The District of Columbia and the Commonwealth of Virginia only prohibit balance billing of in-network HMO patients but allow balance billing for patients with out-of-network health plans and PPO plans. When these disputes occur, a lot of patients end up taking their frustrations on their health insurance company.

Which states have laws that protect patients from surprise balance billing?

New York has protected patients from surprise balance billing since 2015. California enacted AB72 in 2016; it applies to plans issued or renewed on or after July 1, 2017, and prevents patients from having to pay out-of-network charges for care received at in-network facilities. Florida enacted HB221 in 2016.

Does your state regulate balance billing?

States also may regulate balance billing in certain other situations, such as where networks are deemed inadequate. In addition to the limitations noted in this issue brief, such as setting, type of health plan, and balance billing approach, there may be other limits on protections.

What is balance billing and how does it affect Medicare?

Balance billing occurs when the doctor sends the patient a bill for more than the normal deductible and coinsurance out-of-pocket costs, and is essentially trying to recoup the portion of the bill written off by Medicare. If your doctor is a participating provider with Original Medicare, balance billing is forbidden.

Is there a federal solution to the problem of balance billing?

A federal solution would go farthest, since most individuals with private insurance are in employer-sponsored self-insured plans, which are regulated primarily under federal law. Indeed, as it considers legislation to amend or replace the Affordable Care Act, Congress could take steps to better protect consumers from balance billing.

Can Medicare patients be balanced billed?

Balance billing is prohibited for Medicare-covered services in the Medicare Advantage program, except in the case of private fee-for-service plans. In traditional Medicare, the maximum that non-participating providers may charge for a Medicare-covered service is 115 percent of the discounted fee-schedule amount.

Is balance billing is allowed the provider?

When a provider bills you for the difference between the provider's charge and the allowed amount. For example, if the provider's charge is $100 and the allowed amount is $70, the provider may bill you for the remaining $30. A preferred provider may not balance bill you for covered services.

Is balance billing illegal in Texas?

Texas and federal laws protect Texas consumers with state-regulated health plans from surprise bills. Federal law bans balance bills for air ambulance services received on or after January 1, 2022. State law bans balance bills for the following received on or after January 1, 2020: Emergency care.

Is balance billing legal in Florida?

You are protected from balance billing for: Florida law also provides some protection for balance billing. If your insurance* provider is from Florida, then you can't be balance billed for emergency services. You are only responsible for paying your copay, deductible and coinsurance.

How do you fight balance billing?

Steps to Fight Against Balance BillingReview the Bill. Billing departments in hospitals and doctor offices handle countless insurance claims on a daily basis. ... Ask for an Itemized Billing Statement. ... Document Everything. ... Communicate with Care Providers. ... File an Appeal with Insurance Company.

Can a par provider can bill the patient for the difference between their fee and insurance companies allowed amount?

Importantly, as a PAR provider, you cannot bill patients for any amount over the set Medicare allowable fee.

How do I fight balance billing in Texas?

If you feel that the out-of-network provider is billing you more than you agreed at the time you signed the Balance Billing Waiver, contact the Texas Department of Insurance at 1-800-252-3439.

What is the No surprise Billing Act 2022?

The No Surprises Act prohibits providers from billing patients more than the applicable in-network cost sharing amount in these situations. Starting in 2022, providers will need to find out patient's insurance status before submitting the surprise out-of-network bill directly to the health plan.

How can I get my medical bills forgiven?

How does medical bill debt forgiveness work? If you owe money to a hospital or healthcare provider, you may qualify for medical bill debt forgiveness. Eligibility is typically based on income, family size, and other factors. Ask about debt forgiveness even if you think your income is too high to qualify.

Can a hospital sue you for unpaid medical bills in Florida?

The statute of limitations for medical debt in Florida is five years. This time period starts when the patient signs a form before treatment that states they will pay their bill. A hospital, or medical provider may sue to collect monies owed from medical bills.

How often do hospitals sue for unpaid bills?

The study, published Dec. 6 in the journal Health Affairs, found that lawsuits over unpaid bills for hospital care increased by 37% in Wisconsin from 2001 to 2018, rising from 1.12 cases per 1,000 state residents to 1.53 per 1,000 residents. During the same period, wage garnishments from the lawsuits increased 27%.

Is Surprise billing the same as balance billing?

Surprise medical billing, also known as balance billing, happens when someone seeks care at an in-network facility or provider but receives services that are out-of-network. Many times, patients receive such care without prior knowledge or authorization.

Which state has a law that prevents out-of-network health providers from sending balance bills to patients?

6. New Hampshire. In July 2018, the state of New Hampshire enacted a law that prevents out-of-network health providers that perform services in in-network hospitals or ambulatory surgical centers from sending balance bills to patients.

Which state has the first balance billing law?

New York was the first state to enact a balance billing law that protects patients from the financial responsibility of surprise bills. The law went into effect on March 31, 2015, after a review of more than 2,000 complaints regarding surprise bills in which 90 percent were not for emergency services but rather for other in-hospital services.

What is the law in Florida regarding billing disputes?

Florida law outlines a process in which healthcare providers and insurance companies are able to work out billing disputes without putting an additional financial strain on patients. If a patient in Florida is seen by an out-of-network provider at an in-network hospital, the law states that the patient is only responsible for paying the provider the in-network fee.

What is balance billing?

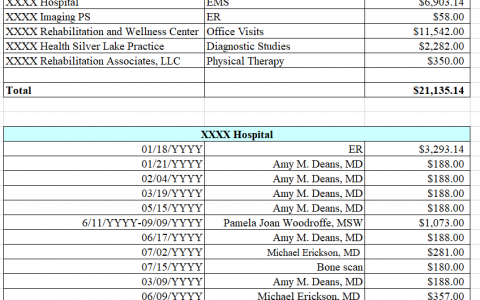

Balance billing, also refer red to as surprise billing, is the difference between a healthcare provider’s charge and the amount allowed by the insurance company based on your policy. The practice of balance billing is a common occurrence with visiting providers who are out-of-network and therefore not subject to the terms ...

How much is the bill for a doctor's visit in 2020?

May 13, 2020 by Brandon Downs. After visiting your doctor for treatment, you receive a bill in the mail. The statement says that your provider charged $100 but the allowed amount is only $60. Your provider is now trying to bill you for the remaining $40 not covered by your insurance. Are you required to pay the balance?

What states have a surprise bill?

1. California. In July 2017, a new law took effect in California that protects consumers who use in-network hospitals or other health facilities, from being charged with surprise bills after receiving care from a provider who has not contracted with their insurer.

Do insurance companies have to offer out of network rates?

Instead, insurers will have to offer out-of-network providers the standard commercial rate for services. This amount is often close to or identical to what an in-network provider receives. 10. Other States. Other states in the U.S. are also adopting new laws to make balance billing illegal.

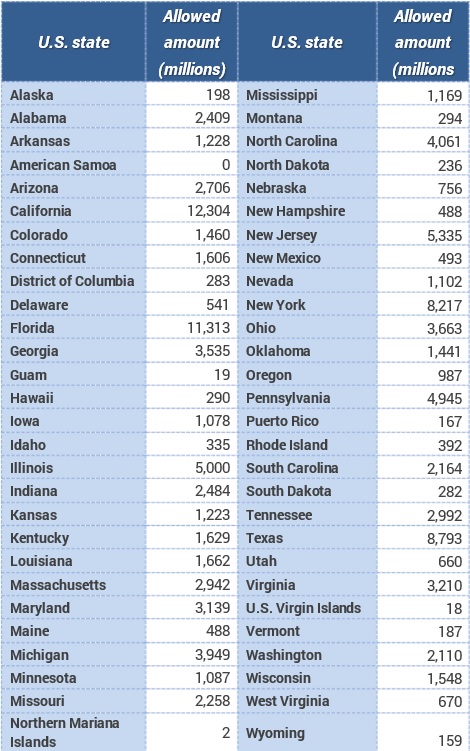

How many states have balance billing protections?

Eight states have balance-billing protections that apply only to services provided by out-of-network providers in ED settings—but not in in-network hospital settings, and one state law (Massachusetts) applies only in the in-network hospital setting. State officials acknowledge these gaps in consumer protections.

Why is balance billing unclear?

The incidence of balance billing is unclear because most data sources do not capture whether providers send their patients balance bills or seek to collect them. But many consumers are at significant risk for being balance billed because they use out-of-network providers.

What happens when an out-of-network provider charges you?

When an enrollee is treated by an out-of-network provider, the health plan will often limit its payment to an amount that it determines is fair. When this happens, an enrollee may be billed by the out-of-network provider for the difference between what their health plan paid and what the provider charges.

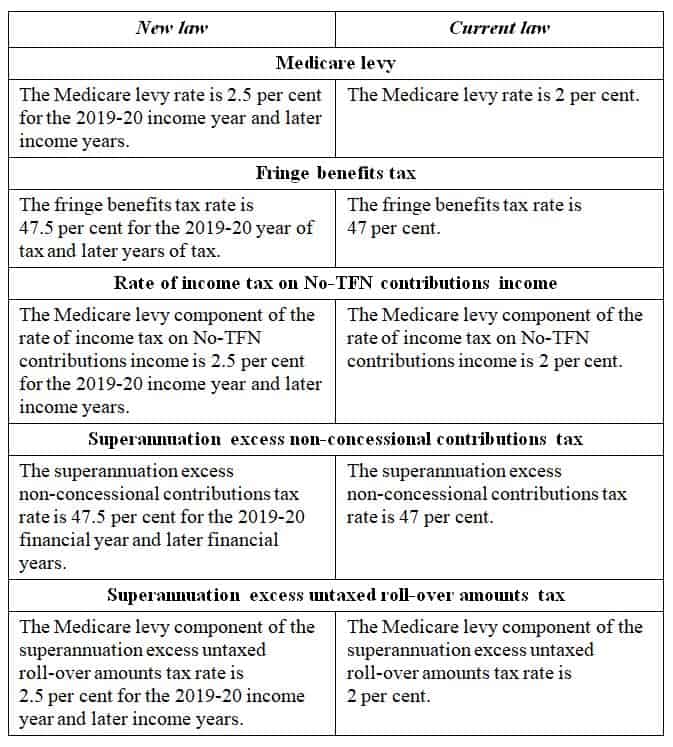

What percentage of Medicare is required by California?

For example, California requires that an insurer pay the greater of 125 percent of Medicare’s rate or the average in-network rate paid by the insurer in a region. 12 By contrast, Illinois has not adopted a standard for adequate payment.

Why do people buy private health insurance?

Consumers buy private health insurance coverage to protect themselves from the high cost of medical care. They expect that if they pay their premiums and use in-network providers, their insurer will cover the cost of medically necessary care beyond their specified copayments, coinsurance, and deductibles.

What percentage of hospital stays are likely to produce a surprise bill?

Researchers found that 14 percent of ED visits were likely to produce a surprise bill as were 9 percent of hospital stays. The risk is even greater for patients admitted to the hospital via the ED—20 percent of such patients were likely to receive a surprise bill. 3.

Which states have a comprehensive approach to protecting consumers?

9 Only six states—California, Connecticut, Florida, Illinois, Maryland, and New York— have a comprehensive approach to protecting consumers.

How common is opting out of Medicare?

Opting out is rare overall, but fairly common for some specialties. According to Becker’s Hospital Review data, only 1 percent of all doctors have opted out of Medicare, but that rises to 38 percent among psychiatrists.

How much does Medicare pay for non-participating doctors?

Medicare pays non-participating doctors 95 percent of the regular Medicare rate, and the doctor can increase that amount by up to 15 percent and charge it to the patient (in addition to the normal Medicare deductible and/or coinsurance that applies for the service). This 15 percent cap is known as the limiting charge.

What is balance billing?

Balance billing is a practice in which doctors or other health care providers bill you for charges that exceed the amount that will be reimbursed by Medicare for a particular service. Your normal deductible and coinsurance are not counted as balance billing.

What is the 15 percent cap on Medicare?

This 15 percent cap is known as the limiting charge . Providers who have opted out of Medicare altogether cannot seek reimbursement from Medicare at all. The patient is fully responsible for paying the entire bill in that case, and there’s no limit to how much the provider can bill.

Is it rare to opt out of Medicare?

It’s important for patients to understand the difference between a doctor who is non-participating versus a doctor who has opted out altogether, since the Medicare limiting charge doesn’t apply to doctors who have opted out of Medicare. Opting out is rare overall, but fairly common for some specialties.

Can a doctor be a non-participating provider?

Some doctors aren’t participating providers with Medicare, but they also haven’t opted out of Medicare altogether. These non-participating providers can balance bill you, but the total charge can’t be more than 15 percent more than Medicare will pay the doctor (some states further limit this amount).

What is balance billing?

In the United States, balance billing usually happens when you get care from a doctor or hospital that isn’t part of your health insurance company’s provider network or doesn’t accept Medicare or Medicaid rates as payment in full.

What happens if a doctor doesn't accept assignment with Medicare?

But if your doctor hasn't opted out but just doesn't accept assignment with Medicare (ie, doesn't accept the amount Medicare pays as payment in full), you could be balance billed up to 15% more than Medicare's allowable charge, in addition to your regular deductible and/or coinsurance payment.

What happens if you have a contract with a medicaid provider?

When your doctor or hospital has a contract with your health plan and is billing you more than that contract allows. In each of these cases, the agreement between the healthcare provider and Medicare, Medicaid, or your insurance company includes a clause ...

Is it stressful to receive a balance bill?

Receiving a balance bill is a stressful experience, especially if you weren't expecting it. You've already paid your deductible and coinsurance and then you receive a substantial additional bill—what do you do next?

Can a lab balance bill you?

It can also happen for services received from a provider chosen by someone else, such as when you have a pap smear or a biopsy done in your doctor’s office, or blood drawn by your home health nurse. If your doctor or nurse sends the specimen to an out-of-network lab, that lab can balance bill you.

Can an out of network provider accept my insurance?

But the out-of-network provider is not obligated to accept your insurer's payment as payment in full. They can send you a bill for the remainder of the charges, even if it's more than your plan's out-of-network copay or deductible.

Is a health insurance plan self funded?

If your health plan is self-funded, meaning your employer is the entity actually paying the medical bills even though an insurance company may administer the plan, then your health plan won't fall under the jurisdiction of your state’s department of insurance.