Several changes have been proposed to the standard Part D benefit, including: Creating a maximum out-of-pocket cap for beneficiaries when they reach the catastrophic spending phase of the program, something that currently doesn’t exist.

When can I Change my Medicare Part D?

You can change from one Part D plan to another during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this period, you can change plans as many ...

When can you change Medicare Part D plans?

You can change from one Part D plan to another during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this period, you can change plans as many ...

What are the proposed changes to Medicare?

- The Biden administration’s “human infrastructure” proposal would expand Medicare coverage for dental, vision, and hearing aids.

- It also would attempt to lower the cost for prescription drugs.

- The proposal also explores the possibility of lowering the eligibility age to under 65.

How do I Change my Medicare Part D plan?

- Switch from Original Medicare to a five-star Medicare Advantage plan

- Switch from a Medicare Advantage plan with fewer than five stars to a five-star plan

- Switch from a Part D plan with fewer than five stars to a five-star plan

- Switch from one five-star Medicare Advantage plan to another five-star Medicare Advantage plan

What are the changes to Medicare Part D?

Part D Cost Sharing Plans are implementing a mix of cost-sharing changes for 2022, with both increases and decreases in cost-sharing amounts on various formulary tiers. Of note, however, are cost-sharing increases for non-preferred drugs in 6 of the 16 national PDPs (while decreasing in only 2 of the 16).

What are the 2022 changes to Medicare?

Part A premiums, deductible, and coinsurance are also higher for 2022. The income brackets for high-income premium adjustments for Medicare Part B and D start at $91,000 for a single person, and the high-income surcharges for Part D and Part B increased for 2022.

What is the cost of Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

Are Medicare Part D premiums going up in 2022?

Medicare Part D Premium Will Increase in 2022. The Centers for Medicare and Medicaid Services (CMS) recently announced that the projected 2022 Medicare Part D monthly premium will average at $33. This is an increase from $31.47 in 2021.

What is the Part D deductible for 2022?

$480 inWhat is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.

Will Medicare premiums increase in 2023?

HHS: Higher Medicare Premiums Stay In Place This Year, Will Drop In 2023.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

What are the 4 phases of Part D coverage 2022?

If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

Who has the cheapest Part D drug plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

What is the Part D premium for 2021?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What will Medicare cost in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Q: What are the changes to Medicare benefits for 2022?

A: There are several changes for Medicare enrollees in 2022. Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that...

How much will the Part B deductible increase for 2022?

The Part B deductible for 2022 is $233. That’s an increase from $203 in 2021, and a much more significant increase than normal.

Are Part A premiums increasing in 2022?

Roughly 1% of Medicare Part A enrollees pay premiums; the rest get it for free based on their work history or a spouse’s work history. Part A premi...

Is the Medicare Part A deductible increasing for 2022?

Part A has a deductible that applies to each benefit period (rather than a calendar year deductible like Part B or private insurance plans). The de...

How much is the Medicare Part A coinsurance for 2022?

The Part A deductible covers the enrollee’s first 60 inpatient days during a benefit period. If the person needs additional inpatient coverage duri...

Can I still buy Medigap Plans C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are n...

Are there inflation adjustments for Medicare beneficiaries in high-income brackets?

Medicare beneficiaries with high incomes pay more for Part B and Part D. But what exactly does “high income” mean? The high-income brackets were in...

How are Medicare Advantage premiums changing for 2021?

According to CMS, the average Medicare Advantage (Medicare Part C) premiums for 2022 is about $19/month (in addition to the cost of Part B), which...

Is the Medicare Advantage out-of-pocket maximum changing for 2022?

Medicare Advantage plans are required to cap enrollees’ out-of-pocket costs for Part A and Part B services (unlike Original Medicare, which does no...

How is Medicare Part D prescription drug coverage changing for 2022?

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans is $480 in 2022, up from $445 in 2021. A...

Each "Part" of Medicare changes at least a little every year - including Part D prescription drug coverage

Since it was first introduced in 2006, Medicare Part D has gone through numerous changes. One that may be surprising, given the general rise in healthcare costs, is the government's attempts to lower prescription drug costs. For example, closing the donut hole was a provision of the Affordable Care Act (ACA, also known as Obamacare ).

How does pricing work under Medicare Part D?

Most people don't know about the four phases of Medicare Part D. And you have to in order to understand the donut hole and pretty much all of your out-of-pocket costs for your prescription drug plan.

Medicare Part D changes in 2022

Now that the donut hole closed, the big news for Part D is the rising costs of prescription drug plans (PDPs) coupled with the fact that most people will have fewer plans to choose from, thanks to the consolidation of PDPs offered by Cigna and Centene.

Medicare Part D proposals

The year 2021 saw a big push to let Medicare negotiate drug prices, with President Biden including this ability in the Build Back Better (BBB) framework. Democrats are confident this legislation will pass in 2022, which should result in huge savings at the pharmacy for everyone - not just those enrolled in Medicare.

Do You Need Help Finding a Medicare Part D Plan?

Comparing your Medicare Part D options can be confusing. Our Find a Plan tool makes it easy. Just enter your zip code, estimated start date, and hit Continue. To make it even simpler to compare options, enter any prescriptions you currently take and your preferred pharmacy.

When will Medicare Part D change to Advantage?

Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that beneficiaries can change during the annual fall enrollment period that runs from October 15 to December 7.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

How long is a skilled nursing deductible?

See more Medicare Survey results. For care received in skilled nursing facilities, the first 20 days are covered with the Part A deductible that was paid for the inpatient hospital stay that preceded the stay in the skilled nursing facility.

The Four Phases of Medicare Part D

Before we look at the changes planned for 2020, you need to understand the four phases of Medicare Part D.

Medicare Part D Changes Under Current Law

The big news for 2020 is that the donut hole has closed, but what does that really mean? After all, you’re still paying 25 percent of costs.

If the Donut Hole Is Closed, Why Is There Still a Coverage Gap?

The coverage gap phase used to refer mainly to the fact that beneficiaries shouldered 100 percent of their prescription costs. However, ACA also included provisions for calculating costs that qualify you for the catastrophic coverage phase.

How Do You Enter the Donut Hole?

Medicare counts 100 percent of your prescription drug costs toward entering the coverage gap. That means that, if your prescription costs $100, even though your co-pay is only $25, the entire $100 counts toward the $4,020 cap that moves you from the initial coverage phase to the coverage gap.

How Are Costs Shared in the Coverage Gap in 2020?

For generic prescriptions, it’s much simpler: 25 percent to you, 25 percent to your plan.

Proposed Changes that Would Impact Medicare Part D

There are currently three proposals in the White House that would impact Medicare Part D.

Understanding Medicare Part D Changes in 2020

Medicare can be confusing even when nothing has changed. The licensed agents at Medicare Solutions are here to help. Just call us toll-free at 855-350-8101 to get started. The best part? It won’t cost you a cent! You can also start comparing plan options in your area with our easy-to-use online tool.

What is the Medicare Part D coverage gap?

If the total cost of your prescriptions reaches a certain amount— set each year by the federal government — you pay more for your prescriptions. This is the Medicare Part D coverage gap, also known as the out-of-pocket threshold or “donut hole.”. In 2020, once you and your plan have spent $4,020 on your prescription ...

How much is the Medicare deductible for 2020?

Medicare Part D deductible caps at $435 in 2020. Stand-alone Medicare Part D Prescription Drug Plans may charge an annual deductible. The federal government sets a limit on the Medicare Part D deductible each year. For 2020, a Medicare Part D plan cannot set a deductible higher than $435, which is $20 over the maximum Medicare Part D deductible in ...

Does Medicare Part D cover outpatient prescriptions?

Medicare Part D helps cover outpatient prescription drugs. Each plan has its own formulary, or list of drugs the plan covers, so not every plan will necessarily cover the same medications. A plan’s formulary may change at any time. You will receive notice from your plan when necessary.

Does Medicare have a monthly premium?

Medicare prescription drug plans set their own monthly premium amounts. Premiums may vary depending on where you live, what plan you select, and whether you qualify for help paying your Part D premium.

Does Medicare cover insulin?

Medicare Part D also may cover some self-injected medicines, such as insulin for diabetes . But if you go to a doctor’s office or other outpatient facility to receive, for example, chemotherapy, dialysis or other medicines that are injected or given intravenously, Medicare Part B — not Part D —may help pay for those treatments.

Medicare Part D Plan Options

To change Medicare Part D plans, there are specific windows of time, known as enrollment periods, that allow you to change your current Medicare coverage. To make changes outside these enrollment windows, medical underwriting may be required.

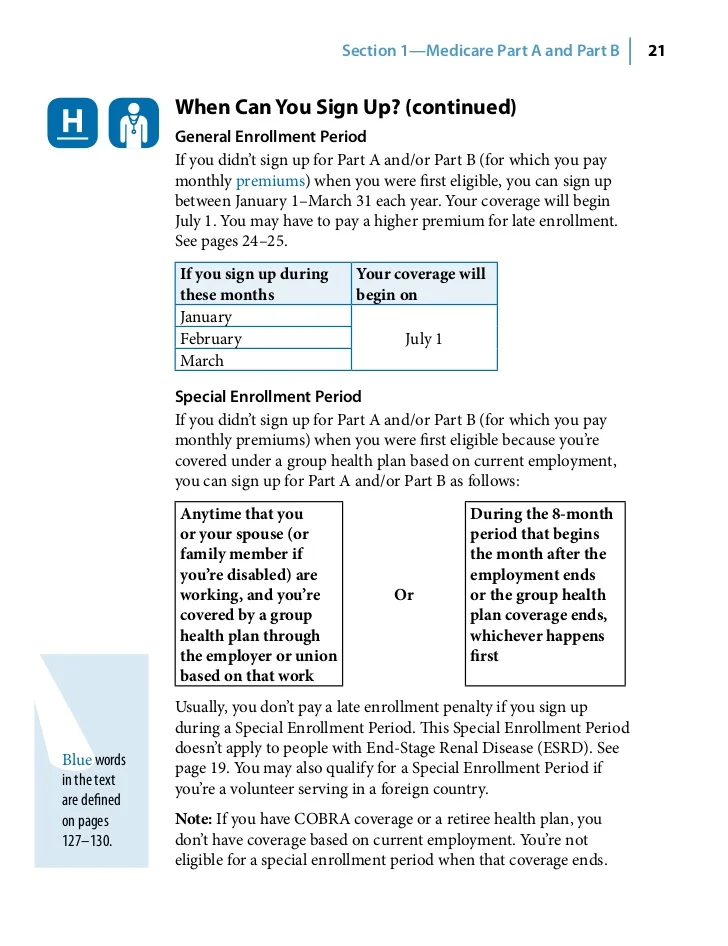

Part D Enrollment Periods

Medicare enrollment periods stay the same every year, but your coverage needs can change. Below is a chart explaining each enrollment period and what it is for. Keep reading to get important information on prescription drug coverage so you can:

Change Medicare Part D Plans Outside Enrollment Windows

If you find yourself outside the IEP and AEP, you may fall under the “Special Circumstances” category. Contact a Medicare agent who can quickly and easily tell you if your specific situation fits under one of the qualifiers for SEP.

How to Prepare for the Call

So that the agents can best assist you in navigating enrollment windows and coverage options, here are some quick tips: