Full Answer

What is a Medicare reimbursement rate for CPT codes?

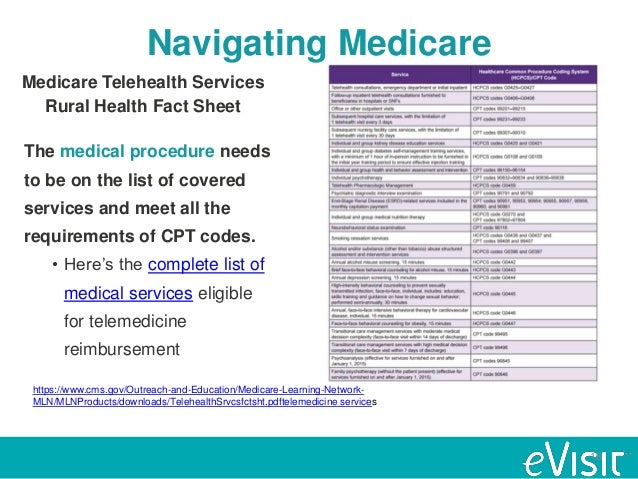

A Medicare reimbursement rate is the amount of money that Medicare pays doctors and other health care providers for the services and items they administer to Medicare beneficiaries. CPT codes are the numeric codes used to identify different medical services, procedures and items for billing purposes.

What is the CPT code for epidural catheter insertion?

When performed primarily for postoperative pain management the time utilized for a single injection (CPT codes 62310 and 62311) or the insertion of the epidural catheter (CPT codes 62318 and 62319) should not be included in the time reported for the anesthesia care for the surgical procedure.

What are the Medicare CPT coding rules for audiologists?

See also: Medicare CPT coding rules for audiologists and speech-language pathologists . All Part B services require the patient to pay a 20% co-payment. The MPFS does not deduct the co-payment amount. Therefore, the actual payment by Medicare is 20% less than shown in the fee schedule.

How much does Medicare reimbursement cover?

In fact, Medicare’s reimbursement rate is generally around only 80% of the total bill as the beneficiary is typically responsible for paying the remaining 20% as coinsurance. Medicare predetermines what it will pay health care providers for each service or item.

Does Medicare pay for epidural steroid injections?

How many epidural steroid injections will Medicare cover per year? Medicare will cover epidural steroid injections as long as they're necessary. But, most orthopedic surgeons suggest no more than three shots annually. Yet, if an injection doesn't help a problem for a sustainable period, it likely won't be effective.

How many cortisone shots will Medicare pay for?

How Many Cortisone Shots will Medicare Cover? Beneficiaries needing cortisone shots may have coverage for three cortisone shots annually. Repetitive injections may cause damage to the body over time.

How do you bill for a transforaminal epidural?

A transforaminal epidural steroid injection (TFESI) performed at the T12-L1 level should be reported with CPT code 64479. When reporting CPT codes 64479 through 64484 for a unilateral procedure, use one line with one unit of service.

What is the cost of a cervical epidural steroid injection?

On MDsave, the cost of an Epidural Steroid Injection ranges from $1,027 to $1,487. Those on high deductible health plans or without insurance can save when they buy their procedure upfront through MDsave. Read more about how MDsave works.

Is a cortisone injection covered by Medicare?

But now the $20 rebate for a cortisone injection is no longer specifically covered by Medicare. The Federal Government says the injections can be done by a GP during a routine consultation.

Does Medicare pay for injections?

Injectable and infused drugs: Medicare covers most injectable and infused drugs given by a licensed medical provider if the drug is considered reasonable and necessary for treatment and usually isn't self-administered.

Does CPT 64483 need a modifier?

Answer: If you perform a bilateral transforaminal epidural injection (64483) you can report CPT 64483 with Modifier 50 (bilateral procedure). Some payors require CPT 64483-single level (1 side) and 64483-50 (the other side) whereas some payors may require RT/LT.

What is a transforaminal epidural steroid injection?

A transforaminal lumbar epidural steroid injection (TFESI) is an injection of corticosteroids (anti-inflammatory medication) into the epidural space. When it is done from the side where the nerve exits the spine, it is called a transforaminal injection. It puts medication near the source of the inflammation.

What is the CPT code for caudal epidural steroid injection?

62311. lumbar or caudal epidural injections are for patients with pain in the legs and/or lower back/buttock(s) area. 62318.

How much does a spinal injection cost?

How much do spinal injections cost? Most insurance companies and Medicare cover spinal injections if they are recommended to diagnose or treat a condition. The average cost of spinal injections is around $600, with costs ranging from $100 to $1,000 per injection.

How much is a steroid shot?

Cortisone shots typically cost roughly $100 to 300 but can be more than $1,000. Your insurance may cover some or all of the cost. The exact cost that you pay out of pocket for a cortisone shot varies widely between clinics and depends on: the clinic you visit.

How much does a cortisone shot cost in the back?

Back pain injections can cost as much as $600 per shot. Insurance will pay much of the cost and there are often a lot of shots given.

What is the cost of a 62311?

62311 – Injection (s), of diagnostic or therapeutic substance (s) (including anesthetic, antispasmodic, opioid, steroid, other solution), not including neurolytic substances, including needle or catheter placement, includes contrast for localization when performed, epidural or subarachnoid; lumbar or sacral (caudal) Average fee amount $230 – 260.

What is 62310 in medical terms?

62310 – Injection (s), of diagnostic or therapeutic substance (s) ( including anesthetic, antispasmodic, opioid, steroid, other solution), not including neurolytic substances, including needle or catheter placement, includes contrast for localization when performed, epidural or subarachnoid; cervical or thoracic – Average fee amount $230 – 260

What is the unbundled code for 64479?

The 64479 code is Unbundled in the CCI Edits from code 62310 (Regular ESI procedure) in the Mutually Exclusive Table of the CCI Unbundling Material. Code 64483 is Unbundled from code 62311 (Regular ESI procedure) in the Mutually Exclusive Table of the CCI Unbundling Material. Therefore, for Medicare and other payors who observe the CCI edits, these codes are not billable together when they are performed at the SAME spinal area. If the physician does an ESI (62311) at level L5 and a Transforaminal ESI (64483) at area L4-5, the procedures are Unbundled and not both billable – only code 62311 would be billable in that case. However, if the physician does an ESI (62311) at level L5 and a Transforaminal ESI (64483) at area L3-4, then it is allowable to put a -59 Modifier on the 64483 code and bill it as the 2nd code following the 62311 ESI code on the claim form.

What is an epidural injection?

Epidural injections are used for the treatment of multiple different conditions in chronic and acute pain. Epidural injections may be used for therapeutic and/or diagnostic purposes. There are multiple approaches to epidural injections including caudal, translaminar, and transforaminal.

What is the modifier code for labor epidural?

** Labor epidural provided by the surgeon must be billed with the appropriate delivery anesthesia code and modifier 97. Labor epidural provided by the anesthesiologist and/or CRNA must be billed with the appropriate **0** anesthesia code

When to use 59?

Modifier -59 should be used when billing these services to indicate that the catheter or injection was a separate procedure from the surgical anesthesia care.

Is CPT code subject to CCI?

1. The HCPCS/CPT code (s) may be subject to Correct Coding initiative (CCI) edits . This policy does not take precedence over CCI edits. Please refer to the current version CCI for correct coding guidelines and specific applicable code combinations prior to billing Medicare.

What is Medicare reimbursement?

Medicare reimburses health care providers for services and devices they provide to beneficiaries. Learn more about Medicare reimbursement rates and how they may affect you. Medicare reimbursement rates refer to the amount of money that Medicare pays to doctors and other health care providers when they provide medical services to a Medicare ...

What percentage of Medicare reimbursement is for social workers?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1. Not all types of health care providers are reimbursed at the same rate. For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1.

Is it a good idea to use HCPCS codes?

Using HCPCS codes. It’s a good idea for Medicare beneficiaries to review the HCPCS codes on their bill after receiving a service or item. Medicare fraud does happen, and reviewing Medicare reimbursement rates and codes is one way to help ensure you were billed for the correct Medicare services.

This includes facility and doctor fees. You may need more than one doctor and additional costs may apply

This is the “Medicare approved amount,” which is the total the doctor or supplier is paid for this procedure. In Original Medicare, Medicare generally pays 80% of this amount and the patient pays 20%.

This includes facility and doctor fees. You may need more than one doctor and additional costs may apply

This is the “Medicare approved amount,” which is the total the doctor or supplier is paid for this procedure. In Original Medicare, Medicare generally pays 80% of this amount and the patient pays 20%.

What is the Medicare Physician Fee Schedule?

The Medicare Physician Fee Schedule (MPFS) uses a resource-based relative value system (RBRVS) that assigns a relative value to current procedural terminology (CPT) codes that are developed and copyrighted by the American Medical Association (AMA) with input from representatives of health care professional associations and societies, including ASHA. The relative weighting factor (relative value unit or RVU) is derived from a resource-based relative value scale. The components of the RBRVS for each procedure are the (a) professional component (i.e., work as expressed in the amount of time, technical skill, physical effort, stress, and judgment for the procedure required of physicians and certain other practitioners); (b) technical component (i.e., the practice expense expressed in overhead costs such as assistant's time, equipment, supplies); and (c) professional liability component.

Why is Medicare fee higher than non-facility rate?

In general, if services are rendered in one's own office, the Medicare fee is higher (i.e., the non-facility rate) because the pratitioner is paying for overhead and equipment costs. Audiologists receive lower rates when services are rendered in a facility because the facility incurs ...

What are the two categories of Medicare?

There are two categories of participation within Medicare. Participating provider (who must accept assignment) and non-participating provider (who does not accept assignment). You may agree to be a participating provider (who does not accept assignment). Both categories require that providers enroll in the Medicare program.

Can speech therapy be provided at non-facility rates?

Therapy services, such as speech-language pathology services, are allowed at non-facil ity rates in all settings (including facilities) because of a section in the Medicare statute permitting these services to receive non-facility rates regardless of the setting.

Does Medicare pay 20% co-payment?

All Part B services require the patient to pay a 20% co-payment. The MPFS does not deduct the co-payment amount. Therefore, the actual payment by Medicare is 20% less than shown in the fee schedule. You must make "reasonable" efforts to collect the 20% co-payment from the beneficiary.