Quick Cost-Sharing Definitions For Medicare

- Premium: The amount you pay every month to keep your coverage.

- Out-of-Pocket Costs / Cost-Sharing: The costs you incur beyond your premium including copays, coinsurance, deductible, and an out-of-pocket maximum.

- Copay: A dollar amount you pay when you access a service subject to a copay.

Does Medicaid have copay or cost sharing?

Sep 18, 2021 · Medicare’s cost-sharing is the out-of-pocket costs Out-of-Pocket Costs for Medicare are the remaining costs that are not covered by the beneficiary's health insurance plan. These costs can come from the beneficiary's monthly premiums, deductibles, coinsurance, and copayments. that beneficiaries pay to receive medical services or supplies, like a doctor’s …

What is the monthly cost for Medicare?

The patient is responsible to pay cost-sharing amounts out-of-pocket. Cost-sharing can be in the form of a deductible, copayment, or coinsurance; most plans incorporate all of these types of cost-sharing, with the specifics depending on the service that’s provided and whether or not the patient has met their deductible (coinsurance generally applies after you’ve met the deductible, …

What is happening to Medicare Cost plans?

Cost Sharing. The share of costs covered by your insurance that you pay out of your own pocket. This term generally includes deductibles, coinsurance, and copayments, or similar charges, but it doesn't include premiums, balance billing amounts for non-network providers, or the cost of non-covered services. Cost sharing in Medicaid and CHIP also includes premiums.

What does share of cost mean for Medicaid?

Sep 02, 2021 · When you enroll in an Advantage plan, the carrier determines what the cost-sharing will be. So, instead of the 20% coinsurance, you have to pay under Medicare, it could be more. The deductible, coinsurance, and copays you’ll need to pay to depend on the plan. You’ll have to pay these costs until you reach the plan’s annual out-of-pocket limit.

What is an example of cost-sharing?

A Deductible is the first part of what you pay for your health care before insurance starts to pay for some of your health care. This is called cost sharing. Example: Your health plan has a $1,000 deductible. Your deductible has not been met. Your doctor's visit costs $100.

What is cost-sharing in Medicare Advantage Plan?

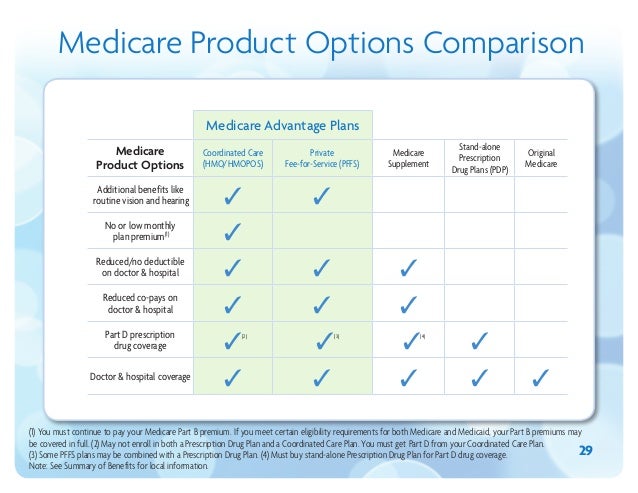

Many Medicare Advantage plans use a copayment system of cost-sharing. Instead of paying 20% of allowable charges for your health care under Original Medicare, with Medicare Advantage you might pay a flat fee each time you visit the doctor or hospital.

Who qualifies for cost-sharing reductions?

Who is eligible for the cost sharing subsidy? People who are eligible to receive a premium tax credit and have household incomes from 100% to 250% of poverty are eligible for cost sharing subsidies.Oct 29, 2021

What are the benefits of cost-sharing?

Plans with lower cost-sharing (ie, lower deductibles, copayments, and total out-of-pocket costs when you need medical care) tend to have higher premiums, whereas plans with higher cost-sharing tend to have lower premiums. Cost-sharing reduces premiums (because it saves your health insurance company money) in two ways.Apr 10, 2021

Is Medicare Advantage more expensive than Medicare?

Abstract. The costs of providing benefits to enrollees in private Medicare Advantage (MA) plans are slightly less, on average, than what traditional Medicare spends per beneficiary in the same county.Jan 28, 2016

What is the Irmaa for 2022?

How much are Part B IRMAA premiums?Table 1. Part B – 2022 IRMAAIndividualJointMonthly Premium$91,000 or less$182,000 or less$170.10> $91,000 – $114,000> $182,000 – $228,000$238.10> $114,000 – $142,000> $228,000 -$284,000$340.203 more rows

Do I have to pay back cost-sharing reductions?

If I underestimate my income and end up earning more than 250 percent of the federal poverty level next year, will I have to pay back the cost-sharing subsidies? No. Unlike premium tax credits, which are reconciled each year based on the income you actually earned, cost-sharing reductions are not reconciled.

How is cost-sharing calculated?

To do this, divide the total cost share obligation by 1.52. (22,280 / 1.52 = 14,658 TDC)....Example:Cost CategoryAmount (example)Total Project Costs111,400X .20Cost share (20% Match on Total Project)22,280Request from Sponsor (80% of Total Project)89,1207 more rows

What plan will have the highest out-of-pocket costs?

The highest out-of-pocket maximum for a health insurance plan in 2022 plans is $8,700 for individual plans and $17,400 for family plans. Plans with lower premiums tend to have higher out-of-pocket maximums and vice versa.

What is the main purpose of cost sharing?

Cost sharing means that insured individuals will pay a portion of their health care costs. Forms of cost sharing are what?

What is mandatory cost sharing?

Federal funding agencies define and acknowledge various types of cost sharing or matching funds, including: Mandatory Cost Sharing -- required by a sponsor as a condition for making an award and usually refers to an overall percentage of total projects costs to be contributed by a source other than the sponsor.

Is cost share the same as copay?

A co-‐payment (also called a “co-‐pay”) is a form of cost-‐sharing. It is a set amount of money you will pay for a service ($3, $15, $40 etc). The amount is the same no matter how much the doctor or hospital charges for the service.

What is cost-sharing?

Cost-sharing refers to the patient’s portion of costs for healthcare services covered by their health insurance plan. The patient is responsible to...

Are premiums part of cost-sharing?

Cost-sharing comes into play when a policyholder actually uses medical and/or prescription drug insurance coverage. Health insurance premiums – the...

Is there a cap on the total amount of cost-sharing I'm required to pay?

Under the Affordable Care Act, most plans must have an out-of-pocket maximum (referred to as maximum OOP, or MOOP) of no more than $8,550 in cost-s...

Where can I find information on what cost sharing my plan requires?

Your health insurance ID card may provide some or all of this information. It’s common for ID cards to list the plan’s copay and deductible amounts...

What is cost sharing?

What is cost-sharing? Cost-sharing refers to the patient’s portion of costs for healthcare services covered by their health insurance plan. The patient is responsible to pay cost-sharing amounts out-of-pocket.

How much will Medicare cost share in 2021?

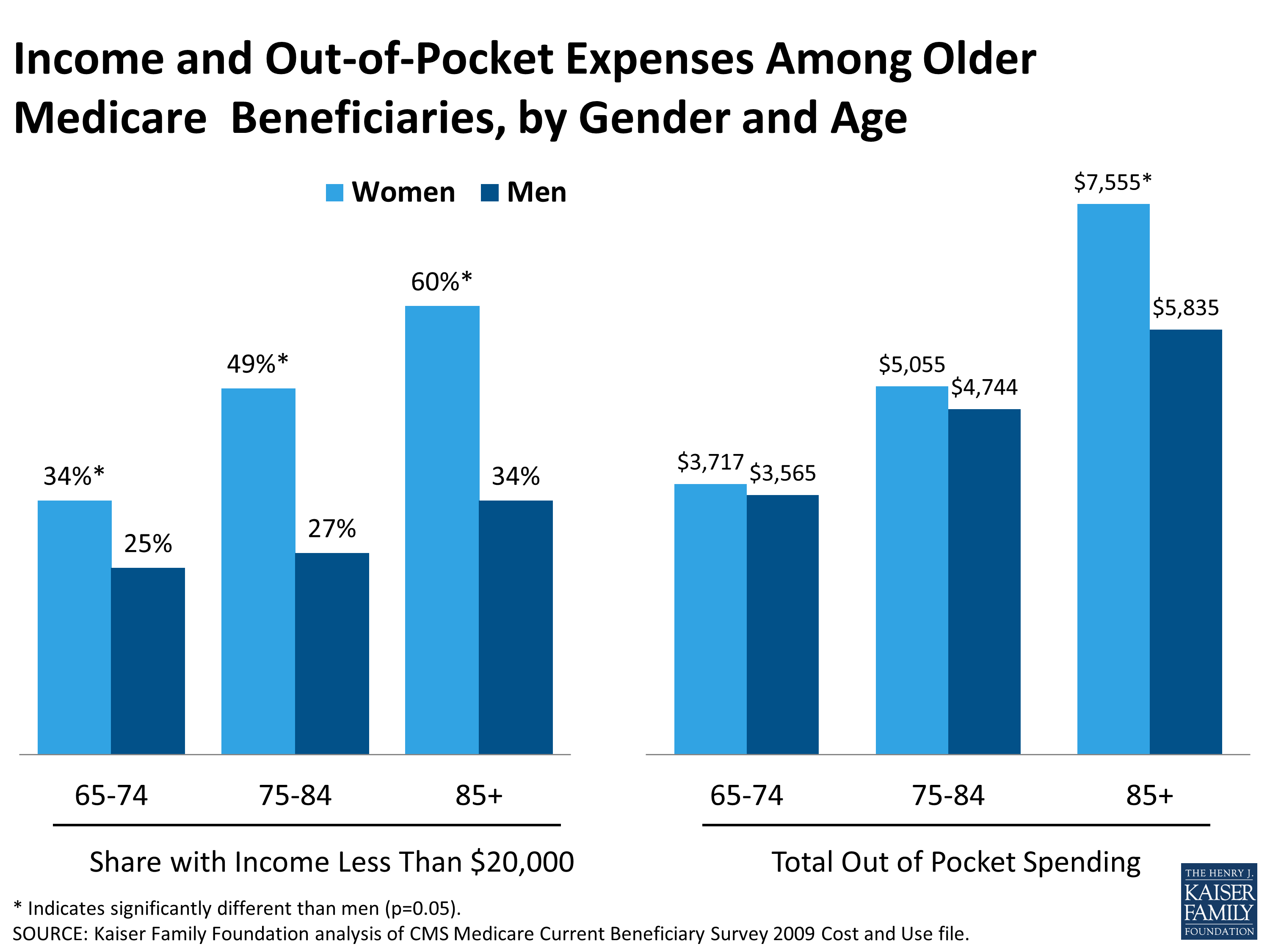

Medicare Advantage plans cannot require members to pay cost-sharing in excess of $7,550 in 2021, although many plans have cost-sharing limits below this (note that the out-of-pocket limits for Medicare Advantage plans do not include the cost of prescription drugs, which are covered separately and have separate — and unlimited — cost-sharing).

What is the certificate of insurance?

The certificate of insurance will list the amount of your individual and/or family deductible as well as copayments or coinsurance amounts you will be required to pay for covered services.

What is out of pocket medical insurance?

But under private health insurance or Medicaid, “out-of-pocket costs” generally only refer to cost-sharing incurred when a person has medical claims (even though premiums are also paid out-of-pocket).

How much is the maximum OOP for 2021?

Under the Affordable Care Act, most plans must have an out-of-pocket maximum (referred to as maximum OOP, or MOOP) of no more than $8,550 in cost-sharing for a single individual in 2021 (this limit is indexed each year in the annual Notice of Benefit and Payment Parameters).

Does the ACA cover grandfathered plans?

The ACA’s limits on out-of-pocket costs only applies to in-network services that fall within the umbrella of essential health benefits. And it does not apply to grandmothered or grandfather ed plans, or to plans that aren’t regulated by the ACA at all, such as short-term health insurance.

Is health insurance a cost sharing amount?

Health insurance premiums – the monthly payments you must make to keep your coverage in force, regardless of whether or not you use a healthcare service – are not considered cost-sharing amounts.

What happens when you enroll in an Advantage plan?

When you enroll in an Advantage plan, the carrier determines what the cost-sharing will be. So, instead of the 20% coinsurance, you have to pay under Medicare, it could be more.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare. You can also find her over on our Medicare Channel on YouTube as well as contributing to our Medicare Community on Facebook.

What is a copayment in Medicare?

Copayment, or copay, is another term you’ll see used in relation to Medicare cost-sharing . A copay is like coinsurance, except for one difference: While coinsurance typically involves a percentage of the total medical bill, a copayment is generally a flat fee. For example, Part B of Medicare uses coinsurance, which is 20 percent in most cases.

What percentage of Medicare coinsurance is covered by Part B?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items. The Medicare-approved amount is a predetermined amount ...

How much is Medicare Part B 2021?

Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth of Part B-covered services for the year. After reaching his Part B deductible, the remaining $97 of his bill is covered in part by Medicare, though John will be required to pay a coinsurance cost. Medicare Part B requires beneficiaries ...

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are optional plans sold by private insurers that offer some coverage for certain out-of-pocket Medicare costs , such as coinsurance, copayments and deductibles.

What is the deductible for John's doctor appointment?

John’s doctor appointment is covered by Medicare Part B, and his doctor bills Medicare for $300. Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth ...

What is the most important thing to know about Medicare?

There are a number of words and terms related to the way Medicare works, and one of the most important ones to know is coinsurance.

Does Medigap cover coinsurance?

In exchange for paying a monthly premium to belong to the plan, a Medigap plan can help cover the cost of your Medicare coinsurance and/or your deductibles. If John from our above example had a Medigap plan that covered his Part B deductible and coinsurance, he may have owed nothing for his doctor’s appointment.

What is a Part D plan?

Part D plans are drug plans. They offer better cost-sharing and coverage on drugs, but each offers unique drug lists subject to copays, coinsurance, deductibles, and a maximum. One important note is that Part D plans have four “phases” (AKA periods) in which cost-sharing amounts on different tiered drugs adjust for that period. They are the Deductible period, Initial Coverage Period, Coverage Gap period, and Catastrophic Coverage Period.

Does Medigap cover Part A?

Medigap plans fill in the gaps in Part A and B, meaning they can offer additional benefits and cost-sharing beyond Original Medicare for the Part A and Part B cost-sharing. Medigap can’t however offer drug plans ( instead you can pair Original Medicare, Part D, and Medigap). What Medigap covers in terms of cost-sharing is standardized by letter plan, but premium costs can differ by region and factors like age.

What is Medicare Cost-Sharing?

When you use Medicare, you share the cost of your care by paying premiums, deductibles, copayments, co-insurance, and out-of-pocket maximums. If you receive a paycheck, part of your check will be set aside for Medicare. You pay for the program when you work and pay again when you use it.

We Explain Cost-Sharing Terms

Cost-Sharing includes your cost of premiums, deductibles, copayments, co-insurance, and out-of-pocket maximums. You share the cost of your medical services with your insurance company.