | Household discount |

| Cigna | 50 | A, B, C, D, F, HD-F, G, and N | Household discount |

| AARP by United Healthcare | 50 | A, B, C, F, G, K, L, and N | Enrollment discount, household discount |

Full Answer

Which insurance company is best for a Medicare supplement?

Feb 22, 2022 · Best Medicare Supplement Insurance Companies of 2022 Best Overall: Mutual of Omaha; Best User Experience: Humana; Best Set Pricing: AARP; Best Medigap Coverage Information: Aetna

What is the cheapest Medicare supplement insurance?

21 rows · Feb 15, 2022 · Depending on where you live, you may be able to apply for Mutual of Omaha Medicare Supplement ...

Which is the best supplemental insurance for Medicare?

Dec 09, 2021 · The Best Medicare Supplement Insurance Companies of 2022 Best for Fast Claims Processing: Mutual of Omaha’s United World Life; Best for Frequent Travelers: Manhattan Life; Best Large Network: Aetna; Best for Preexisting Conditions: Cigna ; Most Cost-Effective: Medico; Best for AARP Members: AARP/UnitedHealthcare

What are the top 10 Medicare companies?

3 rows · Mar 24, 2022 · USAA Life Insurance Company has excellent financial strength ratings: AA+ from A.M. Best and ...

Which Medicare Supplement plan has the highest level of coverage?

Medicare Supplement Plan G is the best overall plan that provides the most coverage for seniors and Medicare enrollees. Plan G will cover almost everything except the Part B deductible.Mar 16, 2022

Who is the best provider for Medicare?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCoverage areaBlue Cross Blue Shield5.0Offers plans in 48 statesCigna4.5Offers plans in 26 states and Washington, D.C.United Healthcare4.0Offers plans in all 50 statesAetna3.5Offers plans in 44 states1 more row•Feb 25, 2022

What is the most popular Medigap insurance company?

What's notable: Around one out of every three Medigap beneficiaries are enrolled in a plan from UnitedHealthcare and AARP. UnitedHealthcare is one of the top two largest insurance companies in the world....Top 10 Best Medicare Supplement Insurance Companies.AARP/UnitedHealthcare ProsAARP/UnitedHealthcare ConsGenerous plan selectionMust be an AARP member to enroll1 more row

Are AARP Medicare Supplement plans community rated?

Community rating: Unlike most Medigap insurers, who set premiums based on your current age (attained-age rating) or your age when you first buy the policy (issue-age), AARP/UnitedHealthcare uses community rating everywhere it's sold.Nov 3, 2009

What is the average cost of a Medicare Supplement plan?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

Is Medicare G the best plan?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What is the difference between Plan G and Plan N?

When you compare Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

How do I choose a Medigap company?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.Feb 9, 2022

How much does AARP Medicare Supplement Plan G cost?

In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it's $209 for those aged 85.Jan 24, 2022

Can I switch from Plan N to Plan G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

Why does AARP recommend UnitedHealthcare?

From our long-standing relationship with AARP to our strength, stability, and decades of service, UnitedHealthcare helps make it easier for Medicare beneficiaries to live a happier, healthier life.

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

What is Medico insurance?

Medico Insurance Company. Medico sells Medicare Supplement Insurance in 25 states and offers several popular Medigap plans, such as Plan A, Plan F, Plan G and Plan N. Medico offers a number of plan discounts for things like automatic premium withdrawal, being a non-smoker or living with another person over the age of 18.

What is a BCBS?

Blue Cross Blue Shield (BCBS) is among the leading health insurance carriers in the U.S., and BCBS companies were the very first to work in conjunction with Medicare. There are now 36 different locally operated BCBS companies administering coverage in all 50 states.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Does Aetna offer Medigap?

Aetna offers a diverse portfolio of insurance products that includes Medigap plans. Over 1 million people trust Aetna for their Medicare Supplement Insurance. 3. Aetna offers several different types of Medigap plans. Plan availability may vary based on your location.

Does Mutual of Omaha offer Medicare Supplement?

Mutual of O maha Medicare Supplement Insurance plans come with an Additional Benefit Rider that may include services such as discounts on fitness programs, hearing care and vision care. Mutual of Omaha offers several types of Medigap plans. Depending on where you live, you may be able to apply for Mutual of Omaha Medicare Supplement Insurance ...

Is Wellcare a Fortune company?

In 2020, WellCare was named one of Fortune Magazine’s “Most Admired Companies,” and the company boasts a number of community-based programs designed to help members navigate their local social support network and connect to community resources. 4

Which states have Medicare Supplement Plans?

All Medicare Supplement plans are available to persons eligible for Medicare because of disability in the following states: Colorado, Florida, Georgia, Idaho, Illinois, Kansas, Kentucky, Louisiana, Minnesota, Missouri, Mississippi, Pennsylvania, South Dakota, Tennessee, and Wisconsin.

How old do you have to be to get a Medicare Supplement?

You must also be a citizen of the United States (for at least the past five consecutive years) and be 65 years of age or older.

What is Mutual of Omaha?

Mutual of Omaha’s United World Life, founded in 1983, is quickly becoming a leader in the Medigap insurance industry. The company offers a wide range of products, including many Medicare supplement plans.

How long does it take for Medicare to process a claim?

In fact, the company claims that it pays 98% of all Medicare claims within 12 hours. According to Insurance.com, it takes the average insurance company 30 days to process claims. 5 As far as its financial strength, the company has an A+ rating with AM Best. 6.

What is Cigna insurance?

Cigna began in 1792 as the Insurance Company of North America and was the first-ever Marine insurer in the U.S. Today, Cigna, an 'A' (Excellent) rated company by AM Best, offers Medicare Supplement plans, as well as life, accident, and health insurance 9 .

Why is Mutual of Omaha important?

Why We Chose It: Mutual of Omaha provides affordable coverage, a robust library of information, and quick claims processing. Mutual of Omaha is the parent company for United World Life, which is well known for its fast and efficient claims processing and great customer service.

How much does Medicare pay in 2021?

On average, Medicare only pays approximately 80% of your overall medical costs.

What does Medicare Part B cover?

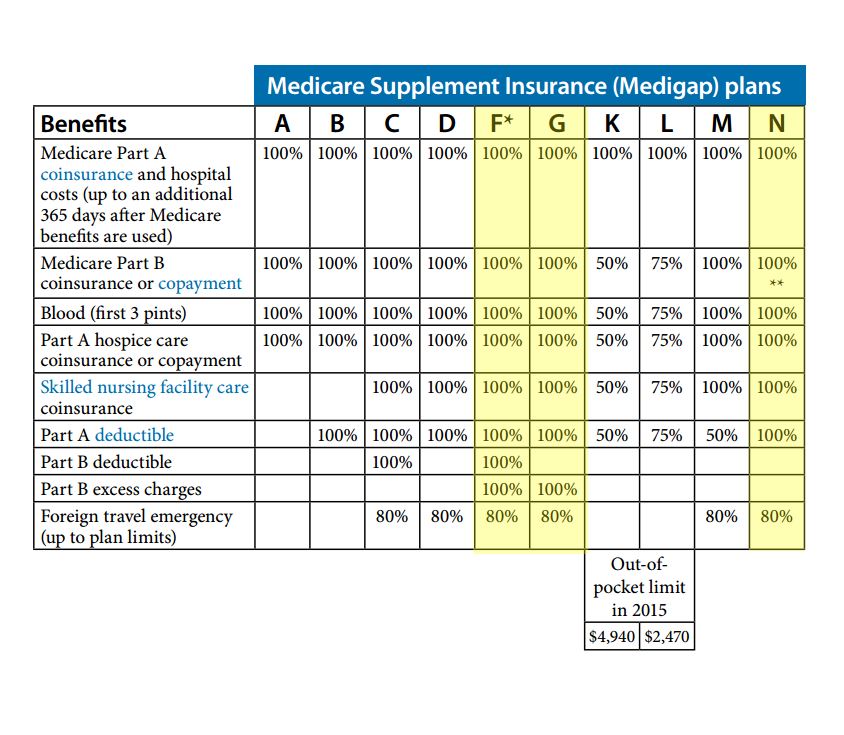

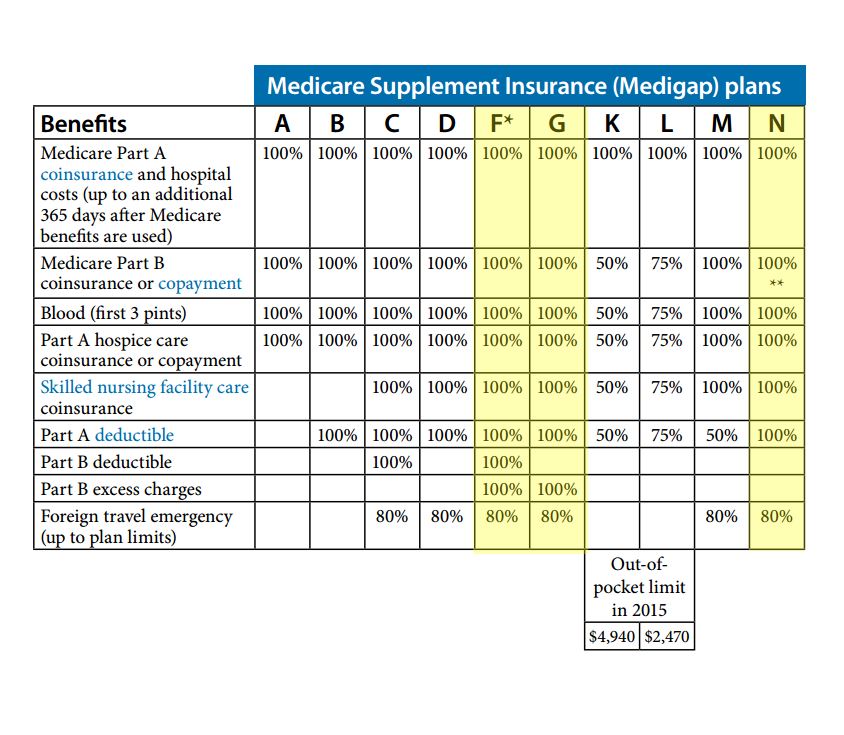

Both plans also cover Medicare Part B coinsurances and copays, the first three pints of blood, Part A hospice care coinsurances or copays, skilled nursing facility care coinsurances, and the Part A deductible, but not at 100% like other plans. Plan K covers these benefits at 50% and Plan L covers them at 75%.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

Does Medicare pay for prescription drugs?

Medicare Part D helps you pay for prescription drugs. Depending on your plan, you may have to shop at preferred pharmacies to get the best price. You may also have to pay an out-of-pocket deductible before the insurance begins paying. Part D drug plans carry a premium which you must pay in addition to the Plan B premium.

What is Plan F?

Plan F. Plan F is the most extensive Medicare Supplement Insurance plan available. It covers everything the other plans cover, in addition to 100% of Medicare Part B excess charges. Plan F also covers 80% of medical emergency expenses when you travel outside of the country.

What factors affect Medicare premiums?

In the case of Medicare Supplement plans, many factors affect what you’ll pay each month. Demographic information – such as age , location, and tobacco use – affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board. Each of the top 10 Medicare Supplement carriers on the list above is ...

What is United American insurance?

United American: A Medigap Carrier with High Ratings. United American Insurance Company was founded in 1947. The company maintains an A+ rating from AM Best and has done so for over 40 years. S&P’s rating for United American is AA-.

When was Aetna founded?

One of the most established insurance companies, Aetna was founded in 1853. Over 39 million customers rely on Aetna for health care, including Medicare. Aetna has excellent ratings all around; an A from AM Best and an A+ from S&P underscore the reasons for this company’s longevity.

What is INA insurance?

The Insurance Company of North America (INA) began in 1792 as the first Marine insurer of the United States. INA would eventually become the company we know today as Cigna, one of the most renowned health insurance carriers offering Medicare Supplement policies. Both AM Best and S&P rate Cigna at an A.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is Medicare Supplement Insurance?

Medicare supplement insurance is also known as “Medigap” because it covers gaps in Original Medicare coverage. This supplemental insurance, offered by private companies, covers costs including deductibles, copayments and coinsurance. You pay a monthly premium for this added coverage.

What is Medicare Select?

Medicare SELECT is a type of Medigap policy that requires policyholders to use hospitals and doctors within its network to get coverage. The premiums are typically lower than those offered by other Medigap providers, which don’t enforce network restrictions. Medicare SELECT can provide the same Plan A through N coverage as other Medigap policies, just with added network and geographical restrictions.

How long does it take to enroll in Medigap?

Medigap open enrollment starts on the first day of the month you are 65 or older and enrolled in Medicare Part B and lasts six months. Because you can enroll in Medicare Part B starting three months before you turn 65, you may have enrolled in Part B but may not yet be able to purchase a Medigap plan.

What is Plan K for Medicare?

Plan K covers additional days in the hospital after Medicare benefits are exceeded and 50% of the following (up to a yearly out-of-pocket limit): Part B coinsurance, up to three pints of blood, hospice care coinsurance or copayments, coinsurance for skilled nursing facilities and the deductible for Part A.

Is Plan C still available for new Medicare recipients?

As of Jan. 1, 2020, Plan C is no longer available for new Medicare recipients.

What is Plan M?

Plan M covers additional days in the hospital after Medicare benefits are exceeded, Part B copayments and coinsurance, hospice care coinsurance and copayments, skilled nursing facility care coinsurance and up to three pints of blood. It also covers 50% of the Part A deductible and 80% of charges for care abroad.

Does Medicare cover Plan F?

Plan F covers everything covered by Plan C and also covers any excess charge by a doctor or hospital that Medicare does not cover. Due to the changes regarding the Part B deductible, newly eligible consumers can no longer enroll in Plan F.

What is a Plan G?

That means a Plan G is a Plan G, regardless of which company you buy it from.

Who is Luke Hockaday?

Luke Hockaday is a Customer Success Rep here at Medicare Allies. Luke has been helping Medicare-eligible clients with their insurance and retirement-planning needs since 2011. Luke is passionate about 3 things, and 3 things only: senior insurance, football, and food!

What is Medicare Supplement Insurance?

Medicare Supplement Insurance is one way seniors can plan ahead for these unexpected costs. Customers pay a monthly premium for insurance that lowers or totally covers the out of pocket costs for expenses. These expenses can include deductibles, copays, hospital stays, and doctor’s appointments.

How many states does State Farm offer?

State Farm currently offers plans A, C, D, F, G, and N. Coverage is offered in 46 states, but not all plans will be available in all states. The company makes it easy to see which plans are available in every location with a simple online tool. Seniors who are interested in purchasing a plan through State Farm only need to fill out a simple form with some basic information to see which options are available to them. The website itself is easy to navigate, and State Farm does a great job of clarifying commonly asked questions throughout the process.

How long has Aetna been in business?

It offers a diverse selection of health insurance plans and is particularly experienced in Medicare Solutions. Aetna has been working with the Medicare system for over 50 years and has been offering Medicare Supplement Insurance for over a decade.

Where is Cigna located?

Based in Bloomfield, Connecticut, Cigna currently serves over 95 million customers around the world. The company is an industry leader with a wealth of experience in the Medicare sector. Cigna offers competitive rates without sacrificing the quality of coverage.

What is Plan K?

Plan K is a low coverage with less expensive premiums. It fully covers Part A coinsurance & hospital costs up to an additional 365 days after Medicare benefits stop, as well as 50% of the following costs:

Is Medicare Supplement a federal program?

While Medicare is a federal program, it’s important to realize that Medicare Supplement policies are provided to consumers by private insurance companies and not the government. However, both the federal and state governments regulate the plans that are offered.

Does Medicare Supplement cover vision?

But they include additional benefits such as dental coverage and vision coverage. Prescription Medications. Medicare Supplement plans do not cover prescription medication. However, customers who want this coverage can add on Medicare Part D, which is offered by many companies that provide Medicare Supplement plans.

What is Humana insurance?

Humana. Humana is a rock-solid supplemental insurance provider that offers plans throughout the country. Humana offers supplementary policies for nine out of 10 Medicare plans and some of Humana’s plans also offer international coverage as well.

Does Walgreens have a copay?

The AARP MedicareRx Walgreens plan covers an array of generic and brand-name drugs. You won’t have copayments on prescription drugs and no deductible on both Tier 1 and 2 drugs. You may also be eligible for $15 cost savings or more on select prescriptions. An AARP membership isn’t required to qualify for coverage.

Does Cigna have a supplement plan?

Cigna’s supplement policies don’t sacrifice quality for low prices; the company offers policies that complement Medicare Parts A, B, and D (prescription drug coverage), as well as a few other less common Medicare benefit plans. Some of Cigna’s higher plans also include international coverage for emergencies.

Does Cigna have international coverage?

Some of Cigna’s higher plans also include international coverage for emergencies. In most cases, you’re free to keep your own primary care physician so long as they accept Medicare coverage without worrying about whether their practice is considered in Cigna’s network.

Does Blue Cross Blue Shield cover Medicare Supplemental?

If you live in a state that places restrictions on Medicare supplemental policies and you’re having a difficult time finding a plan offered in your state, Blue Cross Blue Shield will more than likely have a coverage option that suits your needs.

Is Medicare confusing?

Medicare can be confusing — and understanding exactly what type of supplemental coverage you need can be even more frustrating and time-consuming. However, like most other types of insurance, the best way to make sure that you’re getting the best rate possible is to request as many quotes as you can.

Does Cigna offer Medicare?

Cigna offers competitive premiums and policies are currently offered in 38 states (though some states limit supplement benefits available if you qualify for Medicare because of a disability). You can even get a discount through Cigna’s Household Premium Discount plan if you and your spouse both sign on with a policy.