The Centers for Medicare & Medicaid Services (CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the Department Of Health And Human Services (Hhs)

How is Medicare funded by the government?

Medicare is funded by a combination of a specific payroll tax, beneficiary premiums, and surtaxes from beneficiaries, co-pays and deductibles, and general U.S. Treasury revenue. Medicare is divided into four Parts: A, B, C and D.

What agency runs the Medicare program?

The Centers for Medicare & Medicaid Services (CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the Department Of Health And Human Services (Hhs)

How is Social Security funded?

Skip to content. Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $128,400 (in 2018), while the self-employed pay 12.4 percent.

How many Americans pay for their Medicare?

“Americans have paid for their Medicare, and it has been a lifeline and continues to be for over 63 million people today,” Health and Human Services Secretary Xavier Becerra said.

What federal department is Social Security under?

the Department of Health and Human Services-As a component of the Department of Health and Human Services, SSA had received legal services from the Office of General Counsel of HHS through a component headed by a Chief Counsel for Social Security.

Where does the government get the money to fund Social Security and Medicare?

In 2020, $1.001 trillion (89.6 percent) of total Old-Age and Survivors Insurance and Disability Insurance income came from payroll taxes. The remainder was provided by interest earnings $76 billion (6.8 percent) and revenue from taxation of OASDI benefits $41 billion (3.6 percent).

Who is responsible for Social Security and Medicare?

State and local government employees who are covered by Social Security and Medicare pay into these programs and have the same rights as workers in the private sector. Each state has a designated official, called the State Social Security Administrator, who is responsible for the state's Section 218 agreement.

Is Social Security under the Treasury Department?

The Social Security trust funds are financial accounts in the U.S. Treasury. There are two separate Social Security trust funds, the Old-Age and Survivors Insurance (OASI) Trust Fund pays retirement and survivors benefits, and the Disability Insurance (DI) Trust Fund pays disability benefits.

Who administers funds for Medicare?

The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, and the Children's Health Insurance Program (CHIP).

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

Who is the trustee of Social Security?

Social Security/Medicare Trustees The Secretary of Treasury, designated as Managing Trustee and Chair.

Who owns the social security number?

the Social Security AdministrationThe number is issued to an individual by the Social Security Administration, an independent agency of the United States government.

Who are the trustees of the Social Security trust fund?

Who Are the Trustees? There are six Trustees, four of whom serve by virtue of their positions in the Federal Government: the Secretary of the Treasury, the Secretary of Labor, the Secretary of Health and Human Services, and the Commissioner of Social Security.

Where does the money for the Social Security fund come from?

Social Security benefits are paid from the reserves of the Old-Age, Survivors, and Disability Insurance ( OASDI ) trust fund. The reserves are funded from dedicated tax revenues and interest on accumulated reserve holdings, which are invested in Treasury securities.

When did Social Security get moved to the general fund?

In 1993, legislation was enacted which had the effect of increasing the tax put in place under the 1983 law. It raised from 50% to 85% the portion of Social Security benefits subject to taxation; but the increased percentage only applied to "higher income" beneficiaries.

Overview

Administration

The Centers for Medicare and Medicaid Services (CMS), a component of the U.S. Department of Health and Human Services (HHS), administers Medicare, Medicaid, the Children's Health Insurance Program (CHIP), the Clinical Laboratory Improvement Amendments (CLIA), and parts of the Affordable Care Act (ACA) ("Obamacare"). Along with the Departments of Labor and Treasury, the CMS also implements the insurance reform provisions of the Health Insurance Portability an…

History

Originally, the name "Medicare" in the United States referred to a program providing medical care for families of people serving in the military as part of the Dependents' Medical Care Act, which was passed in 1956. President Dwight D. Eisenhower held the first White House Conference on Aging in January 1961, in which creating a health care program for social security beneficiaries was p…

Financing

Medicare has several sources of financing.

Part A's inpatient admitted hospital and skilled nursing coverage is largely funded by revenue from a 2.9% payroll tax levied on employers and workers (each pay 1.45%). Until December 31, 1993, the law provided a maximum amount of compensation on which the Medicare tax could be imposed annually, in the same way that the Social Security payroll tax operates. Beginning on January 1, …

Eligibility

In general, all persons 65 years of age or older who have been legal residents of the United States for at least five years are eligible for Medicare. People with disabilities under 65 may also be eligible if they receive Social Security Disability Insurance (SSDI) benefits. Specific medical conditions may also help people become eligible to enroll in Medicare.

People qualify for Medicare coverage, and Medicare Part A premiums are entirely waived, if the f…

Benefits and parts

Medicare has four parts: loosely speaking Part A is Hospital Insurance. Part B is Medical Services Insurance. Medicare Part D covers many prescription drugs, though some are covered by Part B. In general, the distinction is based on whether or not the drugs are self-administered but even this distinction is not total. Public Part C Medicare health plans, the most popular of which are bran…

Out-of-pocket costs

No part of Medicare pays for all of a beneficiary's covered medical costs and many costs and services are not covered at all. The program contains premiums, deductibles and coinsurance, which the covered individual must pay out-of-pocket. A study published by the Kaiser Family Foundation in 2008 found the Fee-for-Service Medicare benefit package was less generous than either the typical large employer preferred provider organization plan or the Federal Employees He…

Payment for services

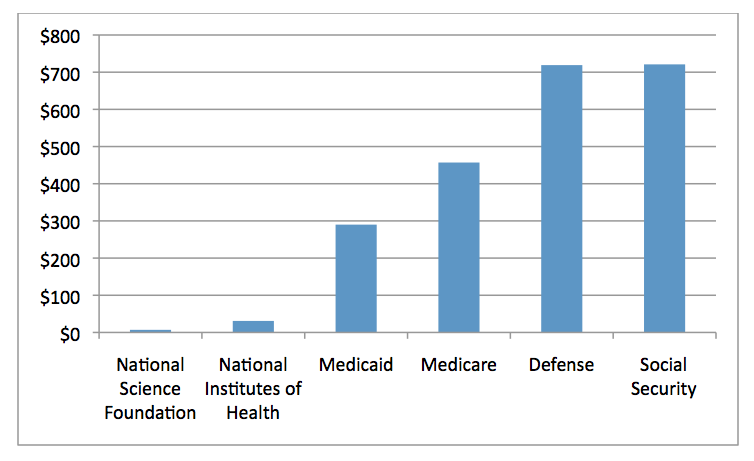

Medicare contracts with regional insurance companies to process over one billion fee-for-service claims per year. In 2008, Medicare accounted for 13% ($386 billion) of the federal budget. In 2016 it is projected to account for close to 15% ($683 billion) of the total expenditures. For the decade 2010–2019 Medicare is projected to cost 6.4 trillion dollars.

For institutional care, such as hospital and nursing home care, Medicare uses prospective payme…