Does Medicare cover a podiatrist?

Medicare Part B (Medical Insurance) covers podiatrist (foot doctor), foot exams or treatment if you have diabetes-related nerve damage or need Medically necessary treatment for foot injuries or diseases, like hammer toe, bunion deformities, and heel spurs. Your costs in Original Medicare

How much does a podiatrist make a year?

national average for all occupations, $51,960. If you’re someone who loves feet, then pursing a career in podiatry could be up your alley. While there is a substantial amount of education required to become one, the payoff can be quite a lot.

How much will Medicare Cost you in 2016?

In most years, Medicare cost increases are covered by the Social Security cost-of-living adjustment. But there will be no Social Security COLA for 2016 because of low inflation, which means that the monthly premiums will be capped at $104.90 for Medicare beneficiaries who have their premiums withheld from their Social Security benefits.

How much does Medicare Part a cost per month?

Enrollees age 65 and over who have fewer than 40 quarters of coverage and certain persons with disabilities pay a monthly premium in order to receive coverage under Part A. Individuals with 30-39 quarters of coverage may buy into Part A at a reduced monthly premium rate, which will be $226. 00 in 2016, a $2. 00 increase from 2015.

How much did Medicare go up in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

How much did my doctor make from Medicare?

On average, doctors get about 19% of their money treating Medicare patients through copayments, deductibles, and secondary-insurance. For a $70 evaluation visit, Medicare usually pays about $49 and the patient or their private insurer covers the rest.

What was the Medicare deductible for 2016?

The 2016 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $411. The Medicare Part A deductible for all Medicare beneficiaries is $1,288.

What were Medicare premiums in 2017?

Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

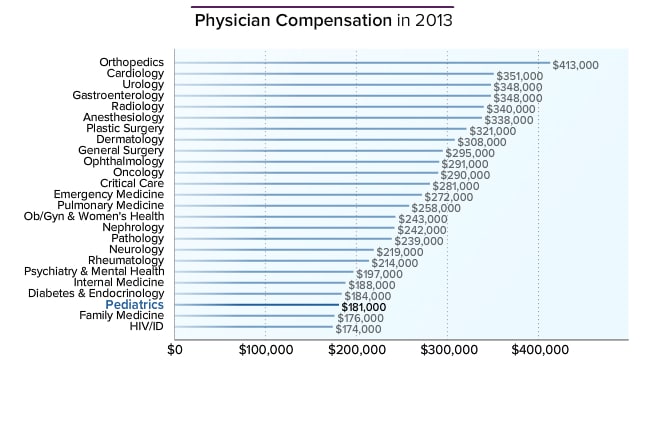

Does Medicare pay doctors less?

Fee reductions by specialty Summarizing, we do find corroborative evidence (admittedly based on physician self-reports) that both Medicare and Medicaid pay significantly less (e.g., 30-50 percent) than the physician's usual fee for office and inpatient visits as well as for surgical and diagnostic procedures.

Do doctors get paid for prescribing certain drugs?

Under this statute, it is illegal for a physician to receive remuneration for referring a patient for a service that will be paid in whole or in part by a federal health care program or for prescribing or recommending the purchase of a drug that will be paid in whole or in part by a federal health care program.

What were Medicare Part B premiums in 2016?

If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What were Medicare premiums in 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

How much will Medicare premiums increase in 2022?

$170.10 a monthMedicare premiums are rising sharply next year, cutting into the large Social Security cost-of-living increase. The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month.

What were Medicare premiums in 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

How much did Medicare go up in 2018?

Medicare Part A Premiums/Deductibles The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017.

When did Medicare start charging a premium?

1966President Johnson signs the Medicare bill into law on July 30 as part of the Social Security Amendments of 1965. 1966: When Medicare services actually begin on July 1, more than 19 million Americans age 65 and older enroll in the program. 1972: President Richard M.

How much did Medicare pay in 2016?

In 2016, you pay: $0 for the first 20 days of each benefit period. $161 per day for days 21-100 of each benefit period. All costs for each day after day 100 of the benefit period. If you don’t qualify for premium-free Medicare Part A, you can enroll in Part A for $226 per month if you’ve worked and paid Social Security taxes for 30 to 39 quarters, ...

How much of your Medicare plan is covered by generic drugs?

While in the coverage gap, you may have to pay: 45% of your plan’s cost for covered brand-name drugs. 58% of your plan’s cost for covered generic drugs. To learn more about your Medicare plan options, you can call one of eHealth’s licensed insurance agents by calling the number shown below.

What is Medicare Supplement Plan?

Costs for Medicare Supplement (Medigap) Those who need help paying for such health-care costs as deductibles, premiums, and other Original Medicare expenses may want to purchase a Medicare Supplement plan, also known as Medigap plan.

How to contact Medicare directly?

To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800 -MEDICARE (1-800-633-4227) , TTY users 1-877-486-2048; 24 hours a day, 7 days a week.

How long is a benefit period for Medicare?

Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient. The end of the benefit period occurs when you haven’t received any inpatient hospital care (or skilled care in an SNF) for 60 consecutive days. Deductible: $1,288.

How much is coinsurance for 61 days?

Coinsurance for days 61 to 90: $322 per day. Coinsurance for days 91 and beyond: $644 per day. Note that every Medicare Part A beneficiary is entitled to 60 “lifetime reserve days” as a hospital inpatient. You begin using these reserve days after you spend 90 days as a hospital inpatient within one benefit period.

Is there a penalty for late enrollment in Medicare Part A?

Note that beneficiaries who delay enrollment in Medicare Part A after they first become eligible may be subject to a late-enrollment penalty in the form of a higher premium. Medicare Part B has an annual deductible ($166 in 2016).

What does a foot doctor cover?

covers podiatrist (foot doctor), foot exams or treatment if you have diabetes-related nerve damage or need. medically necessary. Health care services or supplies needed to diagnose or treat an illness, injury, condition, disease, or its symptoms and that meet accepted standards of medicine.

What is original Medicare?

Your costs in Original Medicare. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference.

How much money did Medicare spend in 2016?

In FY 2016, the Office of the Actuary has estimated that gross current law spending on Medicare benefits will total $672.6 billion. Medicare will provide health insurance to 57 million individuals who are 65 or older, disabled, or have end-stage renal disease.

What is the Medicare budget for 2016?

The FY 2016 Budget includes a package of Medicare legislative proposals that will save a net $423.1 billion over 10 years. The proposals are scored off the President’s Budget adjusted baseline, which assumes a zero percent update to Medicare physician payments. These reforms will strengthen Medicare by more closely aligning payments with the costs of providing care, encouraging health care providers to deliver better care and better outcomes for their patients, and improving access to care for beneficiaries. The Budget includes investments to reform Medicare physician payments and accelerate physician participation in high-quality and efficient healthcare delivery systems. Finally, it makes structural changes in program financing that will reduce Federal subsidies to high income beneficiaries and create incentives for beneficiaries to seek high value services. Together, these measures will extend the Hospital Insurance Trust Fund solvency by approximately five years.

What is a Part D beneficiary?

2/ In Part D only, some beneficiary premiums are paid directly to plans and are netted out here because those payments are not paid out of the Trust Funds. 3/ Includes related benefit payments, including refundable payments made to providers and plans, transfers to Medicaid, and additional Medicare Advantage benefits.

What is the authority for a program to prevent prescription drug abuse in Medicare Part D?

Establish Authority for a Program to Prevent Prescription Drug Abuse in Medicare Part D: HHS requires Part D sponsors to conduct drug utilization review, which assesses the prescriptions filled by a particular enrollee.

How many people are in Medicare Part D in 2016?

In 2016, the number of beneficiaries enrolled in Medicare Part D is expected to increase by about 3.5 percent to 43.7 million , including about 12.6 million beneficiaries who receive the low‑income subsidy.

How much has Medicare saved?

Cumulatively since enactment of the Affordable Care Act, 9.4 million beneficiaries have saved a total of $15 billion on prescription drugs. The FY 2016 Budget includes a package of Medicare legislative proposals that will save a net $423.1 billion over 10 years.

What are the goals of CMS for FY 2016?

Clinical Quality Improvement: The key goals for FY 2016 are improving the health status of communities; delivering patient-centered, reliable, accessible, and safe care; and better care at lower costs. Through improving cardiac health, reducing disparities in diabetic care, using immunization information systems and meaningful use of health IT to improve prevention coordination, CMS aims to improve the health status ofbeneficiaries. These goals will also be achieved by efforts to reduce healthcare‑associated infections, healthcare‑associated conditions in nursing homes, and hospital readmissions and adverse drug events.