Plan G Benefits

| Standard Medicare Supplement Insurance b ... | Plan G |

| Coinsurance for skilled nursing facility | ✓ |

| Medicare Part A deductible | ✓ |

| Medicare Part B deductible | |

| Medicare Part B excess charges | ✓ |

Is Plan G the best Medicare supplement plan?

What is the Deductible for High Deductible Plan G in 2021? The deductible for High Deductible Plan G is $2,370. Beneficiaries reaching this deductible is what keeps the premiums low for this plan. What is the best Medicare supplement for seniors? Best Medicare Supplement Insurance Companies of 2021 Best Overall: Mutual of Omaha.

Does plan G cover Medicare deductible?

Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Should You Choose Medicare supplement plan F or Plan G?

Medigap Plan G: A Small Deductible = Big Savings Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $233 in 2022.

Is Medicare Plan G better than Plan F?

Summary: High Deductible Plan G is a good alternative to High Deductible Medicare Supplement Plan F, which won’t be available to new beneficiaries in 2022. The plan deductible is $2,490. Once the deductible is met, you get the same coverage as a regular Plan G. You’ve been doing a lot of research regarding your Medicare coverage.

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the annual deductible for Plan G?

How much does Medicare Supplement Plan G cost?Atlanta, GASan Francisco, CAPlan G premium range$107– $2,768 per month$115–$960 per monthPlan G annual deductible$0$0Plan G (high-deductible) premium range$42–$710 per month$34–$157 per monthPlan G (high-deductible) annual deductible$2,370$2,370

What is the deductible for Plan G in 2020?

The deductible for High Deductible Plan G is $2,490. Beneficiaries reaching this deductible is what keeps the premiums low for this plan. Alternatively, if you are more comfortable with higher monthly premiums and would rather not pay the higher deductible, standard Plan G would be the better choice for you.Mar 1, 2022

What is the monthly premium for Plan G?

The cost of Medicare Supplement Plan G varies depending on multiple factors, including where you live. However, the average cost of Medigap Plan G can range from $100-$300 per month. Medicare Supplement premium prices depend on ZIP Code, age, gender, and more.Feb 4, 2022

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Does United Healthcare have a high deductible plan G?

High-deductible Plan F and Plan G each have a $2,370 deductible in 2021. Both plans include more coverage than the other lettered plans. The difference in benefits between Plan F and Plan G is that Plan G doesn't cover the Medicare Part B deductible ($203 in 2021).

What is the difference between Plan G and high deductible plan G?

High Deductible Health Plan G is an option for current and new Medicare beneficiaries. Plan G HDHP has the same coverage as Plan G, but the beneficiary must pay a $2,490 (2022) deductible –which includes the Medicare Part B deductible – before the plan begins to pay.Jun 3, 2020

What is the out of pocket maximum for Medigap Plan G?

Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year.Dec 12, 2019

Does AARP offer high deductible plan G?

AARP also offers a high-deductible version of Plan G. This option will require you to pay a deductible of $2,340 before the plan begins to assist with costs. Once you've met your deductible, the plan will pay 100% of covered costs for the remainder of the year.Jan 4, 2022

Is Plan G going away?

Medicare Plan G is not going away. There is a lot of confusion surrounding which Medigap plans are going away and which are still available. Rest assured that Plan G isn't going away. You can keep your plan.Feb 11, 2020

Is Medicare Part G tax deductible?

Yes, your supplemental health insurance is deductible as a medical expense on Schedule A, Itemized Deductions, for Form 1040. You can deduct the amount that exceeds a certain percentage of your adjusted gross income, or AGI, and that depends on your age during the year.Mar 24, 2015

What is the difference between high deductible F and high deductible G?

The only difference between Plan F and Plan G is the fact that Plan G does not pay the Part B deductible ($233 in 2022), while Plan F does. Overall, this won't hurt your pocket. Many seniors find they still find a substantial amount of savings with Plan G, even though they have to pay the Part B deductible.

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

What is Medicare Plan G?

Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, we can probably help you on premiums by looking ...

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

What is Plan G?

After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

Does Frank have a medicare plan?

Frank is a diabetic who has Medicare Supplement Plan G. He sees his primary care doctor once per year, but visits his endocrinologist several times a year to renew his prescriptions. In January, he goes to his first doctor visit for the year. The specialist bills Medicare, which pays 80% share of the bill except for the $203 outpatient deductible, which is billed to Frank.

Which is better, Plan F or Plan G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more than Plan G since it picks up the annual Part B deductible. COMPARE PLANS AND PRICING.

Does Medicare pay for inpatient hospital?

So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, durable medical equipment, x-rays, ambulance, surgeries and much more. Medicare pays first, then Plan G pays all the rest after you pay ...

What is a Medigap Plan G?

Medigap Plan G High Deductible Coverage . The most crucial aspects of the HD Plan G plan are the benefits you will receive and the deductible amount. Your benefits will cover: Part B excess charges. Foreign travel emergency (up to plan limits) Skilled nursing facility care coinsurance.

What is the difference between Plan F and Plan G?

The only difference between Plan F and Plan G is the fact that Plan G does not pay the Part B deductible ($203 in 2021), while Plan F does. Overall, this won’t hurt your pocket. Many seniors find they still find a substantial amount of savings with Plan G, even though they have to pay the Part B deductible. Because Plan F is going away, it’s ...

What are the changes to Medicare in 2020?

What are the Medicare Changes in 2020? To provide a quick recap of the events happening in 2020, Medicare Supplement Plan F and Plan C are going away for those who are not eligible for Medicare before January 1, 2020.

Changes to Medicare in 2020

With the passage of MACRA in 2015, the biggest change to new Medicare beneficiaries is the removal of the option to choose Medicare supplements that cover the Part B deductible. The three plans that cover this are the Plan F, the High Deductible Plan F, and the Plan C.

How do High Deductible Medicare Supplement Plans work?

High deductible plans require the consumer pay a large deductible before the plan begins to pay. Once this deductible is met, the plan pays 100% of covered services for the rest of the calendar year.

High Deductible Plan G Coverage

With the removal of the High Deductible Plan F for new Medicare beneficiaries in 2020 and beyond, the High Deductible Plan G was added as a new option.

Who are high-deductible Medicare plans good for?

High deductible Medicare plans can work great for people who can easily afford the $2,340 annual deductible if they have a bad year and wish to substantially save on their Medicare supplement premiums. If you are paying over $250 a month, you could actually save money by going the high deductible route.

What are the benefits of Medicare Supplement Plan G?

Medicare Supplement Plan G covers: 1 Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out 2 Part A deductible ($1,484 in 2021) 3 Part A hospice care coinsurance or copayment 4 Part B coinsurance or copayment 5 Part B excess charges 6 Blood (the first three pints needed for a transfusion) 7 Skilled nursing facility coinsurance 8 Foreign travel emergency care (up to plan limits of $50,000)

How much is Plan G deductible?

Let’s imagine a situation where the Plan G premium is $120 a month where you live. That’s $1,440 a year. If you are admitted to the hospital for inpatient care, you would have to pay a Part A deductible of $1,484 for each benefits period in 2021 before your Part A benefits kick in.

What is Medicare Plan G?

Medicare Plan G, a Medigap plan, pays for many of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Medicare Plan G, which is similar to Plan F, can be worth the cost if you expect significant medical bills during the year. Medicare offers an alphabet soup’s worth of parts and plans.

How much does Medicare pay for an appointment?

State law may add more limits in some states. So, if Medicare allows a fee of $100 for a doctor’s office appointment, a physician who doesn’t accept assignment may charge an additional 15% ($15) for the appointment. Medicare Part B pays 80% of only the allowed rate, or $80.

What is a Part D plan?

Part D prescription drug plans. After that come the 10 different Medigap plans – otherwise known as Medicare Supplement insurance – which each have a letter title, including Plans A, B, C, D, G, F, K, L, M and N.

How much does Medicare Part B cost?

Medicare Part B pays 80% of only the allowed rate, or $80. You are responsible for the remaining 20% of the allowed rate ($20) plus the excess charge of $15, for a total of $35. Plan G coverage, though, is the only Medigap plan (besides Plan F) which pays both the $20 coinsurance and the $15 excess charge in this example.

Does Plan G cover Part B?

The only thing that Plan G does not cover that Plan F does is the Part B deductible. However, Plan F is no longer available to those who became eligible for Medicare after. Jan. 1, 2020. So for the newly eligible, Plan G may be the best option for the most extensive Medicare Supplement coverage.

What is the Medicare Supplement Plan G deductible for 2021?

With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203.

What is a G plan?

This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

Medicare Plan G Coverage

Probably the easiest way to explain what Medicare Plan G covers, is to simply explain what it doesn’t cover. Medigap Plan G pays 100% of the gaps in Medicare (All costs) except for the annual Medicare Part B deductible.

Medicare Supplement Plan G – What it Pays

The following is a list of the rest of the items that Medicare Plan G pays. These are the most common things you might run into when using your coverage.

Medicare Plan G vs Plan F

Medicare plan F used to be the plan with the highest coverage. It paid 100% of all your medical bills for you, including the Medicare Part B deductible.

Medicare Part G Cost

Medicare Plan G varies in cost based on where you live, your age, gender, tobacco use, and if you qualify for a household discount or not. The cost for Plan G Medicare ranges from $85 – $120 per month.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $148.50 per month. The maximum cost of Medicare Part B coverage is $504.90 per month in 2021, and that's for individuals reporting half a million dollars or more in income in 2019.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

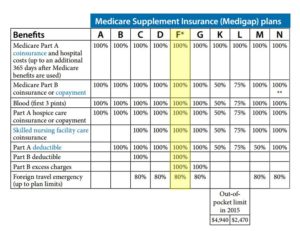

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,370 in 2021.