Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

How to set up Medicare crossover?

Jan 18, 2021 · A crossover claim is a claim for a recipient who is eligible for both Medicare and Medicaid, where Medicare pays a portion of the claim, and Medicaid is billed for any remaining deductible and/or coinsurance. A Coordination of Benefits Contractor (COBC) is used to electronically, automatically cross over claims billed to Medicaid for eligible recipients.

What does crossover mean in medical insurance terms?

Feb 06, 2020 · Crossover is the transfer of processed claim data from Medicare operations to Medicaid (or state) agencies and private insurance companies that sell supplemental insurance benefits to Medicare. beneficiaries.

How does the Medicare crossover claim system work?

Apr 26, 2013 · Medicare crossover is not insurance. It is an electronic claim processing system used by Medicare providers to submit claims to Medicare. Once Medicare adjudicates the claim and approves it, the claim is sent to your Medigap carrier of record. This eliminates the need for your provider to file one claim with Medicare, another with your Medicare supplement provider.

How does Medicare Crossover claims?

Part 1 – Medicare/Medi-Cal Crossover Claims Overview Page updated: August 2020 Automatic Crossover Claims Medicare uses a consolidated Coordination of Benefits Contractor (COBC) to automatically cross over to Medi-Cal claims billed to any Medicare contractor for Medicare/Medi-Cal eligible recipients.

What does Medicare crossover mean?

A crossover claim is a claim for a recipient who is eligible for both Medicare and Medicaid, where Medicare pays a portion of the claim, and Medicaid is billed for any remaining deductible and/or coinsurance.Jan 18, 2021

When would you do a crossover claim?

In health insurance, a "crossover claim" occurs when a person eligible for Medicare and Medicaid receives health care services covered by both programs. The crossover claims process is designed to ensure the bill gets paid properly, and doesn't get paid twice.

What is a Medicare crossover only provider?

Crossover Only providers are those providers who are enrolled in Medicare, not enrolled in Medi-Cal, and provide services to dual-eligible beneficiaries. Dual-eligible beneficiaries are those beneficiaries who are eligible for coverage by Medicare (either Medicare Part A, Part B or both) and Medi-Cal.

Does Medicare automatically forward claims to secondary insurance?

Medicare will send the secondary claims automatically if the secondary insurance information is on the claim. As of now, we have to submit to primary and once the payments are received than we submit the secondary.Aug 19, 2013

Does Medicare crossover to AARP?

Things to remember: When Medicare does not crossover your claims to the AARP Medicare Supplement Plans, you will need to make sure this CO253 adjustment is applied before you electronically submit to AARP as a secondary payer.Mar 2, 2022

What is it commonly called when Medicare electronically forwards secondary claim information?

A. The Electronic Remittance Advice (ERA), or 835, is the electronic transaction which provides claims payment information in the HIPAA mandated ACSX12 005010X221A1 format.

How do I submit a void claim to Medicare?

The fastest way to cancel a claim is to call Medicare at 800-MEDICARE (800-633-4227). Tell the representative you need to cancel a claim you filed yourself. You might get transferred to a specialist or to your state's Medicare claims department.Jun 17, 2020

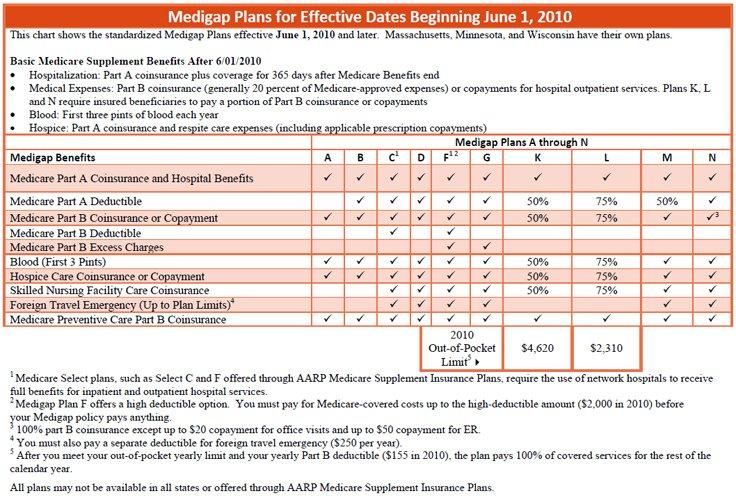

What do Medigap policies cover?

Medigap is extra health insurance that you buy from a private company to pay health care costs not covered by Original Medicare, such as co-payments, deductibles, and health care if you travel outside the U.S. Medigap policies don't cover long-term care, dental care, vision care, hearing aids, eyeglasses, and private- ...Nov 18, 2020

Is Medicare and Medicare supplement the same thing?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

How do you know if Medicare is primary or secondary?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

What happens when Medicare is secondary?

The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the remaining costs. If your group health plan or retiree coverage is the secondary payer, you may need to enroll in Medicare Part B before they'll pay.

Will secondary pay if primary denies?

If your primary insurance denies coverage, secondary insurance may or may not pay some part of the cost, depending on the insurance. If you do not have primary insurance, your secondary insurance may make little or no payment for your health care costs.

What is Medicare Part A?

Medicare divides its services into Part A and Part B. Part A covers institutional services and Part B covers non-institutional services. Recipients may be covered for Part A only, Part B only or both.

When will Medicare replace HIC?

Beginning April 1, 2018 , the Health Insurance Claim (HIC) number traditionally appearing on Medicare cards is being replaced by a non-Social Security Number based Medicare Beneficiary Identifier (MBI) number. Updated Medicare cards with MBIs will be phased into use through December 31, 2019. Therefore, the term HIC will be phased out of the Medi-Cal provider manuals, as appropriate. Removal of references to HIC does not preclude providers from processing transactions using HIC numbers. Providers can continue to process both HIC and MBI numbers, as appropriate, from April 1, 2018 through December 31, 2019. Providers should refer to the CMS website for detailed information.

What is OHC in Village Health?

Medicare providers of services to dual-eligible VillageHealth Medicare Part C recipients should refer to the Other Health Coverage (OHC) section for instructions for requirements for billing coinsurance and/or deductible claims.

Does California pay Medicare Part B?

California has a buy-in agreement with the federal government whereby the Department of Health Care Services (DHCS) pays the Medicare Part B premiums on behalf of all individuals eligible for Medi-Cal. These individuals are therefore protected by federal Medicaid rules that preclude providers from charging recipients any sums in addition to payments made to the provider.

What is Medi-Cal eligibility verification?

The Medi-Cal eligibility verification system indicates a recipient’s Medicare coverage when a provider submits a Medi-Cal eligibility inquiry. One of the following messages will be returned if a recipient is eligible for Medicare:

Do you have to bill Medicare before you use Medi-Cal?

If a recipient has Medicare Part A coverage only, and a provider is billing for Part A covered services, the provider must bill Medicare prior to billing Medi- Cal. However, if billing for Part

Is Medicare covered by Medicare?

Most medical supplies are not covered by Medicare and can be billed directly to Medi-Cal. However, the medical supplies listed in the Medical Supplies: Medicare-Covered Services section of the appropriate Part 2 manual are covered by Medicare and must be billed to Medicare prior to billing Medi-Cal.

What is crossover process?

The crossover process allows providers to submit a single claim for individuals dually eligible for Medicare and Medicaid, or qualified Medicare beneficiaries eligible for Medicaid payment of coinsurance and deductible to a Medicare fiscal intermediary, and also have it processed for Medicaid reimbursement.

What happens if a claim is crossed over?

If a claim is crossed over, you will receive a message beneath the patient’s claim information on the Payment Register/Remittance Advice that indicates the claim was forwarded to the carrier.

Definition of Medicare Crossover Claims

Medicare crossover claims are claims that have been approved for payment by Medicare and sent to Medicaid for payment towards the Medicare deductible and coinsurance within Medicaid program limits.

Definition of Medicaid Program Limits

Medicaid will not pay a crossover claim when it has been paid by Medicare in an amount that is the same or more than Medicaid’s rate for the specified service.

Who is an Eligible Recipient

A Medicaid recipient who is also receiving Medicare benefits is called “dually eligible.”

How Medicaid Receives Crossover Claims

After providing a service to a dually-eligible recipient, the provider sends a claim to its Medicare carrier or intermediary. After Medicare processes the claim, it sends the provider an explanation of Medicare benefits. If Medicare has approved the claim, Medicaid can pay towards the deductible and coinsurance according to Medicaid policy.

Automated Crossover Carriers and Intermediaries

Some Medicare intermediaries and carriers have arranged to send crossover claims to Medicaid. These automated Medicare intermediaries and carriers are:

Two Different Programs

Medicare is a federal program that provides health care coverage to people age 65 and older, as well as disabled adults. Medicaid is a combined federal-state program that covers low-income people regardless of age. Because of overlaps in eligibility, some people may be covered by both programs.

Handling Crossover Claims

Rules for crossover claims are set by the federal Centers for Medicare & Medicaid Services. Health-care providers submit all crossover claims to Medicare. Medicare assesses the claim, pays its portion of the bill, and then submits the remaining claim to Medicaid.