Typically, Original Medicare (Part A and Part B) does cover pre-existing conditions. Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Do Medicare supplement plans cover pre-existing conditions?

All Medicare Supplement insurance plans cover Medicare Part A (hospital insurance) coinsurance for up to 365 days after Medicare benefits are used up. If you are in a pre-existing condition waiting period and you are hospitalized for a car accident, which is not a pre-existing condition for you, your Medicare Supplement insurance plan may cover your hospital coinsurance.

Does Medigap cover pre-existing conditions?

Jul 26, 2021 · For the first six months after you enroll, a Medicare Supplement plan can cover the Part A coinsurance when the visit doesn’t relate to the pre-existing condition. A visit relating to a pre-existing condition won’t have coverage. Although Medicare will pay some of the hospital bills, you pay the rest.

What is considered a pre-existing condition for Medicare?

Mar 19, 2019 · After 6 months, the Medicare Supplement plan must cover any pre-existing condition. The company may use a waiting period ONLY if the condition was treated or diagnosed within 6 months before the Medigap coverage starts. Under some circumstances, you may avoid or shorten the waiting period.

Does Medicare supplement insurance cover car accident injuries?

Sep 10, 2018 · If you’re interested in buying Medicare Supplement insurance and you have a pre-existing condition, in some situations you might not get accepted. If you apply for the policy after your Medicare Supplement Open Enrollment Period is over, the private insurance company selling the plan can require you to have a health evaluation. If you have a health condition, the …

Can Medigap insurance be denied for pre-existing conditions?

Be aware that under federal law, Medigap policy insurers can refuse to cover your prior medical conditions for the first six months. A prior or pre-existing condition is a condition or illness you were diagnosed with or were treated for before new health care coverage began.

Does Medicare cover pre-existing condition?

Medicare defines a pre-existing condition as any health problem that you had prior to the coverage start date for a new insurance plan. If you have Original Medicare or a Medicare Advantage plan, you are generally covered for all Medicare benefits even if you have a pre-existing condition.Jul 1, 2021

Can you be turned down for a Medicare Supplement plan?

Once you retire after 65, you have a “guaranteed issue right” for up to 63 days after the termination of your previous coverage. Within that time, companies must sell you a Medigap policy at the best available rate, no matter what health issues you have. You cannot be denied coverage.

Can you switch from Medicare Advantage to Medigap with pre-existing conditions?

The Medigap insurance company may be able to make you wait up to 6 months for coverage of pre-existing conditions. The number of months you've had your current Medigap policy must be subtracted from the time you must wait before your new Medigap policy covers your pre-existing condition.

What pre-existing conditions are not covered?

Health insurers can no longer charge more or deny coverage to you or your child because of a pre-existing health condition like asthma, diabetes, or cancer, as well as pregnancy. They cannot limit benefits for that condition either.

What's considered a pre-existing condition?

A health problem, like asthma, diabetes, or cancer, you had before the date that new health coverage starts. Insurance companies can't refuse to cover treatment for your pre-existing condition or charge you more.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Is Medigap plan G guaranteed issue?

Medigap Plan G is only available as a guaranteed issue plan to people who became eligible for Medicare on or after January 1st, 2020. You may still apply for Medigap Plan G through the usual methods (link to article) if you entered Medicare before 2020, but your acceptance may not be guaranteed.

Can you switch Medigap plans without underwriting?

During your Medigap Open Enrollment Period, you can sign up for or change Medigap plans without going through medical underwriting. This means that insurance companies cannot deny you coverage or charge you more for a policy based on your health or pre-existing conditions.Nov 22, 2021

Who pays for Medigap?

You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Can you be turned down for Medicare Part D?

A. You cannot be refused Medicare prescription drug coverage because of the state of your health, no matter how many medications you take or have taken in the past, or how expensive they are.Dec 15, 2008

What are the pre-existing conditions?

Pre-existing conditions include cancer, heart disease, and asthma. According to the Department of Health and Human Services, up to 50% of non-elderly Americans have a pre-existing health condition. While pre-existing conditions don’t affect Medicare, they can affect Medigap eligibility. A pre-existing condition can slow down ...

How long do you have to wait to get insurance for pre-existing conditions?

Federal law doesn’t require insurers to cover pre-existing conditions for the first six months. The six-month waiting period is also known as the “look-back period,” meaning insurers can delay coverage for health conditions that you sought treatment for before applying. During this waiting period, Part A and Part B continue to provide coverage ...

What does Medigap cover?

Once the waiting period ends, the Medigap policy covers costs like deductibles and copays. It’s important to understand what the waiting period might mean for your health care needs.

What does it mean to enroll in Medigap?

Enrolling in Medigap during the Open Enrollment Period means that the carrier can’t deny coverage or charge higher premiums. The good news is that the Medigap pre-existing condition waiting period is often reduced by the number of months that you had creditable coverage before enrolling.

What happens if you don't buy a Medigap plan?

If you don’t purchase your Medigap plan during your Open Enrollment Period or do not have guaranteed issue rights during that time, you will have to answer questions about your health and medications when you go through underwriting. These include whether you have pre-existing conditions.

How long does it take for Medicare Supplement to start in 2021?

Otherwise, you can expect to wait six months before coverage of your pre-existing condition begins. Pre-existing conditions include cancer, heart disease, and asthma.

How long do you have to wait to get Medigap coverage?

In this case, you may need to wait six months for your pre-existing condition to have coverage. The six-month waiting period begins once your policy starts. These pre-existing condition waiting periods only apply to Medigap policies.

Medicare Supplement plans Pre-existing Conditions – Open Enrollment Period

The best time to enroll in a Medigap plan is during the Medicare Supplement Open Enrollment Period – six month period after you’ve enrolled in Medicare Part B. During this period an insurance company cannot use medical underwriting:

Medicare Supplement plans Pre-existing Conditions – Guaranteed Issue Rights

In certain situations, known as Guaranteed Issue Rights, you are entitled by law to buy a Medigap policy without medical underwriting, i.e., without having to answer any health questions.

Medicare Supplement plans Pre-existing Conditions – Medical Underwriting

If you are applying for a Medicare Supplement policy after your Open Enrollment Period and do not have Guaranteed Issue Rights, the insurance company is allowed to use medical underwriting to decide whether to accept your application, to charge more for the plan, or to impose its regular (up to six months) pre-existing conditions waiting period.

US Government Reading

Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare.

Please give us your feedback!

What do you think about Do Medicare Supplement plans have Pre-existing Conditions? Write your comments.

Contact Us

For help finding whether you have Pre-existing Conditions for Medicare Supplement, please contact Liberty Medicare or call us at 877-657-7477.

How old do you have to be to get Medicare Supplement?

Here are a couple of useful tips about Medicare Supplement insurance: In some states, you need to be age 65 or over to be eligible for Medicare Supplement insurance, even if you qualify for Medicare before age 65.

What is ALS in Medicare?

You have amyotrophic lateral sclerosis (ALS, also called Lou Gehrig’s disease). Your Medicare benefits may start during the first month you receive SSA or RRB benefits. You have end-stage renal disease (ESRD) – that is, you have kidney failure that requires you to receive dialysis regularly, or a kidney transplant.

How long do you have to be a resident to qualify for medicare?

You’re typically eligible for Medicare when you turn 65 if you’re a United States citizen or a legal resident for at least five years in a row. If you have a health condition or disability, you might qualify for Medicare before the age of 65 if any of the following applies to you: 1 You receive disability benefits from the Social Security Administration (SSA) or Railroad Retirement Board (RRB). If you’ve been receiving these benefits for 24 months in a row, you’ll be automatically enrolled in Medicare during the 25th month. 2 You have amyotrophic lateral sclerosis (ALS, also called Lou Gehrig’s disease). Your Medicare benefits may start during the first month you receive SSA or RRB benefits. 3 You have end-stage renal disease (ESRD) – that is, you have kidney failure that requires you to receive dialysis regularly, or a kidney transplant. In this case, you might qualify for Medicare, but you will usually need to apply for Medicare instead of getting enrolled automatically, if you’re under 65 years old.

Can you get Medicare if you have end stage renal disease?

If you have end-stage renal disease (ESRD), you might not be eligible for a Medicare Advantage plan.

Is Medicare Supplement endorsed by the government?

Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the Federal Medicare program. The product and service descriptions, if any, provided on these Medicare.com Web pages are not intended to constitute offers to sell or solicitations in connection with any product or service.

What is Medicare Advantage?

Medicare Advantage (Medicare Part C) plans are an alternative to Original Medicare that allow you to receive your Part A and Part B benefits from a private health insurance company. Most Medicare Advantage plans cover preexisting conditions, unless you have ESRD.

How long does open enrollment last for Medicare?

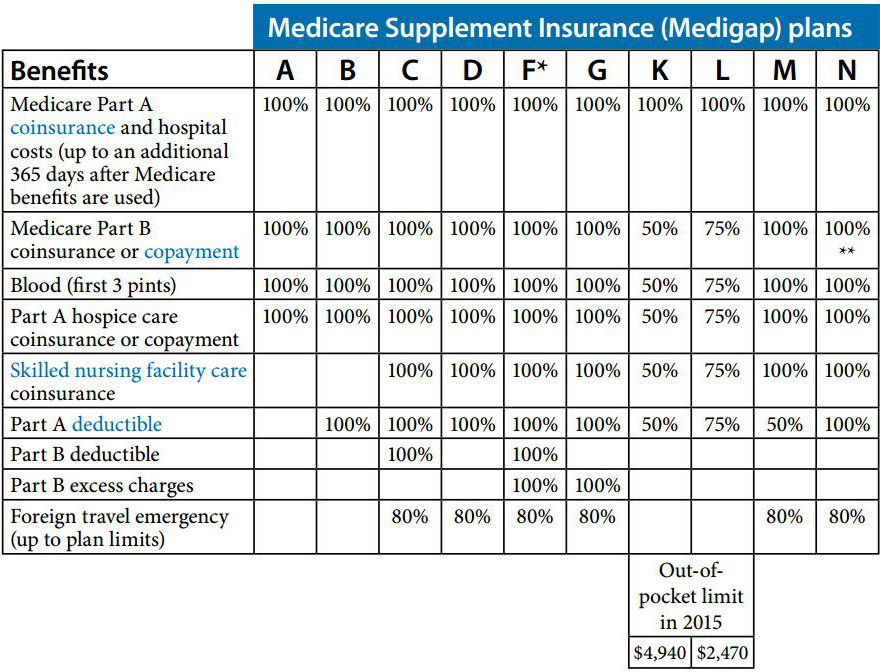

Your open enrollment period only lasts for six months and starts as soon as you are both: At least 65 years old. Enrolled in Medicare Part B. During your Medigap open enrollment period, insurers cannot deny you coverage or charge more for a Medigap policy based on any pre-existing conditions you may have. There are 10 standardized Medigap plans ...

Can you be denied coverage for pre-existing conditions?

With Original Medicare, you can't be denied coverage for pre-existing conditions.

Can you get Medicare Supplement Insurance if you don't buy it?

Medicare Supplement Insurance (Medigap) policy providers may deny you coverage or charge higher premiums based on your health if you don't buy your policy during your Medigap open enrollment period. Medicare Advantage plan carriers don't use pre-existing conditions as a consideration when you apply for a plan, unless you have end-stage renal ...

How long does Medicare cover pre-existing conditions?

Depending on your situation, some insurance companies may be able to deny you based on your health or refrain from covering those conditions for up to six months after your plan begins. We’ll take a look at how you can determine if your health may impact your options, and which companies offering Medicare Supplement plans cover pre-existing ...

What are some examples of pre-existing conditions?

For instance, the following examples may be considered as pre-existing conditions when you’re applying for a Medicare Supplement plan: You had a heart attack 12 years ago. You use an inhaler as needed for asthma. Your doctor has recommended ca taract surgery in the future. You have arthritis.

How long does Medigap cover lapses?

Some Medigap insurance carriers require that people who had lapses in their insurance pay the out-of-pocket costs related to any pre-existing conditions for up to six months. After the waiting period ends, your Medigap plan would then begin to provide coverage for those conditions. Fortunately, if you’ve had creditable health coverage consistently, ...

How long does Medicare Part B open enrollment last?

Your Medigap Open Enrollment Period begins when you first start Medicare Part B, and lasts for six months. There are other situations in which you may avoid medical underwriting, depending on the state you live in or if you qualify for a guaranteed issue right.

Can pre-existing conditions affect Medigap?

Many people have pre-existing conditions, and mild conditions often don’t impact your options for Medigap coverage. However, more severe diagnoses may impact your ability to get coverage if you have to undergo medical underwriting as part of the application process.

Can cataract surgery be done in the future?

Your doctor has recommended cataract surgery in the future. You have arthritis. You’re receiving treatment for cancer. As you can see, that’s quite a range of situations; a pre-existing condition doesn’t necessarily need to be a grave diagnosis.

Does Medicare Supplement cover pre-existing conditions?

Medicare Supplement plans cover pre-existing conditions, with one caveat; if you had a gap in health insurance before beginning your new plan, not all companies that offer Medicare Supplement plans cover pre-existing conditions right away. Some Medigap insurance carriers require that people who had lapses in their insurance pay ...

What is a pre-existing condition?

Pre-existing conditions are any health condition, injury, illness, sickness, disease, disabilities or other physical, mental, medical or nervous condition that you have acquired before your application or the start of coverage of your new insurance policy.

What is Medicare supplement insurance?

Medicare Supplement insurance or Medigap, are insurance policies that supplement the coverage of Original Medicare. It is offered by private insurance companies and has monthly premiums that you need to pay aside from the one for Medicare Part B.

Do Medicare Supplement insurance cover pre-existing conditions?

Yes! Provided that the applicant will buy the policy during his or her Medicare supplement open enrollment period.

People with Original Medicare have Medigap as their source of supplemental coverage

In 2015, about a quarter of traditional Medicare beneficiaries has Medicare supplement plan to help them cover the gaps of Medicare and limit their out-of-pocket costs for Medicare-covered expenses.

What happens if you have Medicare Advantage?

You have a Medicare Advantage Plan and it’s leaving Medicare or ending coverage in your area. You have Original Medicare and need to replace an employer health plan that will soon discontinue. You have Original Medicare and a Medicare SELECT policy and you move out of the policy’s service area.

How long does a Medigap policy last?

If you buy a Medigap policy outside your open enrollment period, your insurer may enforce a waiting period that lasts for up to 6 months.

What happens if you have a guaranteed issue right?

If you have a guaranteed issue right, an insurance company must sell you a Medigap policy, must cover all pre-existing conditions, and cannot charge you more because of your pre-existing condition. You have a guaranteed issue right in the following five situations:

What happens after open enrollment?

Guaranteed access after open enrollment. Once the open enrollment period ends, consumer protections shrink for those with pre-existing conditions. There are only five situations that give you guaranteed access to Medicare Supplement insurance after open enrollment.

Can I get a medicaid policy if I have a pre-existing condition?

It’s possible to get a policy after the enrollment period, but it’s not guaranteed.

Can I get a Medigap policy after the enrollment period?

It’s possible to get a policy after the enrollment period, but it’s not guaranteed. During the open enrollment period, insurers cannot use underwriting. That means they cannot deny you Medigap coverage because of a pre-existing condition or force you to pay a higher premium.

What is the enrollment window for Medicare?

Every beneficiary gets an enrollment window called your Initial Enrollment Period. At this time, you can enroll in Medicare without any health questions . Once you enroll in Part B, you’ll have another enrollment window that allows you to enroll in a supplemental plan without pre-existing conditions impacting your chances ...

How long can you wait to get medicare?

They can only do this for 6 months. The pre-existing condition waiting period really only applies to Medigap plans. Medicare will cover your pre-existing condition on covered services. However, for the first 6 months, 20% of out of pocket costs will be covered by you.

What happens if you don't enroll in OEP?

If you don’t enroll during your Open Enrollment Period, you can be denied coverage or charges a higher premium due to pre-existing health conditions. If you enroll outside your OEP, you may have a waiting period before coverage will begin. They can only do this for 6 months. The pre-existing condition waiting period really only applies ...

Does Medicare cover pre-existing conditions?

Yes, Medicare Supplements cover pre-existing conditions as long as you enroll at the right time. When purchasing a Medicare Supplement plan during your Medigap Open Enrollment Period, you’re automatically eligible for coverage. During this period, you’re granted Guaranteed Issue Rights.

Can you get denied Medigap coverage?

During this period, you’re granted Guaranteed Issue Rights. Private insurance companies offering Medigap plans cannot deny you coverage or increase your rates due to any pre-existing health conditions. If you don’t enroll during your Open Enrollment Period, you can be denied coverage or charges a higher premium due to pre-existing health conditions.

Is Medicare dependent on health?

Medicare isn’t dependent on the status of your health. Meaning pre-existing health conditions won’t impact eligibility as long as you apply at the right time. Below, we’ll go over what you need to know about pre-existing conditions and your Medicare coverage.

Can ESRD get denied?

ESRD is the only chronic condition that can get you denied a Medicare Advantage plan. This is one of the features that attract beneficiaries to Advantage plans. However, they don’t consider all the out of pocket costs you have to pay when you go to the doctor.