Ten advantages of Medicare Supplement plans

- Large medical bill protection Let’s say you regularly need to purchase Medicare-covered, but costly, medical supplies.

- Coverage outside of the United States If you’re on vacation outside the U.S. and an accident or sudden illness happens...

- Guaranteed acceptance Depending on when you buy Medicare Supplement insurance, the...

Full Answer

What is the best and cheapest Medicare supplement insurance?

Sep 16, 2018 · Ten advantages of Medicare Supplement plans Large medical bill protection Let’s say you regularly need to purchase Medicare-covered, but costly, medical supplies. Coverage outside of the United States If you’re on vacation outside the U.S. and an accident or sudden illness happens... Guaranteed ...

What are the top 5 Medicare supplement plans?

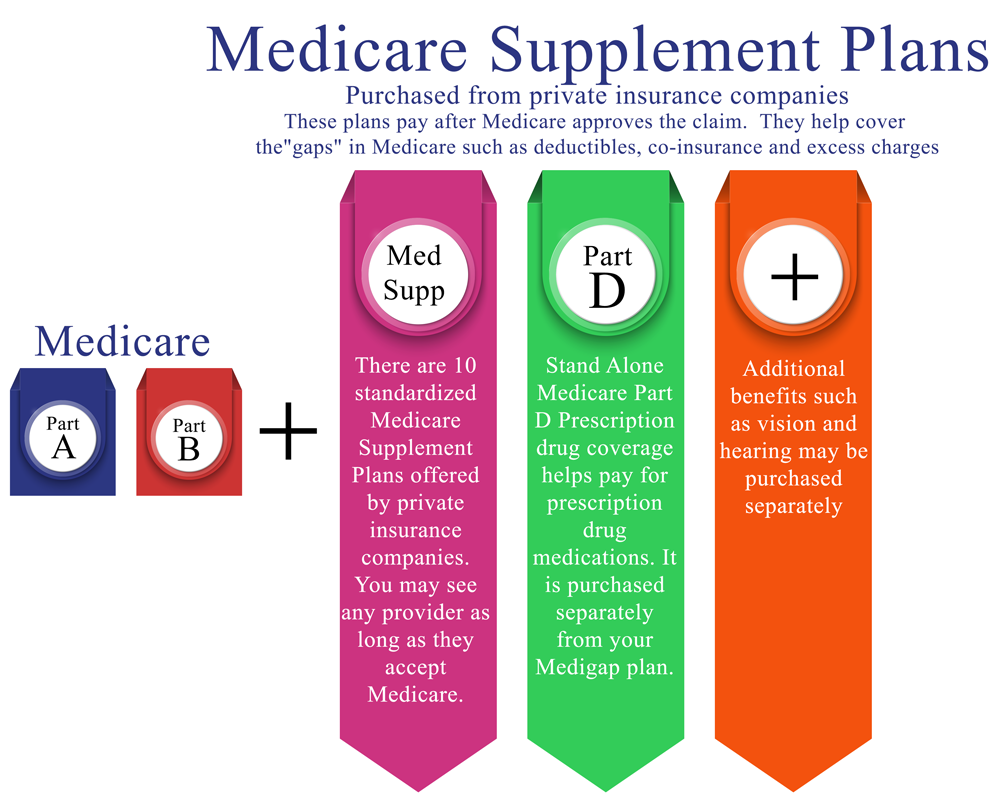

Aug 04, 2021 · Why do you need Medicare Supplement coverage? Medicare is a program that pays for about 80% of your health insurance. Getting a supplemental insurance plan pays for the other parts that your primary health insurance would not cover. There are ten standardized plans that each pertain to individual out-of-pocket costs (to some degree).

Is supplemental insurance mandatory if I qualify for Medicare?

Jan 07, 2022 · Why Do I Need Supplement Insurance with Medicare? Original Medicare Parts A & B don’t cover all medical benefits necessary for seniors, such as prescription medication... Medicare supplement insurance covers medical services that Original Medicare doesn’t cover. Medigap, Medicare Advantage, and ...

Why to get affordable Medicare supplement insurance plans?

Nov 20, 2021 · Supplemental Medicare policies help pay some of the shared costs baked into the Medicare system. Oftentimes people look at the monthly premiums for a Medicare supplement and want to know if the extra coverage is really necessary? And more importantly, are they worth the cost? Medicare Only Pays About 80%

What is the purpose of a Medicare supplement policy?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance.

Is it worth getting supplemental insurance?

In addition, supplemental insurance is a great choice for you if you believe you're at risk for needing it. If you have a family history of cancer, for example, it's worth considering cancer insurance coverage, since you likely have a higher risk of being diagnosed with cancer.Dec 7, 2021

Is Medicare supplemental required?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is the difference between Medicare and Medicare supplement?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

Who might benefit from supplemental insurance and why?

Supplemental health insurance can be an added layer of protection used to cover what a traditional health insurance plan does not. It can also help pay for nonmedical expenses that can go with illness or injury, such as lost income or childcare.

Do I need supplemental insurance if I have Medicare and Medicaid?

Do You Need Medicare Supplement Insurance if You Qualify for Medicare and Medicaid? The short answer is no. If you have dual eligibility for Medicare and full Medicaid coverage, most of your health costs are likely covered.

Do you have to renew Medicare Supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.May 16, 2018

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What are the 4 phases of Medicare Part D coverage?

If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage. Select a stage to learn more about the differences between them.Oct 1, 2021

Is it better to have a Medicare Supplement or an Advantage plan?

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.Oct 1, 2020

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

Do I need Medigap insurance?

Most retirees have a fixed budget and can't afford to pay that much out of pocket. Without a Medicare supplement, you will not be protected from ca...

Is supplemental Medicare insurance a waste of money?

Going with just Original Medicare and no supplemental coverage is financially unwise. The coverage gaps in Medicare are considerable, leaving you t...

Is Medicare Advantage or supplement better?

A Medicare Advantage plan may be a better choice if you are exceptionally healthy or if you can get an employer-sponsored plan. The reason is that...

What is the difference between Medicare Advantage and Supplemental?

With Medicare Advantage, you pay most of the costs when you use services. With a Medigap plan, you pay most costs in advance. This causes great confusion for many people and it gets them in trouble.

What is Medicare Advantage enrollment?

With Medicare Advantage, enrollment and dis-enrollment are only available during certain enrollment periods. The most common of these is the annual open enrollment. In health insurance, open enrollment is a period during which a person may enroll in or change their selection of health plan benefits.

How much does Medicare cover?

A serious illness or accident can spin up hospital and doctor bills very quickly. Medicare only covers about 80 percent of a beneficiary’s major medical costs. The other 20 percent is paid by the beneficiary, via deductibles.

Does Medicare Advantage cover the same benefits as Original Medicare?

Your health now and in the future is a serious factor in choosing the best Medicare insurance. Sure, both Original Medicare and Medicare Advantage cover the same core major medical benefits. But, did you know that Medicare Advantage plans#N#Medicare Advantage (MA), also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare (Medicare Part A and Medicare Part B)....#N#are not required to cover your Medicare Part A and Medicare Part B benefits in the same way as Original Medicare?

What age do you have to be to get medicare?

Medicare is a federal health insurance program for people ages 65 and older and people with certain disabilities.... , and most states, only require insurance companies to issue a Medigap policy, without restrictions, for a very limited time. That time is when you first turn age 65 and have a guaranteed issue right.

Is Medicare Advantage expensive?

In other words, if you are not a healthy person, Medicare Advantage can get very expensive. Private insurance companies are in business to make money, and the monthly premiums on their top insurance plans and the copayment they attach to various healthcare services reflect this.

Do you have to pay Medicare Part B premiums?

NOTE: No matter which Medicare insurance option you choose, you must continue to pay your monthly Medicare Part B premium for outpatient coverage. MA plan premiums and Medigap premiums do not replace what you owe for your Part B coverage. In other words, there’s no such thing as a free Medicare Advantage plan.

What happens if you don't have Medicare Supplement?

The gaps in Medicare are substantial, leaving you to pay for expensive deductibles and 20% of all your outpatient coverage. If you don’t have a Medicare Supplement plan, often referred to as Medigap coverage, or a Medicare Advantage Plan, you’ll have to come up with the difference yourself.

When is the annual election period for Medicare?

If you don’t enroll in a Medicare Advantage plan during your initial enrollment window, then you will have an annual chance to do so each year in the fall from October 15 th – December 7 th. This is called the Annual Election Period.

How much is Medicare Part A deductible in 2021?

Medicare Part A covers up to 60 days of hospitalization, but you pay a deductible of $1,484 in 2021.

What is Plan F?

Plan F pays 100% of all out-of-pocket expenses. If you are looking for a comprehensive plan that will pay for everything, this one is it. Here are a few of the benefits that a Medigap plan can help pay for: Medicare Part A coinsurance hospital costs after initial Medicare coverage is exhausted. Medicare Part B copayment.

How long does it take to open enrollment for Medicare?

You will be given a ONE-TIME open enrollment period to enroll in any Medigap plan with no health questions. Your open enrollment period is the first six months from the first day you signed up for Medicare Part B. During open enrollment, you can sign up for any supplemental plan and you are guaranteed coverage.

Does Medicare pay for prescription drugs?

One popular feature of Medicare Advantage plans is that most include coverage for prescription drugs (Part D). These plans pay instead of Medicare (as opposed to after Medicare, as Medigap plans do). When you join a Medicare Advantage plan, Medicare pays that plan to deliver your care.

Does Medicare Advantage have a whole state network?

That network might be just in one or two counties or occasionally we see them include a whole state. You agree to treat with those providers according to the plan’s rules.

What is Medicare Supplement Insurance?

Medicare Supplement insurance is meant to limit unpleasant surprises from healthcare costs. Your health at age 65 may be no indicator of what’s to come just a few years later. You could get sick and face medical bills that devastate years of planning and preparation. Combine this with the fixed income that so many seniors find themselves on, ...

How much does Medicare Supplement cover?

Choosing Medicare Supplement insurance can help. It can cover up to 100% of out-of-pocket costs, depending on the plan. One out of every three Original Medicare beneficiaries — over 13 million seniors — have chosen to do so. 1.

What is the deductible for Medicare Supplement 2020?

In 2020, the Part A deductible for hospitalization is $1,408 per benefit period and the Part B annual deductible is $198. 3. Medicare Supplement insurance is designed to help cover these out-of-pocket deductibles and coinsurance.

How long is the open enrollment period for Medicare?

The Medigap Open Enrollment Period covers six months. It starts the month you are 65 or older and are enrolled in Medicare Part B. In this period, no insurer offering supplemental insurance in your state can deny you coverage or raise the premium because of medical conditions.

Does Medicare Advantage cover vision?

Medicare Advantage plans cap out-of-pocket expenses. Medicare Advantage is all-encompassing, even offering dental and vision coverage (Original Medicare does not). But, you are limited to its doctor network and need referrals to see specialists.

Does private insurance cover out of pocket expenses?

Private insurance companies – vetted by the federal government – offer it to help manage out-of-pocket expenses. These policies do not add coverage. Instead, they help pay for what Medicare Part A and B does not, including copays, coinsurance, and deductibles. 2 It does not affect which doctors you can see.

Does Medicare cover out of pocket medical expenses?

Medicare coverage lasts for the rest of your life. As you age, doctor visits and hospitalizations may increase. But, it is impossible to project your future healthcare needs. Medigap policies work hand-in-hand with Original Medicare to limit your exposure to unexpected out-of-pocket medical costs.

Why Do I Need Supplemental Insurance If I Have Medicare?

If you look at the Medicare website, they list out what you could owe out of pocket for needing care. You may be responsible for some sizable deductibles, co-payments and coinsurance costs.

How Do I Choose Medicare Supplement Insurance?

Insurance companies label Medigap plans with a letter (A through N) to show what benefits are included. For example, according to Medicare.gov, Medigap Plan F will pay for health care during foreign travel but Plan A will not.

Who Is Eligible for Supplemental Insurance?

Anyone who has Medicare Part A and Part B is eligible to apply for a Medicare supplement plan. However, you need to qualify for coverage with the private insurance company. When you first turn 65 and sign up for Medicare Part B, you have a Medigap open enrollment period that lasts six months.

Are There Any Other Considerations?

To keep your Medicare supplemental insurance coverage, you need to pay premiums throughout the year. This is an additional cost during retirement. If you don't end up needing treatment, it's possible you could pay more in premiums than the value you'd get from the policy, similar to any health insurance program.

Are There Alternative Insurance Programs?

Besides Medigap, you could also cover your retirement health insurance costs through a Medicare Advantage plan. Medicare Advantage is private health insurance. Through this program, you would leave traditional Medicare and instead have the private insurer pay for your health care bills.

The Bottom Line

As you figure out how to manage your retirement health care coverage, consider speaking with a financial representative. They can help you determine the next steps for managing health care costs in retirement.

How long is a hospital stay for Medicare?

1. The average length of a hospitalization, even for Medicare patients, is about 5 days. Hospitalizations rarely exceed two weeks and 60-day hospitalizations are practically unheard of. Even hospitalizations for heart attacks or major surgeries rarely exceed a week. 2.

How much does Medicare cover for X-rays?

How well does Medicare cover you for all of the tests, office visits and treatments you might need if you're not treated in a hospital? If you have Medicare Part B, it will cover 80 percent of all approved charges for doctor's office visits, blood tests, X-Rays, CT scans, MRIs and ER visits.

Does Medicare Supplemental Insurance cover outpatient care?

Unless a supplemental policy specifically states otherwise, the most it will cover are the Medicare deductibles ($147 outpatient and $1,187 hospitalization) and the 20 percent co-insurance. Supplemental policies do not usually cover any medical services Medicare won't cover. What's more, Medicare supplemental insurance will only pay health care ...

How long do you have to sign up for Medicare Part B?

You are able to sign up for Part B anytime you have current employer health coverage. Once employment ends, you will have eight months to sign up for Medicare Part B without having to pay a penalty. If you are enrolled in Medicare and another health plan, one of your insurers is the primary payer. The other is the secondary payer.

How much does Medicare Part B cost?

The standard premium for Medicare Part B, however, is $90.90 per month. From there, premiums are tied to annual income, so Part B coverage can cost anywhere from $99 .90 to $319.70 monthly.

What is the primary payer?

While each insurer is a payer, your primary payer is the one with the responsibility to pay first for services you receive. Your primary payer is required to pay all costs to the limits of its coverage. Once the primary payer’s obligations are met, your secondary payer does likewise.

Is Medicare your primary payer?

If you work for a smaller company and are covered under both Medicare and your current employer’s group health plan, Medicare will normally be your primary payer. If you are covered under both Medicare and a former employer’s group health plan, Medicare is your primary payer.