What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

Does Medicare Part B have a premium?

Most people actually pay less than the standard Medicare Part B premium amount, which is determined by the federal government each year. In 2021, the standard Medicare Part B premium is $148.50. You might pay more if you have a high income. See details below.

What determines your part B Medicare premium?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

How much does Medicare Part B costs?

and Part B which covers doctor’s visits and other medical services, and costs $170.10 per month for most enrollees in 2021. Everyone is eligible for Medicare at age 65, even if your full Social ...

How much was Medicare Part B in 2014?

How much did Medicare deductible increase in 2014?

What is the Part B and Part D surcharge based on?

What is the income limit for seniors in 2012?

About this website

What was the cost of Medicare Part B in 2015?

$104.90 per monthHow much will Medicare premiums cost in 2015? Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums.

What was the Medicare Part B premium in 2013?

How much will Medicare Part B premiums be in 2013? Most people will pay $104.90 per month for Medicare Part B premiums, which is a $5 monthly increase from 2012's premiums.

What were Medicare premiums in 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

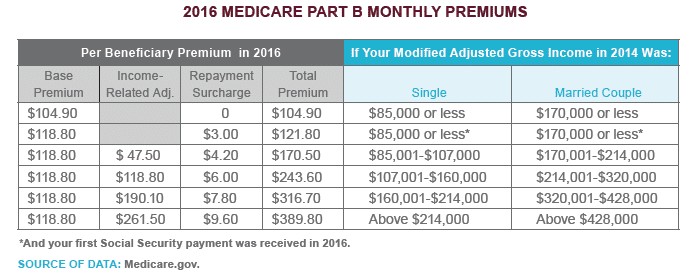

What was the Medicare Part B premium for 2016?

If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What was the Medicare Part B premium in 2010?

Medicare Part B Premiums for 2010 The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $110.50 in 2010. However, most Medicare beneficiaries will not see an increase in their monthly Part B premiums in 2010 because of a “hold-harmless” provision in current law.

What was the Medicare Part B premium for 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What was the Medicare deductible in 2014?

$1,216The Medicare Part A deductible that beneficiaries pay when admitted to the hospital will be $1,216 in 2014, an increase of $32 from this year's $1,184 deductible.

How much did Medicare go up in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

How much does Medicare Part B increase each year?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

What was Medicare Part B premium in 2005?

Part B Deductible background: The Part B deductible was increased to $110 in 2005 and was subsequently indexed to the increase in the average cost of Part B services for aged beneficiaries, as part of the Medicare Modernization Act. The reason for the increase in the average cost of Part B services was described above.

Is Medicare Part B premium adjusted annually?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

What is the Medicare premium for 2014?

2014 Medicare Part A Premium: The Medicare Part A premium, which only about 1 percent of Medicare recipients are required to pay, will be $426, a $15 decrease from the 2013 rate.

When did Medicare Part B and Part A change?

The Medicare administration has announced Medicare Part A and Part B rates for 2014, with changes taking effect Jan. 1, 2014.

How much did Medicare pay for skilled nursing in 2014?

2014 Medicare Part A Skilled Nursing: After 20 days in a skilled nursing facility, the per-day Medicare Part A skilled nursing co-payment in 2014 will be $152, or $4 more than in 2013.

How much did Medicare pay for hospital stays in 2014?

For a hospital stay of 91-150 days, the per-day Medicare Part A co-payment in 2014 is $608, a $16 increase from 2013. After 150 days, Medicare no longer helps pay for hospital expenses.

Does Plan F cover Medicare Part A?

With fixed premiums that can easily fit into your budget, Plan F covers all Medicare Part A and Part B deductibles along with “excess charges” you would otherwise have to pay out of pocket. Excess charges are the difference between what Medicare pays and what your medical provider charges—and they can add up fast without ...

Latest News

As announced by the Centers for Medicare and Medicaid Services (CMS) last October, the standard 2014 Medicare Part B premium remained unchanged from the 2013 amount of $104.90 per month. Part B covers physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and other items.

Medicare Part B premiums in 2014

As announced by the Centers for Medicare and Medicaid Services (CMS) last October, the standard 2014 Medicare Part B premium remained unchanged from the 2013 amount of $104.90 per month. Part B covers physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and other items.

What is the deductible for Medicare Part B in 2014?

If you have to pay a higher amount for your Part B premium and you disagree, you can appeal the IRMAA. The 2014 Medicare Part B annual deductible remains $147 (unchanged from 2013). *If you pay a late-enrollment Penalty, your monthly premium is higher.

How much is the 2014 Part D premium?

The 2014 Part D plan premiums range from $3 to $175. The 2014 standard Part D plan deductible is $310, however the actual plan deductible can be anywhere from $0 to $310 .

What is Medicare Advantage 2014?

2014 Part C (Medicare Advantage) Monthly Premium. Medicare Advantage plan premiums*, deductibles, and benefits will depend on the Medicare Advantage plans available in your service area (county or ZIP code). Along with your Medicare Advantage plan premium, you must continue to pay your Part B premium ...

Do you pay Social Security if your adjusted gross income is above a certain amount?

However, if your modified adjusted gross income as reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS) is above a certain amount (see chart below), you may pay more.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

When did Medicare pay for inpatient hospital care?

1989. The spell of illness and benefit period coverage of laws before 1988 return to the determination of inpatient hospital benefits in 1990 and later. After the deductible is paid in benefit period, Medicare pays 100 percent of covered costs for the first 60 days of inpatient hospital care.

When was Medicare first introduced?

When first implemented in 1966 , Medicare covered most persons aged 65 or older.

How many days are covered by Medicare?

The number of SNF days provided under Medicare is limited to 100 days per benefit period (described later), with a copayment required for days 21 through 100.

What is Medicare Advantage?

Medicare Advantage plans are offered by private companies and organizations and are required to provide at least those services covered by Parts A and B, except hospice services. These plans may (and in certain situations must) provide extra benefits (such as vision or hearing) or reduce cost sharing or premiums.

What is fee for service in Medicare?

Since the inception of Medicare, fee-for-service claims have been processed by nongovernment organizations or agencies under contract to serve as the fiscal agent between providers and the federal government. These entities apply the Medicare coverage rules to determine appropriate reimbursement amounts and make payments to the providers and suppliers. Their responsibilities also include maintaining records, establishing controls, safeguarding against fraud and abuse, and assisting both providers and beneficiaries as needed.

How many days of inpatient hospital care can you use for Medicare?

If a beneficiary exhausts the 90 days of inpatient hospital care available in a benefit period, the beneficiary can elect to use days of Medicare coverage from a nonrenewable “lifetime reserve” of up to 60 (total) additional days of inpatient hospital care. Copayments are also required for such additional days.

How long do you have to be on Medicare to receive Part A?

Similarly, individuals who have been entitled to Social Security or Railroad Retirement disability benefits for at least 24 months, and government employees or spouses with Medicare-only coverage who have been disabled for more than 29 months, are entitled to Part A benefits.

How much was Medicare Part B in 2014?

How much will I pay in premiums for Medicare Part B in 2014? And is there still a high-income surcharge for Part B and Part D prescription-drug coverage? The monthly premium for Medicare Part B remains $104.90 for most people in 2014 – the same as in 2013.

How much did Medicare deductible increase in 2014?

The Centers for Medicare and Medicaid Services also announced that the Medicare Part A deductible, which people pay when admitted to the hospital, will increase by $32 in 2014, to $1,216.

What is the Part B and Part D surcharge based on?

Both the Part B and Part D surcharges are based on your income in 2012, which is the last tax return the government has on file for most people.

What is the income limit for seniors in 2012?

Seniors whose 2012 adjusted gross income (plus tax-exempt interest income) was more than $170,000 if married filing jointly or $85,000 if single will continue to pay higher premiums, as they have since 2007. The high-income surcharges remain the same as in 2013.

Medicare Part A and Part B Changes from 2013 to 2014

Medicare Part A in 2014

- 2014 Medicare Part A Premium:

The Medicare Part A premium, which only about 1 percent of Medicare recipients are required to pay, will be $426, a $15 decrease from the 2013 rate. - 2014 Medicare Part A Deductible:

The 2014 Medicare Part A deductible will be $1,216per benefit period, up from $1,184 per benefit period in 2013.

Medicare Part B in 2014

- 2014 Medicare Part B Premium:

The standard 2014 Medicare Part B premium will remain at $104.90per month, the same rate as in 2013. Higher Part B premium rates for people with higher incomes will also remain at 2013 levels. - 2014 Medicare Part B Deductible:

The Medicare Part B 2014 deductible will remain unchanged at $147.

Medigap Protection Against Deductibles, Co-Pays, and Coinsurance

- Medicare supplement plans go a long way toward helping eliminate Medicare out-of-pocket costs that often go up from one year to the next. An excellent, budget-friendly solution is Medicare Supplement Plan F, which covers all Medicare-approved costs not covered by Medicare Part A and Medicare Part B. With fixed premiums that can easily fit into your budget, Plan F covers all …